Environmental, Social, and Governance (ESG) Compliance

FinregE for Environmental Social and Governance Regulatory Excellence

FinregE’s Horizon Scanning for ESG Institutions and Frameworks

The intensification of ESG-related legislation, regulations, and industry standards necessitates a proactive approach to managing ESG risk management and compliance.

ESG Horizon Scanning is a strategic process to foresee, identify, and grasp new regulations, legislation, standards, and guidance, through a diligent examination of global trends. It is a crucial step for organizing resources effectively, ensuring preparedness, and fostering communication with stakeholders.

FinregE offers comprehensive insights and oversight across an extensive range of global entities that are influential in the ESG regulatory space. Our extensive database on news and publication is continuously updated with detailed analysis and insights into the activities, publications, and evolving standards of a wide array of global entities that are shaping the future of ESG compliance and reporting.

FinregE’s Horizon Scanning for ESG Coverage and Sources

Climate Change and Energy Transition

- Carbon Disclosure Project (CDP)

- Committee for Climate Change (CCC)

- Intergovernmental Panel on Climate Change (IPCC)

- Glasgow Financial Alliance for Net Zero (GFANZ)

- International Carbon Reduction & Offsetting Alliance (ICROA)

- Net Zero Banking Alliance (NZBA)

- Task Force on Climate-related Financial Disclosures (TCFD)

- Network for Greening the Financial System (NGFS)

- Science Based Targets initiative (SBTi)

- RE100 (Renewable Energy Initiative)

- EP100 (Energy Productivity Initiative)

- EV100 (Electric Vehicles Initiative)

- LCTPi (Low Carbon Technology Partnerships initiative)

- Science Based Targets Network

- Transition Pathway Initiative (TPI)

- Climate Bonds Initiative (CBI)

Sustainable Finance and Responsible Investment

- United Nations Environment Programme Finance Initiative (UNEP FI)

- Principles for Responsible Investment (PRI)

- Sustainable Finance Disclosure Regulation (SFDR)

- Global Sustainable Investment Alliance (GSIA)

- Global Impact Investing Network (GIIN)

- Operating Principles for Impact Management (OPIM)

- UN Principles for Responsible Banking (PRB)

- Equator Principles

- Green Bond Principles (ICMA)

- Social Bond Principles (ICMA)

- Sustainability-Linked Bond Principles (ICMA)

- Investor Agenda

- Global Investors for Sustainable Development (GISD) Alliance

- Poseidon Principles

Environmental Conservation and Natural Resources

- World Resources Institute (WRI)

- World Wildlife Fund (WWF)

- International Union for Conservation of Nature (IUCN)

- Natural Capital Finance Alliance (NCFA)

- Taskforce on Nature-related Financial Disclosures (TNFD)

- CDP Water Security

- Investors Policy Dialogue on Deforestation (IPDD)

- The Biodiversity Consultancy

- Accountability Framework Initiative

- Natural Capital Coalition

- Science Based Targets for Nature (SBTN)

- Global Sustainable Seafood Initiative (GSSI)

- Forest Stewardship Council (FSC)

- Programme for the Endorsement of Forest Certification (PEFC)

- Integrated Biodiversity Assessment Tool (IBAT)

Social Issues and Human Rights

- UN Global Compact

- International Labour Organization (ILO)

- UN Guiding Principles on Business and Human Rights

- Corporate Human Rights Benchmark (CHRB)

- Access to Medicine Index

- Access to Nutrition Index

- Global Compact on Refugees

- ILO Tripartite Declaration of Principles

- OECD Due Diligence Guidance for Responsible Business Conduct

- Social & Human Capital Coalition

- Taskforce on Inequality-Related Financial Disclosures (TIFD)

Reporting Standards and Frameworks

- Global Reporting Initiative (GRI)

- International Integrated Reporting Council (IIRC)

- Sustainability Accounting Standards Board (SASB)

- Climate Disclosure Standards Board (CDSB)

