As the UK government comes to grips with a post-Brexit world, its regulators are starting to exercise their rule-making authority. They are changing the financial industry to make it more sustainable, more friendly to consumers, less volatile, and innovative and are using regulatory rulings as the instrument to facilitate these changes.

This means we can expect a series of regulatory reforms that will bolster risk management policies, consumer protection laws, and climate change directives. While this might seem like a large volume of regulatory reforms that could threaten to overwhelm your compliance team, organisations are looking at a prospective gold mine for building up their company’s reputation for stability and reliability.

Adopting internal operations to meet the latest regulatory reforms, no matter how recent or ambitious, can help organisations build a competitive advantage. They will be following best practices in the industry – pushing innovation in a sustainable manner and offering more appropriate products/services for a diverse, inclusive financial market – while also creating a reputation as a reliable, trustworthy company for both clients and companies.

In this blog, we are going to explain how you can turn regulation from a costly, inefficient process into your greatest competitive advantage using an automated regulatory management solution.

Assessment of regulatory risks

Financial penalties often arise from a weakness in compliance controls, processes, and policies. These policy deficiencies often arise due to the institution’s struggle to meet the latest regulatory requirements, which reveals a flaw in the underlying processes.

With regulatory bodies promising changes to all aspects of finance, organisations that do not make changes to their policies could find themselves facing warnings. If these warnings are to the public, it could undermine confidence in your organisation and hamper relationships with stakeholders, investors, and consumers.

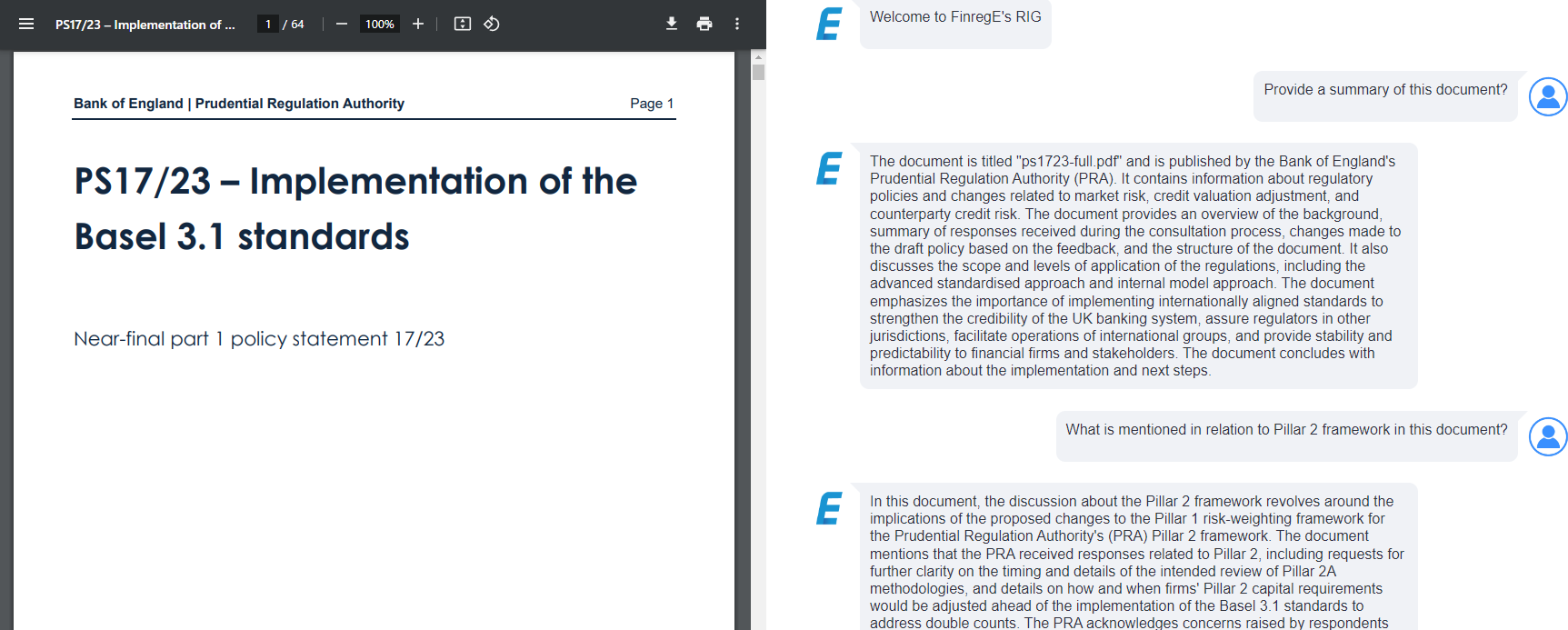

An automated regulatory compliance solution allows financial institutions to reduce the risk of penalties by keeping their compliance strategies updated. The platform can issue regulatory alerts directly to your inbox, allowing your compliance team to stay updated on the latest updates without wasting time scouring web pages, PDF documents and rulebooks.

By digitising regulations, institutions can assess their own internal operations to identify compliance gaps, determine risks, and take appropriate measures to appropriately integrate new updates into internal operations to always stay in compliance. This would allow you to build a competitive advantage by being known as the firm that always stays in compliance – boosting confidence from investors, stakeholders, and consumers. Moreover, businesses can avoid any negative attention from the press should they fail to meet compliance standards.

