Chief Risk Officers (CROs) are under constant pressure and operate in an environment defined by complexity, rapid regulatory changes, and emerging technologies.

With heightened scrutiny from regulators and a host of new risks such as climate change, geopolitical risks, cyber threats, and artificial intelligence, CROs have more on their plates than ever before. Here are key pain points that are keeping CROs up at night:

Key pain points facing CROs in financial institutions

- Regulatory overload and compliance challenges: as financial regulations evolve rapidly across global jurisdictions, keeping up with compliance obligations is becoming increasingly difficult. From DORA, Basel IV and ESG regulations to the EU AI Act, CROs are tasked with managing the ever-increasing volume of regulatory requirements. Falling behind on compliance can lead to severe penalties and reputational damage.

- Managing data quality and integration: risk management requires high-quality data aggregated from various systems. CROs often struggle with fragmented risk data, which makes it difficult to produce accurate and timely reports. Siloed systems, lack of data standardisation, and poor data integration pose significant challenges for risk analysis and reporting.

- Operational resilience and cybersecurity threats: The digital landscape is rapidly evolving, and with it comes a surge in cyber risks. From ransomware to data breaches, cybersecurity is a top concern for CROs. They are responsible for building resilience against these threats while also ensuring compliance with operational resilience regulations.

- Emerging risks: AI, climate change, and geopolitical uncertainty: The emergence of new risks such as climate change, the proliferation of AI, and global geopolitical volatility is forcing CROs to rethink traditional risk strategies. These risks are difficult to predict, and their potential impact on financial institutions can be catastrophic if not properly managed.

- Cost pressures and resource constraints: While the demand for advanced risk management tools and regulatory compliance solutions is increasing, CROs are often faced with budget limitations. Balancing the need for sophisticated risk solutions with the pressure to reduce costs is a delicate balancing act.

How to survive the changing climate as a CRO

Leverage technology for advanced risk management: Forward-thinking CROs are turning to AI and machine learning to enhance risk detection, compliance automation, and the management of emerging risks. Using these technologies helps to streamline processes, improve decision-making, and provide more accurate risk forecasting.

Foster a strong risk culture: Building a risk-aware culture is a priority for CROs. Embedding risk management into business decisions and promoting accountability ensures that risks are proactively identified and addressed, reducing the potential for unexpected crises.

Ensure robust prudential risk management: Compliance with prudential regulations like Basel IV requires precise risk reporting, strong capital management, and regular stress testing. CROs must ensure that their financial institutions meet these regulatory requirements to avoid penalties and maintain stability.

Address non-financial and operational risks in addition to financial risks: CROs are focused on managing non-financial risks such as third-party risks, environmental and social governance (ESG), and operational disruptions. These risks are becoming more prominent as regulators and stakeholders push for better transparency and accountability.

Strengthen cyber resilience: As digital transformation accelerates, the risk of cyberattacks increases. CROs must build and maintain strong cyber resilience frameworks to safeguard their organisations from data breaches and ensure compliance with cyber regulations.

How FinregE helps CROs address these pain points

Regulatory Overload and Compliance

FinregE’s automated regulatory compliance solution provides real-time updates on regulatory changes, ensuring CROs stay ahead of the curve.

By automating compliance workflows and integrating regulatory intelligence into risk management processes, FinregE helps reduce the risk of non-compliance and improve operational efficiency.