- UNCTAD SDG Reporting Guidance

- TCFD Knowledge Hub

- ISO 14000 Environmental Management Standards

- Value Reporting Foundation (SASB, <IR> Framework)

- Future of Sustainable Data Alliance (FoSDA)

- Impact Management Project (IMP)

Sustainable Development and Circular Economy

- United Nations Framework Convention on Climate Change (UNFCCC)

- International Renewable Energy Agency (IRENA)

- Global Alliance for Buildings and Construction (GlobalABC)

- The Ellen MacArthur Foundation

- Ceres

- The Energy and Resources Institute (TERI)

- Alliance for Water Stewardship (AWS)

Sector-Specific Sustainability Initiatives

- Sustainable Agriculture Initiative Platform (SAI Platform)

- Better Cotton Initiative (BCI)

- Roundtable on Sustainable Palm Oil (RSPO)

- Bonsucro (Better Sugar Cane Initiative)

- Aluminium Stewardship Initiative (ASI)

- Responsible Jewellery Council (RJC)

- Initiative for Responsible Mining Assurance (IRMA)

- Towards Sustainable Mining (TSM)

- Sustainable Apparel Coalition (Higg Index)

- Zero Discharge of Hazardous Chemicals (ZDHC)

Other ESG Initiatives and Collaborations

- Business for Societal Impact (B4SI)

- Future-Fit Business Benchmark

- Alliance for Corporate Transparency

- Institutional Investors Group on Climate Change (IIGCC)

- Asia Investor Group on Climate Change (AIGCC)

- Investor Group on Climate Change (IGCC)

- UNEP Finance Initiative Principles for Sustainable Insurance

- OS-Remediation (Operating Guidance on Remediation)

- International Finance Corporation (IFC) Performance Standards

Regulatory and Standard-Setting Bodies

- International Organization of Securities Commissions (IOSCO)

- OECD Guidelines for Multinational Enterprises

FinregE’s ESG Regulatory Topic Coverage

FinregE’s ESG horizon scanning capabilities encompass a wide range of topics, ensuring that you stay ahead of the curve in addressing critical ESG issues. Our coverage includes:

- Carbon emissions and greenhouse gas management

- Climate risk assessment and disclosure

- Transition to a low-carbon economy

- Renewable energy and energy efficiency

- Climate adaptation and resilience

- Environmental Stewardship

- Natural resource management (water, forests, biodiversity)

- Waste management and circular economy

- Pollution prevention and control

- Sustainable agriculture and food systems

- Ecosystem services and natural capital valuation

- Responsible investment and ESG integration

- Green and sustainable finance products (green bonds, sustainability-linked loans)

- Impact investing and blended finance

- Climate finance and carbon pricing mechanisms

- Sustainable risk management and disclosure

- Board diversity and composition

- Executive compensation and alignment with ESG goals

- Shareholder rights and activism

- Business ethics and anti-corruption practices

- Whistleblower protection and grievance mechanisms

- Human rights due diligence and risk assessment

- Fair labor practices and worker rights

- Supply chain management and responsible sourcing

- Diversity, equity, and inclusion

- Community relations and indigenous rights

- Access to essential services (healthcare, education, finance)

- Affordable housing and community development

- Product safety and quality

- Data privacy and security

- Human capital development and talent management

- Energy and extractives (oil and gas, mining)