Better insights and business strategy

To place your FI in a position where they convert regulation into a competitive advantage, organisations need to be able to convert regulatory updates into useful information that can inform the creation of new products and services. However, accomplishing this requires a business strategy that turns regulation content into useful data.

Automated regulatory change management can facilitate the creation of this business strategy. Change management platforms leverage NLP and text analysis, making them excellent tools to analyse internal operations, giving organisations the means to review and analyse compliance data and company operations. The insight from the platform allows organisations to understand their progress towards compliance and what regulatory institutions are aiming to accomplish with these updates.

Using the platform can help you build up your competitive advantage because you can use the insight to create detailed business strategies that will see you innovate with new products and services faster than your competitors can while maintaining sustainability requirements.

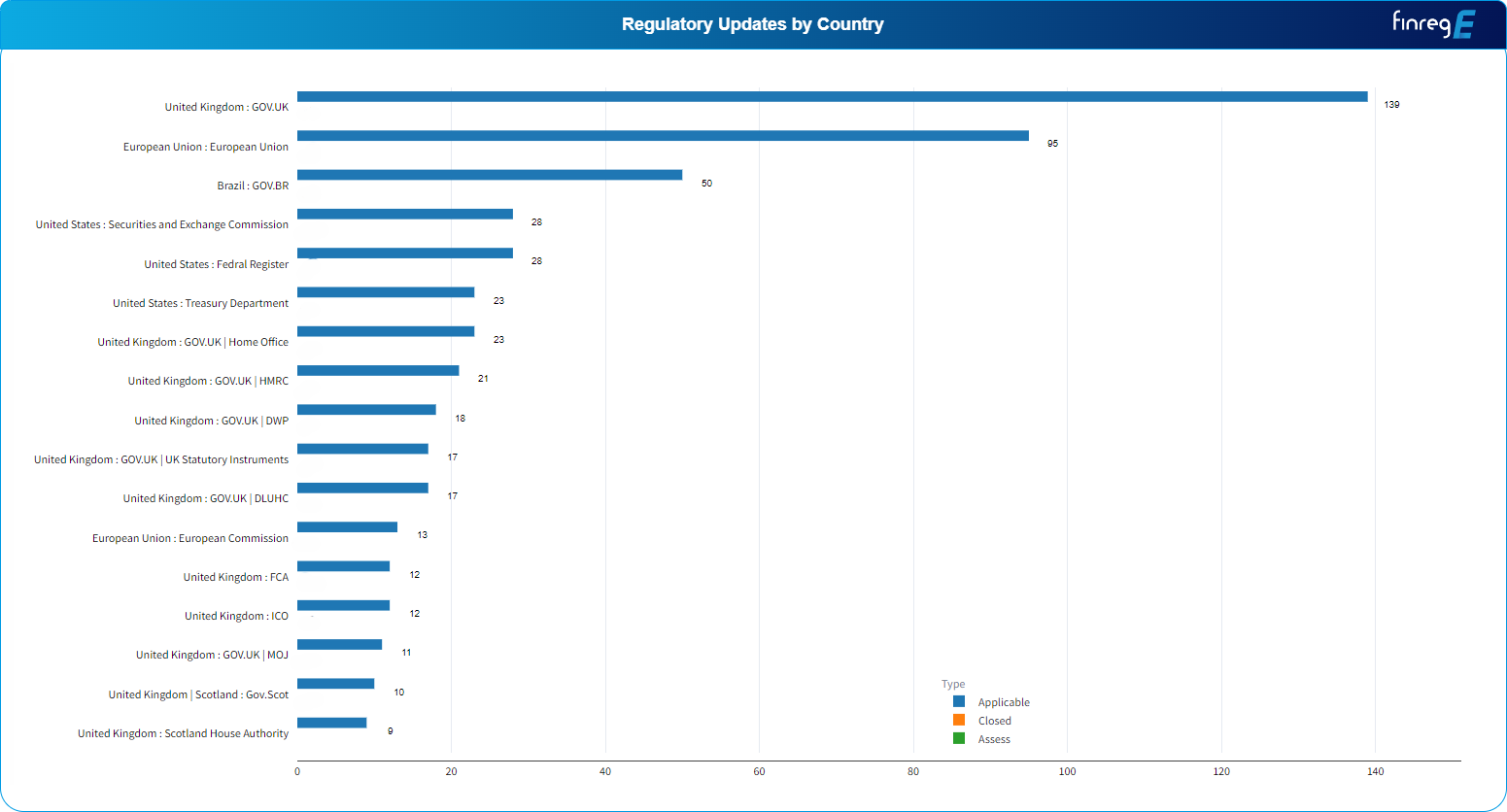

Keep up with regulatory updates

A significant value proposition of automated regulatory change management solutions is its ability to collect regulatory updates from different institutions without requiring institutions to put in extra effort to obtain them. This allows organisations to keep pace with regulatory updates while reducing the cost of regulatory spending while improving efficiency.

The ability to keep pace with regulatory updates by adjusting your internal operations can be seen as a competitive advantage. Given the large number of updates and their complexity, keeping pace with regulatory updates can be seen as a competitive advantage that allows organisations to stay ahead of their competition.

Furthermore, these systems can help organisations rapidly adjust their internal operations to meet these new standards. These platforms can map regulatory updates directly to your internal operations through compliance mapping, allowing your compliance team to determine how any new regulatory updates could change internal operations and assign responsibilities to the relevant business unit. Since the entire process is automated, organisations can not only save time but also eliminate human error from the process, improving efficiency and raising productivity.