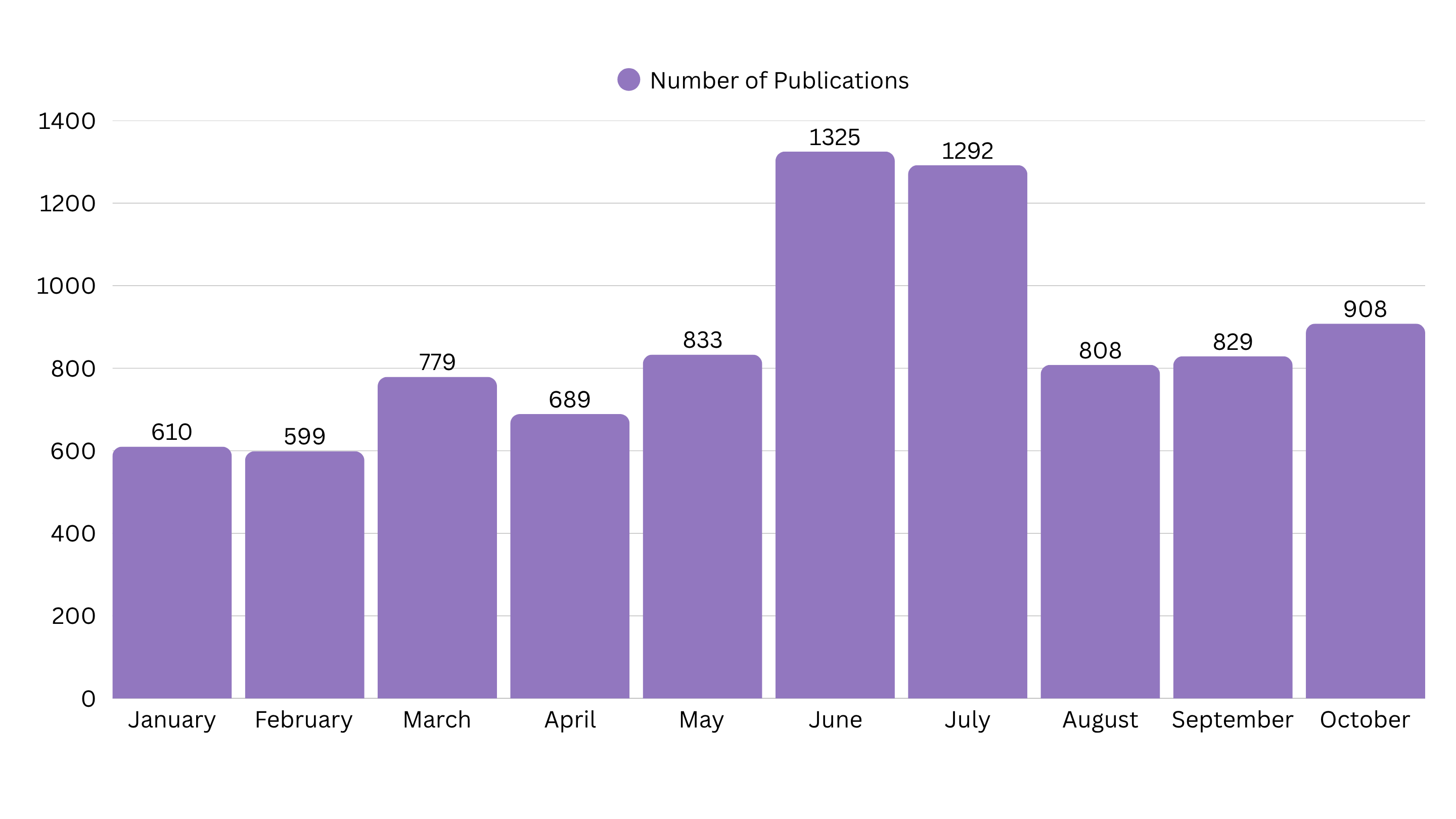

Key use cases: FinregE’s horizon scanning feature enables CROs to stay on top of complex, evolving prudential regulations and risks across 160 countries. For instance, keeping up with changes in Basel regulations is critical for financial institutions.

With FinregE’s horizon scanning, firms can track global regulatory updates such as the implementation of Basel 3.1 in the UK and the FRTB (Fundamental Review of the Trading Book) in Latin America. This ensures CROs receive real-time alerts on prudential regulation changes, allowing them to take timely action.

Our banking and insurance clients rely on FinregE’s horizon scanning impact assessment workflows to manage prudential regulatory changes. These workflows streamline the process of tracking, assessing, and implementing regulatory updates, making it easier to respond to evolving compliance requirements.

