The FCA’s 2016 Regtech call for input highlighted the desire and benefits for the industry to have a “robo-handbook that allows firms to interact with regulation to understand the impact on their compliance”. One example and benefit quoted was a “more interactive FCA Handbook better tailored to a firm’s permissions to make compliance and reporting requirements clearer”.

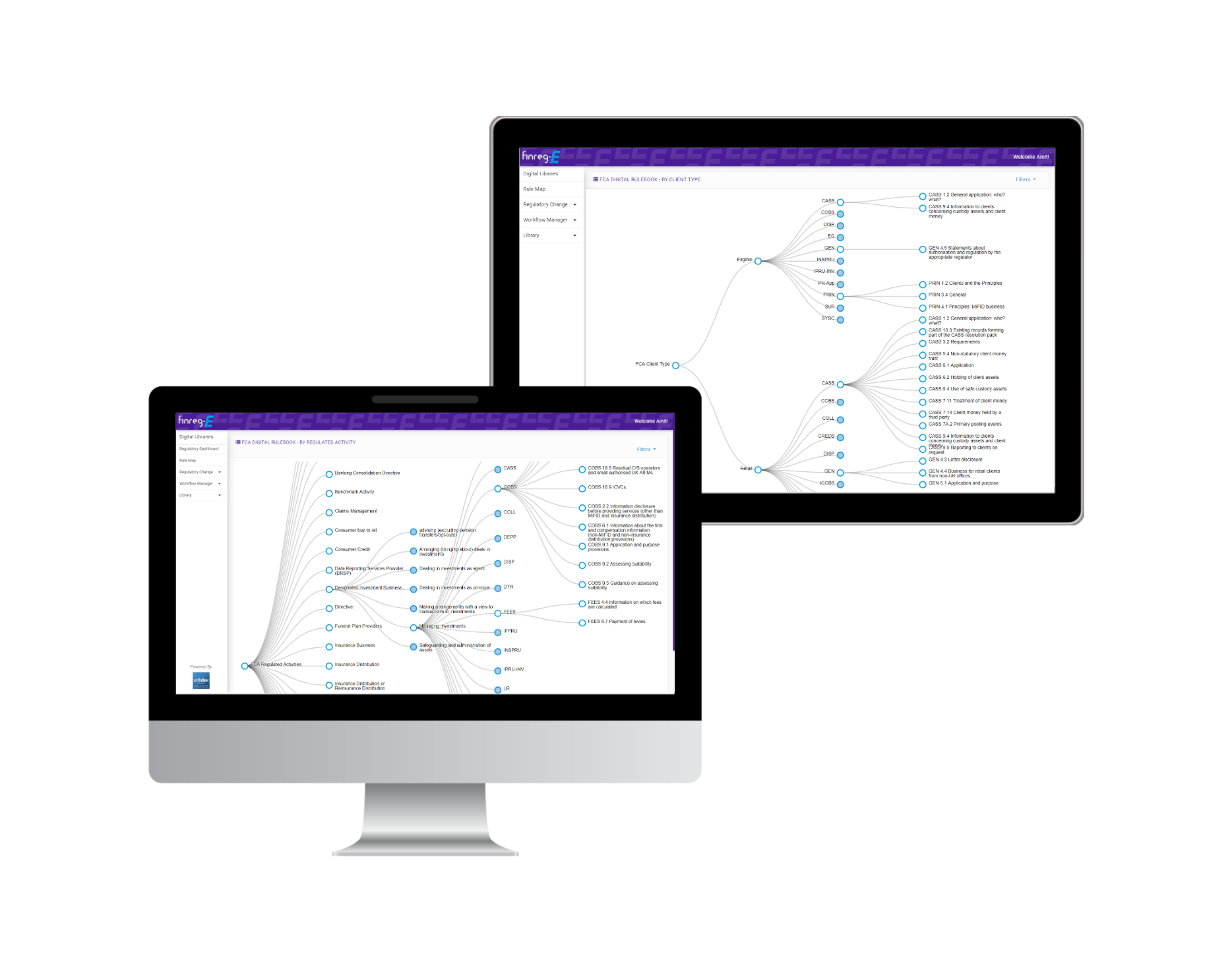

This blog introduces Finreg-E’s FCA’s Robo Handbook, which is one such digital handbook we have in our Digital Rulebook libraries. We explain how it can be used to find out exactly the rules that apply to a FCA regulated firm in a matter of minutes, based on the regulatory characteristics of the firm. We also provide a small demo embedded below for readers to try.