- Manufacturing and industrial processes

- Transportation and logistics

- Construction and real estate

- Agriculture and forestry

- Financial services and insurance

- Technology and telecommunications

- Healthcare and pharmaceuticals

- Hospitality and tourism

- ESG reporting standards and frameworks

- Sustainable finance regulations and taxonomies

- Environmental regulations and emissions trading schemes

- Human rights and labour laws

- Corporate governance codes and guidelines

- Investor relations and shareholder engagement

- Community relations and stakeholder dialogue

- NGO and civil society collaborations

- Public-private partnerships and multi-stakeholder initiatives

- Sustainable Development Goals (SDGs) alignment

- Nature-related financial risks and biodiversity loss

- Circular economy and resource efficiency

- Social impact measurement and valuation

- ESG data management and technology solutions

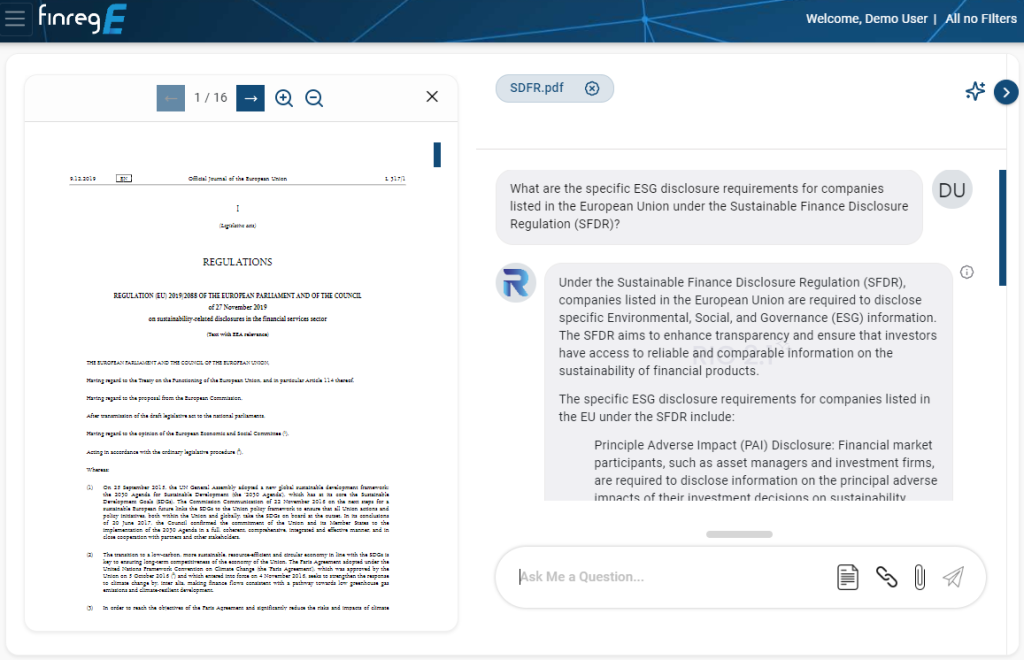

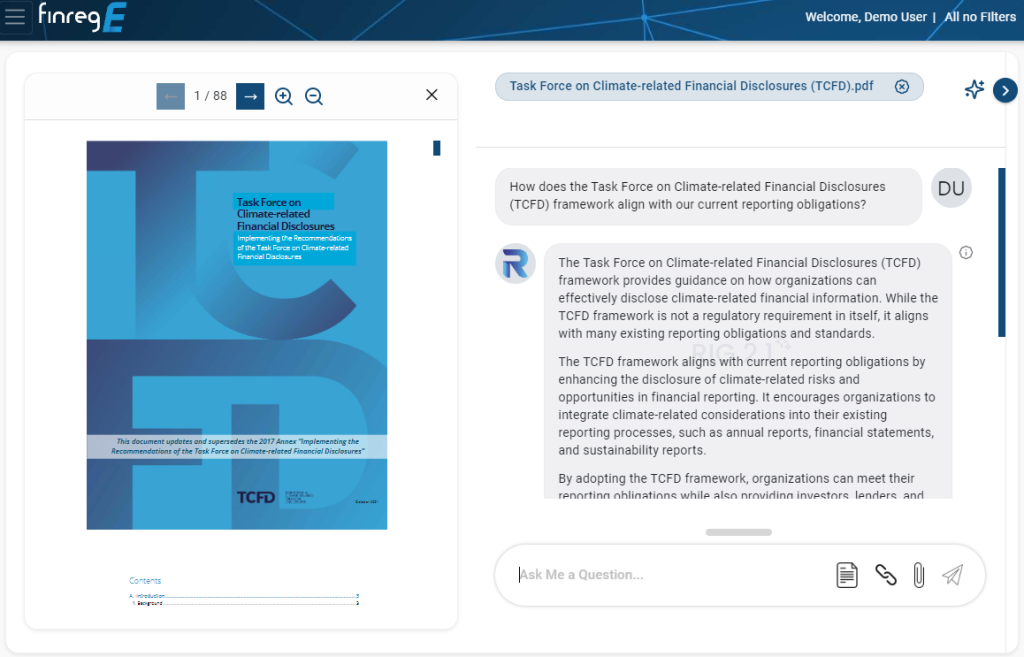

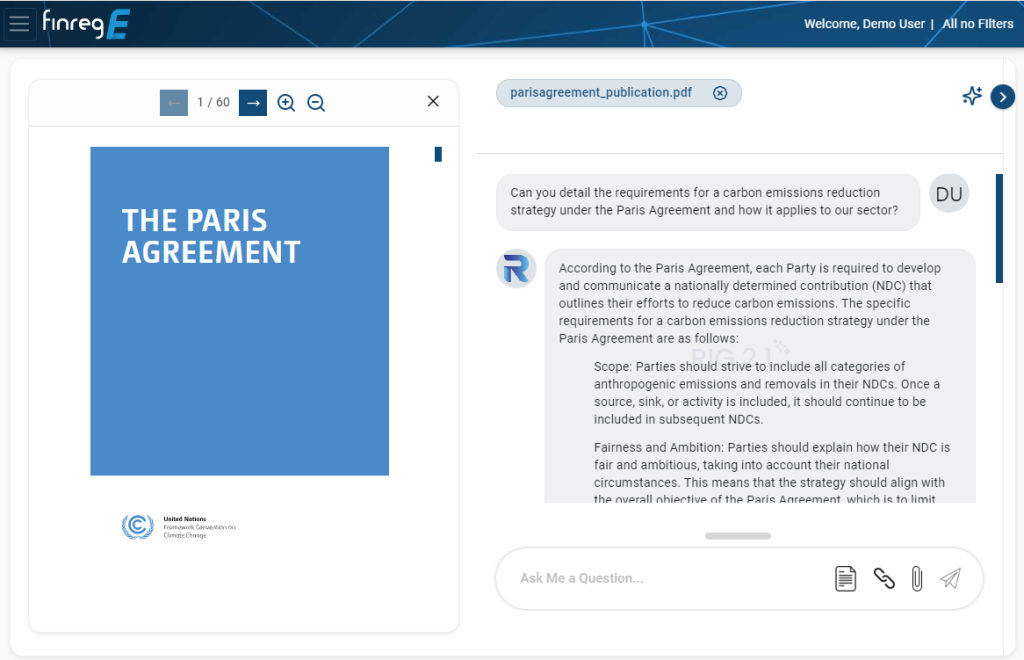

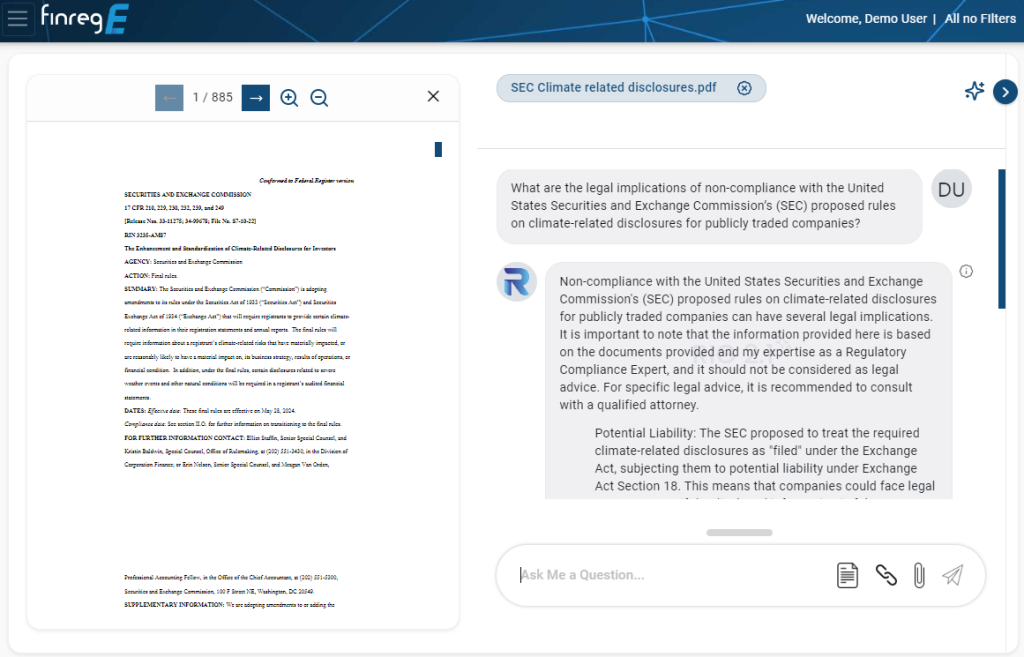

FinregE’s AI-Driven Regulatory Insight Generator (RIG) for Navigating ESG Requirements

Leveraging the power of AI and machine learning, FinregE’s AI Regulatory Insight Generator (RIG) is tailored to parse, understand, and query the vast repository of regulations surrounding Environmental Social and Governance. It acts as your digital consultant, interpreting the nuanced language of regulatory texts and offering insights with precision and speed.