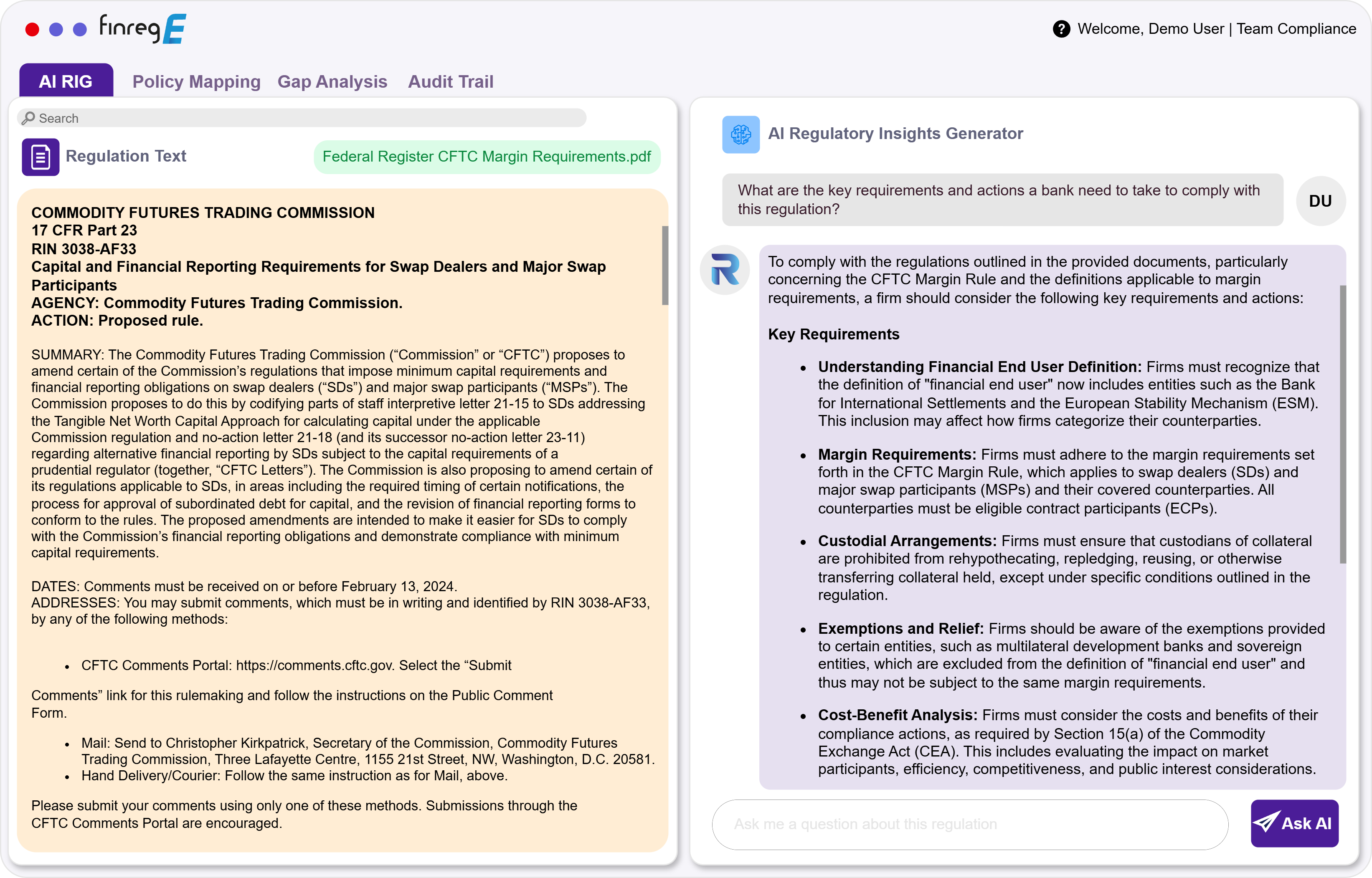

Moreover, FinregE’s AI-powered RIG (Regulatory Insights Generator) LLM allows users to distil large regulatory changes efficiently. By using AI, firms can extract interpretations from complex rules, guidance, and Q&As, gaining a comprehensive understanding of their regulatory requirements. Whether it’s the interpretation of capital requirements under Basel or understanding local prudential guidelines, FinregE provides CROs with a holistic view, ensuring that nothing is missed in the compliance process.

This combination of real-time alerts, automated workflows, and advanced AI interpretation tools enables financial institutions to remain compliant in a fast-changing regulatory environment while reducing manual effort and improving overall efficiency.

Data Quality and Integration

FinregE’s powerful AI-driven platform consolidates regulatory and risk data across departments, improving data quality and integration. With centralized data libraries and real-time tracking of regulatory changes, CROs can generate accurate reports and ensure data consistency across the organization.

Regulatory Reporting Traceability: For compliance with complex regulatory frameworks like Basel reporting rules, FinregE offers full traceability across the entire reporting lifecycle. FinregE’s platform provides a fully integrated traceability library that connects reporting calculations directly to the underlying regulatory rules and instructions. This ensures that every step in the reporting process is transparent and easily traceable.