Why is there a demand for an FCA Robo Handbook?

The FCA supervises ~59,000 firms and regulates certain financial services activities. Firms regulated by the FCA are subject to certain FCA rules and standards. Most of these standards and rules are present in the FCA Handbook, with others driven by European rule and legislation. The FCA’s handbook is likely to be even more important to UK regulated firms once the UK leaves the EU and European legislation falls away.

The FCA’s Handbook currently consists of 3263 chapters of FCA regulatory rules and standards across a ~10,000 rule pages. The rules that apply to a firm are based on a number of regulatory factors or permissions, such as (but not limited to!) –

- The regulated activities it performs;

- The type of firm it is;

- The permissions it has under the regulated activities;

- The type of clients it deals with;

- The products it offers or deals in.

Each factor has a set of rules that apply to it. The starting point for a firm to understand what FCA regulators rules apply to it is to know the firm’s regulatory factors or permissions it has. For most firms, it is typical for them to have more than one regulatory or permission that applies. This results in firms having to comply with an overlapping set of rules across the individual factors of their permissions or activities they do.

The Handbook’s current implementation on the FCA’s website does not allow a firm to know all the rules that apply when all the factors are taken into account together. Put simply, currently there is no capability for a firm to select all the regulatory factors or permissions that apply in order to filter the handbook to show only a list of all rules or rule chapters that apply to the firm.

With Finreg-E’s implementation of the FCA’s handbook, you can do this in a within few clicks. We have successfully extended our tag line from “Financial Regulation Made Easy©” to “FCA Handbook Made Easy©”.

How does Finreg-E’s FCA Digital Handbook work?

Demo Finreg-E’s Intelligent FCA Handbook. For the full version please contact info@finreg-e.com. It is recommended to turn mobile devices to landscape and refresh page to view and play with the demo.

- Use the shaded nodes to expand the Handbook map for results.

- Use mouse scroll to Zoom-In and Out of the map.

- Use left click hold and drag to pan the map.

Finreg-E’s FCA Digital Handbook works in the following easy steps:

- Within Finreg-E’s suite of digital libraries, select the FCA Handbook;

- Select the defined FCA regulatory factor(s);

- Finreg-E automatically filters and shortlists all the Handbook chapters and their related rules that apply in relation to the selected factors;

- The digital handbook can also be filtered by key words search;

- You can read the details of the rules within Finreg-E’s Rule Viewer;

- You can group all applicable rules and export to build a firm specific library of FCA rules either in the Finreg-E software or externally;

- You can select rules to add them to Finreg-E’s Compliance Workflows to assess, define and attach internal firm evidence for compliance and applicability with the rule (e.g. policies and procedures)

- You can track changes to the applicable rules and the entire FCA Handbook as it changes via Finreg-E’s Regulatory Change Viewer and update firm overall compliance against rule changes.

Our digital handbook also provides a guide on the likely FCA firm type a firm is based on a selection of regulated activities. For example, consider a firm that has the permission or wants to seek permission to perform the regulated activity of Dealing in Investments as Agent.

Finreg-E’s digital handbook will show you:

- The firm falls within the regulatory category of a Designated Investment Business;

- The firm has to comply rules within the CASS, DISP, FEES, LR, PERG, SUP, SYSC sections of the FCA Handbook; and

- All the relevant chapters within the applicable Handbook sections that apply.

<img src=”/wp-content/uploads/2020/07/Finreg-E_Intelligent_Digital_FCA-Handbook_Regulated-Activities_UK-1024×585.png” alt=”Finreg-E_Intelligent_Digital_FCA Handbook_Regulated Activities_UK”>

Now consider a firm that has permission for dealing with Eligible Counterparty client types. Finreg-E’s digital handbook will show:

- CASS will be one of the sections of the FCA Handbook that will apply;

- The following chapters of CASS will apply:

- CASS 1.2 General application: who? what?

- CASS 9.4 Information to clients concerning custody assets and client money.