RIG Can Help Specify Regulatory Requirements

What are the specific ESG disclosure requirements for companies listed in the European Union under the Sustainable Finance Disclosure Regulation (SFDR)?

How does the Task Force on Climate-related Financial Disclosures (TCFD) framework align with our current reporting obligations?

Can you detail the requirements for a carbon emissions reduction strategy under the Paris Agreement and how it applies to our sector?

What are the legal implications of non-compliance with the United States Securities and Exchange Commission’s (SEC) proposed rules on climate-related disclosures for publicly traded companies?

AI RIG Enables You To:

Query Complex Regulations: Easily search through the intricacies of emerging ESG regulations and guidelines, obtaining clear and actionable insights.

Anticipate Regulatory Trends: With AI RIG’s predictive capabilities, stay one step ahead by understanding potential future regulatory shifts and preparing accordingly.

FinregE For ESG Implementation and Compliance Strategy

Dynamic Workflows for Regulatory Change Impact

FinregE’s platform is equipped with dynamic workflows tailored to manage the impact of regulatory changes on your firm’s ESG strategy. These workflows are designed to:

Assess Regulatory Impact: Evaluate how new or updated regulations affect your current operations and compliance status.

Implement Change: Guide your organization through the process of adapting to new requirements, ensuring a seamless transition.