FinregE’s connected workflow allows firms to maintain complete data lineage, linking reporting rules to internal interpretations, governance processes, and the specific calculations used in regulatory reporting. By automating this process, CROs can ensure that all aspects of regulatory reporting—from rule interpretation to final data submission—are fully aligned and compliant, significantly reducing the risk of errors and ensuring audit readiness.

Operational Resilience and Cybersecurity

As digital transformation accelerates, CROs must build robust frameworks to ensure operational resilience and protect against increasing cyber threats. FinregE equips organizations with the tools needed to stay compliant with key operational resilience regulations while addressing cybersecurity risks.

Key Use Case: DORA Compliance and PRA/FCA Operational Resilience

For financial institutions subject to PRA/FCA operational resilience requirements, FinregE provides a Senior Manager SIF attestation workflow. This workflow allows CROs and senior managers to conduct line-by-line rule compliance and supervisory statement attestations, ensuring that all operational resilience requirements are met. These attestations can be shared directly with regulators like the PRA and FCA to demonstrate compliance with their stringent resilience mandates.

In preparation for DORA (Digital Operational Resilience Act) compliance, FinregE offers a centralized library of DORA rules and obligations. This comprehensive library covers essential areas such as information security, governance, cryptography, incident reporting, and more. Using FinregE’s AI framework, firms can extract obligations from DORA, map them to their existing internal policies and controls, and identify gaps where action is needed.

FinregE’s platform also supports project planning to ensure firms achieve full compliance by 2025. This includes building detailed action plans that fill gaps in operational resilience, giving CROs the tools they need to navigate DORA compliance and bolster their organization’s cybersecurity defenses.

Emerging Risks: AI, Climate, and Geopolitical

CROs must continuously adapt to emerging risks such as AI, climate change, and geopolitical instability. These risks are unpredictable, multi-faceted, and constantly evolving, making it crucial for financial institutions to remain proactive in their risk management strategies. FinregE provides the necessary tools to help risk divisions stay ahead of these challenges.

Key Use Case: ESG and Sustainability Horizon Scanning

Many risk divisions across our insurance and banking clients rely on FinregE’s comprehensive ESG and sustainability horizon scanning libraries to manage the rapidly changing trends and guidelines in the environmental, social, and governance (ESG) space. FinregE’s ESG module covers critical areas, including:

- Climate Change and Energy Transition

- Sustainable Finance and Responsible Investment

- Environmental Conservation and Natural Resources

- Social Issues and Human Rights

- Reporting Standards and Frameworks

- Sustainable Development and Circular Economy

- Sector-Specific Sustainability Initiatives

- Other ESG Initiatives and Collaborations

- Regulatory and Standard-Setting Bodies

By using FinregE’s ESG horizon scanning, CROs can stay on top of emerging regulations, understand sector-specific sustainability initiatives, and ensure their organizations are compliant with the latest climate and sustainability guidelines. This proactive approach helps financial institutions reduce exposure to climate-related risks and improve their sustainability reporting in line with global standards.

AI Risk Management

In the ever-evolving field of artificial intelligence (AI), FinregE helps risk divisions navigate the complexities of emerging regulations and technologies. Whether tracking the progress of the EU AI Act or monitoring advancements in AI that could impact risk models and operational processes, FinregE’s horizon scanning allows organizations to stay ahead of the curve. Risk leaders can use FinregE’s tools to monitor regulatory developments in AI and integrate these into their compliance frameworks, ensuring the responsible adoption of AI technologies.

For example, FinregE’s platform can identify the regulatory requirements associated with AI adoption, assess how these requirements apply to existing AI systems, and help organizations fill gaps in compliance and governance.

Geopolitical Risk Management with AI

Geopolitical instability—driven by factors like trade tensions, regulatory fragmentation, and international conflicts—poses an ongoing challenge to financial institutions. Managing geopolitical risk effectively requires staying informed about global developments and adjusting risk strategies in real-time. FinregE’s AI-driven platform provides a solution by leveraging real-time data and global risk monitoring to help CROs assess geopolitical risks more accurately.

Through AI-powered analysis, FinregE enables organizations to track geopolitical shifts, sanctions, cross-border regulations, and other market factors. The platform helps risk divisions build contingency plans by predicting potential impacts on global operations, supply chains, and market volatility. CROs can use these insights to adjust risk exposure, hedge against instability, and maintain resilience in an unpredictable global landscape.