If the firm decides to change its permission to dealing with Retail clients, our digital handbook will show that the following 10 additional CASS chapters may also apply:

- CASS 10.3 Existing records forming part of the CASS resolution pack

- CASS 3.2 Requirements

- CASS 5.4 Non-statutory client money trust

- CASS 6.1 Application

- CASS 6.2 Holding of client assets

- CASS 6.4 Use of safe custody assets

- CASS 7.11 Treatment of client money

- CASS 7.14 Client money held by a third party

- CASS 7A.2 Primary pooling events

- CASS 9.5 Reporting to clients on request

Finreg-E’s FCA Digital Handbook can also provide guidance on the type of FCA firm an institution is based on the regulated activities it does. For example, an FCA regulated Broker-Dealer firm is a firm with the following combination of regulated activity permissions:

- Advising on investments

- Arranging deals in investments

- Making arrangements with a view to transactions in investments

- Dealing in investments as principle

- Dealing in investments as agent

Whereas, an Asset Management firm is likely to have the following permissions:

- Advising on investments

- Arranging (bringing about) deals in investments

- Dealing in investments as an agent

- Making arrangements with a view to transactions in investments

- Managing investments

- Safeguarding and administration of assets

Why have we created an FCA interactive digital Handbook?

At Finreg-E, we provide digital regulatory rulebook libraries for major rulesets and topics across global jurisdictions. Our digital rulebooks provide access to PDF rulebooks and rules broken down in individual rules at paragraph level of a defined ruleset. This converts PDF rule and documents into rules data or data points so they can easily used for compliance processing.

For example, currently in order to work with the information or a rule in the FCA Handbook, you have to copy and paste the data from the FCA’s website into Excel, Word, PowerPoint or whatever document format you are using internally to work on a compliance task against that rule.

By having your own digital regulatory rulebook library, you can easily select and process a digital rule for compliance purposes as required.

When used in Finreg-E, each digital rule paragraph is also attached to a firm tailored compliance self-assessment workflow. This workflow allows you to further process the rule to:

- Assign accountability to business units and business owners for compliance.

- Write compliance assessment status against the rule paragraph requirement.

- Attach or reference documentary compliance evidence, such as policies and procedures, against the rule to rule requirement to demonstrate and track compliance.

Throughout our work with our clients, we have found that one of the key things a firm looks for or likes to have is a golden database of all the rules that applies to it. From our point of view, this is also the most logical starting point for ensuring compliance with your regulatory rules – if you know all the rules apply to you as a firm, you know what you need to do to meet compliance against them, and you know where are compliant or not at a point in time. That’s complete compliance with control!

Machine Readable/Machine Executable rules

At Finreg-E we are building machine readable/machine executable regulation in financial services. We want to help regulators meet their initiatives on making their rules machine executable, and to help firms reduce the cost, time and redundant effort it takes to meet compliance with rules. We have spent a lot of time understanding the structure, components, texts, meanings, relationships and actions related to the vocabulary of regulatory rules. We have completed proof of concepts which have proven that you can code regulatory rules and policy to provide you with a list of actions that need to take place and in what business or compliance area of the bank. While such analysis and techniques will not remove human interaction and understanding of regulation and compliance, it does make the work of humans more accurate, fast and with less errors and rework.

In our next blog, we will show an example of how machine executable rules work all the way from policy development to implementation phase.

Frequently Asked Questions

Most financial services are FCA-regulated activities and, therefore, if your company intends to provide services within the financial industry or any activity specified by the Regulated Activities Order 2001 and Payment Services Regulations 2017, then it must be registered with the FCA and your activities must be compliant with their policies.

When you become a member of the FCA, you will be expected to pay a fee and send regular reports to the governing body. Moreover, FCA rules and regulations specify certain standards with which you must comply at all times.

All firms need to conduct a CASS audit—in fact, even those that don’t hold ant client assets may still require a CASS assurance report.

That said, the FCA handbook states that there are certain exemptions such as investment management or personal investment firms that do not require a statutory audit. All assurance reports for DIFs are sent directly to the FCA from the auditor.

Finreg-E provides digital rulebooks across global financial services regulation. Contact a memeber of Finreg-E’s team using our contact page below or simply give us a call.