Monitor Continuously: Keep a vigilant eye on the regulatory horizon, detecting and reacting to changes as they occur.

Integrated Dashboards and Reporting

Our integrated dashboards offer a visual and analytical view of the ESG regulatory change landscape. They provide real-time updates and comprehensive reporting capabilities, allowing for:

Real-Time Monitoring: Track the latest ESG regulatory developments as they happen, with updates and insights delivered directly to your dashboard.

Insightful Reporting: Generate reports that offer a deep dive into the implications of regulatory changes for your firm, enabling informed decision-making.

Why FinregE Is the Go-To Solution for ESG Regulatory Change Management

By choosing FinregE, you gain a partner that provides:

Depth and Breadth of Coverage

Extensive coverage of ESG regulations from across the globe, ensuring no stone is left unturned.

Advanced Technological Edge

Cutting-edge AI tools to dissect and interpret complex regulatory texts, offering clarity and guidance.

Customized Regulatory Workflows

Tailored solutions to manage the specific impact of regulatory changes on your firm’s ESG practices.

Expertise and Support

Access to a team of ESG and regulatory experts, providing support and insights to navigate the regulatory landscape successfully.

FinregE Weekly Regulatory News Alerts

Stay up-to-date with the latest regulatory changes. Sign up to FinregE’s weekly regulatory alerts news.