Cost Pressures and Resource Constraints

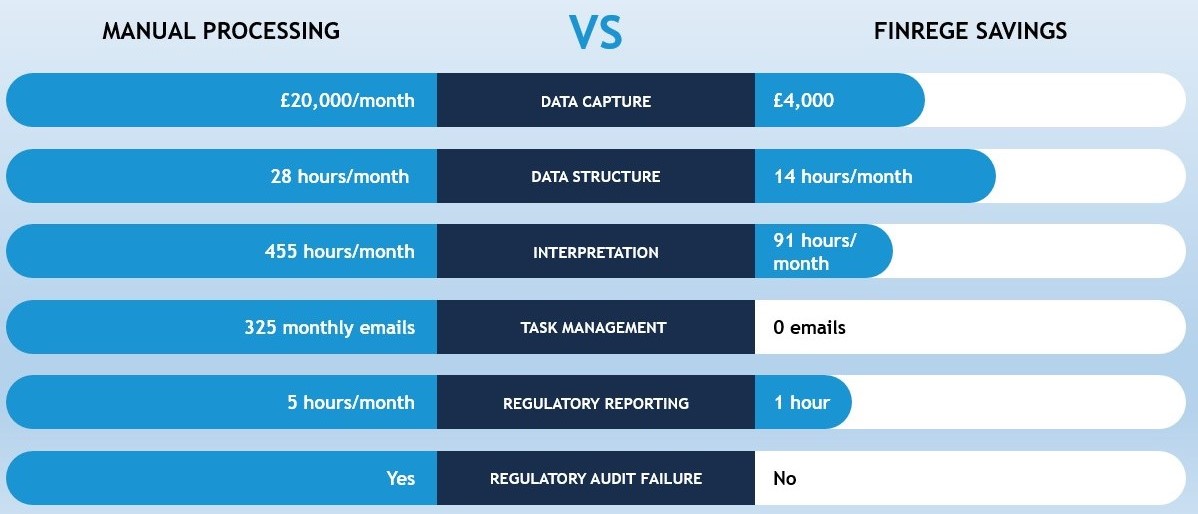

CROs in financial institutions are increasingly facing the challenge of managing growing regulatory demands and complex risk management processes with limited budgets and resources. FinregE helps alleviate these pressures by automating compliance processes, streamlining workflows, and reducing manual effort, ultimately driving down costs.

Key Use Cases:

- Reducing Compliance Costs by Streamlining Processes: FinregE has consistently proven to reduce the cost of compliance in risk teams by eliminating the inefficiencies of scattered systems like spreadsheets, Word documents, and email chains. For instance, instead of relying on manual tracking and management, FinregE provides a centralized workflow for tasks such as annual Senior Manager SIF attestations, making it easier for firms to ensure compliance with less effort.

- Centralized Library for Internal Models and Capital Rules: Risk teams no longer need to manage rules and internal model documents across multiple systems. FinregE offers a centralized library of regulatory rules that integrates seamlessly with internal models, allowing firms to capture changes to capital rules and map them directly to internal policies and controls. This ensures real-time updates and allows for immediate implementation of regulatory changes, significantly cutting down on time and effort.

- Accelerating Audits and Updates of Legacy Policies: Risk teams often face the daunting task of auditing and updating legacy policies and controls. With FinregE’s AI-powered Regulatory Insights Generator (RIG) and NLP-powered document matching, teams can automatically match internal documents with the latest regulations. This technology speeds up the process of ensuring internal policies align with current regulatory standards, saving both time and resources.

- Saving £67,000 a Month by Automating Regulatory Change Management: Managing regulatory changes can be resource-intensive, but FinregE’s horizon scanning technology has helped clients save at least £67,000 a month by improving the efficiency of tracking and implementing regulatory changes. The automated system identifies relevant updates, distills them into actionable insights, and aligns them with internal controls, removing the need for manual monitoring and reducing the chance of compliance errors.

- Fully Audited and Traceable Compliance Processes: FinregE also offers a fully audited and traceable compliance process, providing a clear line of sight from regulations to internal policies and actions. This helps firms reduce regulatory risks and avoid fines while increasing confidence during audits. The return on investment is significant, not only in terms of reduced costs but also in minimizing the risks associated with non-compliance.

By automating key compliance workflows and providing centralized regulatory intelligence, FinregE enables CROs to manage cost pressures effectively, improve resource allocation, and maintain compliance without overextending budgets.

Technology for Advanced Risk Management

FinregE’s AI-powered Regulatory Insights Generator (RIG) helps CROs interpret complex regulatory requirements and convert them into actionable insights. This tool simplifies risk management processes by providing advanced analytics and compliance recommendations tailored to the organization’s unique risk profile.

Strengthening Risk Culture

FinregE supports the development of a strong risk culture through collaborative workflows that promote cross-departmental cooperation on risk management. By assigning tasks and responsibilities across the organization, FinregE helps embed risk awareness in every level of the business.

Adopting AI Safely and Explainably

The adoption of AI in risk management and compliance offers significant potential for efficiency gains, but it also raises concerns around safety, explainability, and control. FinregE addresses these concerns by offering its clients a fully contained and explainable AI solution: the AI Regulatory Insights Generator (RIG) LLM. Many of FinregE’s clients have chosen the AI RIG LLM as their first internal language model because it strikes the right balance between leveraging AI’s capabilities and maintaining stringent oversight over its use.

Safe Adoption of AI: FinregE’s AI RIG LLM operates as a smart retrieval system that assists risk professionals in understanding and interpreting complex regulations. Unlike AI solutions that automate decision-making processes, FinregE’s LLM ensures that all outputs are verified by human experts before any action is taken. This adds an important layer of control, preventing the risks associated with automation while still benefiting from AI’s ability to quickly analyse and distil large volumes of regulatory information. The model functions within predefined parameters, ensuring that its use remains safe and aligned with regulatory standards.

Explainability and Transparency: A common concern with AI models is their “black box” nature—where the reasoning behind decisions is difficult to understand. FinregE’s AI RIG LLM, however, is designed to be fully explainable. The model only works off the text it has been provided, making its outputs transparent and traceable. This allows risk teams to clearly see how the LLM arrived at its conclusions, ensuring that every recommendation or insight is grounded in the given data. This level of transparency is crucial for maintaining trust and accountability in the use of AI for compliance and risk management.

Fully Contained and Secure: Another key feature of FinregE’s AI RIG LLM is that it is fully contained within the client’s instance, meaning all data processing and analysis happen within the organization’s-controlled environment. This ensures that sensitive data related to compliance and regulatory interpretation is never exposed to external networks, reducing the risk of data breaches or misuse. By keeping the AI system localized, FinregE guarantees that all client data remains secure and that organizations retain full ownership and oversight of their AI-driven processes.

Assisting, Not Replacing, Risk Professionals: FinregE’s AI RIG LLM is designed to enhance the capabilities of risk teams by providing rapid insights, not to replace their expertise. By acting as a decision-support tool, the LLM helps professionals efficiently sift through complex regulatory texts, extract relevant information, and make informed decisions. However, all actions remain in the hands of risk professionals, ensuring that human judgment and expertise remain central to the compliance process.

AI Adoption at the Right Pace: For many organizations, the transition to using AI can be daunting due to the risks of over-reliance or unintended consequences. FinregE enables its clients to adopt AI at their own pace with full control and confidence, knowing that the system is both explainable and safe. This approach minimizes risks while allowing organizations to benefit from AI-driven efficiencies in a compliant and secure manner.

In summary, FinregE’s AI RIG LLM is the ideal choice for organizations looking to adopt AI safely and explainably in their regulatory compliance processes. Its contained environment, transparent functionality, and focus on human oversight ensure that clients can leverage the power of AI without compromising security or control.

Conclusion

In today’s rapidly changing risk landscape, CROs face numerous challenges, from managing regulatory overload and data quality issues to addressing emerging risks and cybersecurity threats. FinregE offers an all-encompassing solution that helps CROs stay compliant, manage risks more effectively, and build resilience against future disruptions. By automating compliance processes, improving data integration, and leveraging AI-driven insights, FinregE empowers CROs to turn these pain points into opportunities for growth and success.

What are the risks keeping your CRO awake at night? With FinregE, you can rest easy knowing your risk management and compliance strategies are always one step ahead. Book a demo today.

What is end-to-end regulatory compliance, and how to choose the right regtech vendor

Every year, organisations in regulated sectors such as financial services, healthcare, energy, telecoms, and beyond face a growing volume of regulatory requirements: new laws, changing rules,

FinregE selected and participated in the FCA’s AI Supercharged Sandbox first cohort

FinregE is proud to have been selected out of many to participate in the Financial Conduct Authority’s (FCA) AI Supercharged Sandbox, which ran from

PRA finalises Basel 3.1: What UK firms need to do now

The Prudential Regulation Authority (PRA) has published its final rules for implementing Basel 3.1 in the UK, providing much-needed clarity on capital requirements, risk