Regulatory Obligations

Unveiling the Power of AI via RIG in Regulatory Obligations

Effectively managing regulatory obligations is critical for financial institutions. However, interpreting complex rules across countless pages presents significant challenges. FinregE solves this through AI-powered regulatory intelligence.

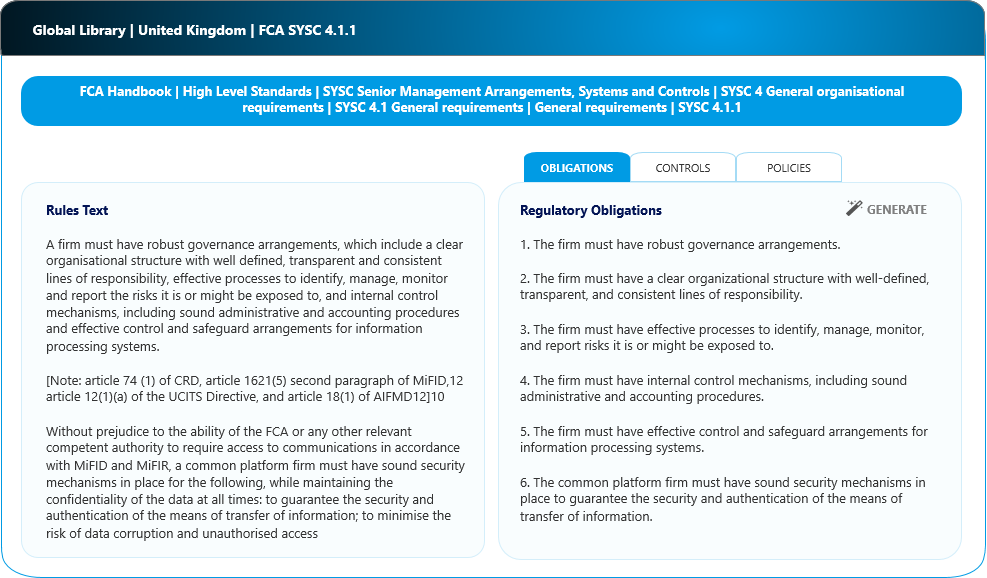

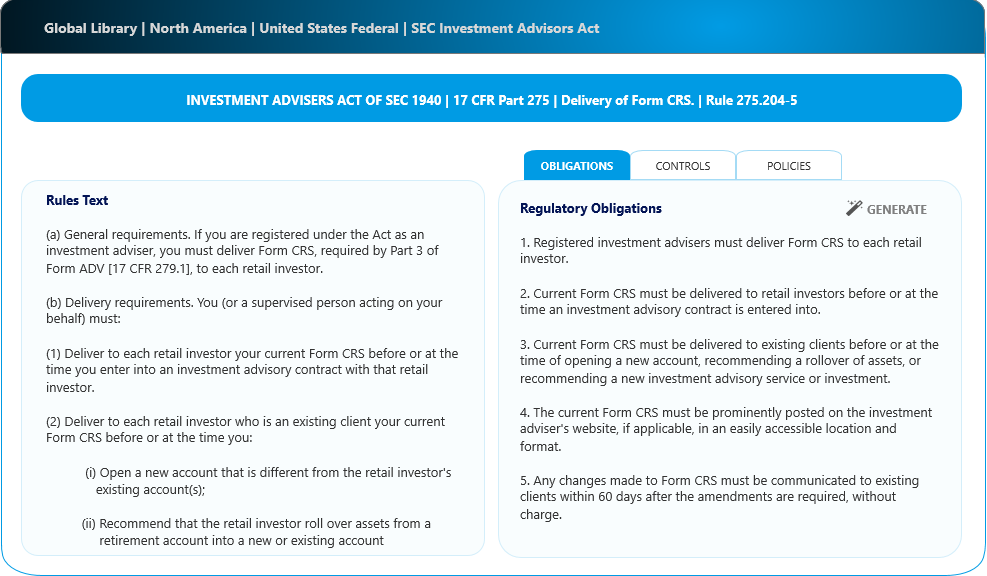

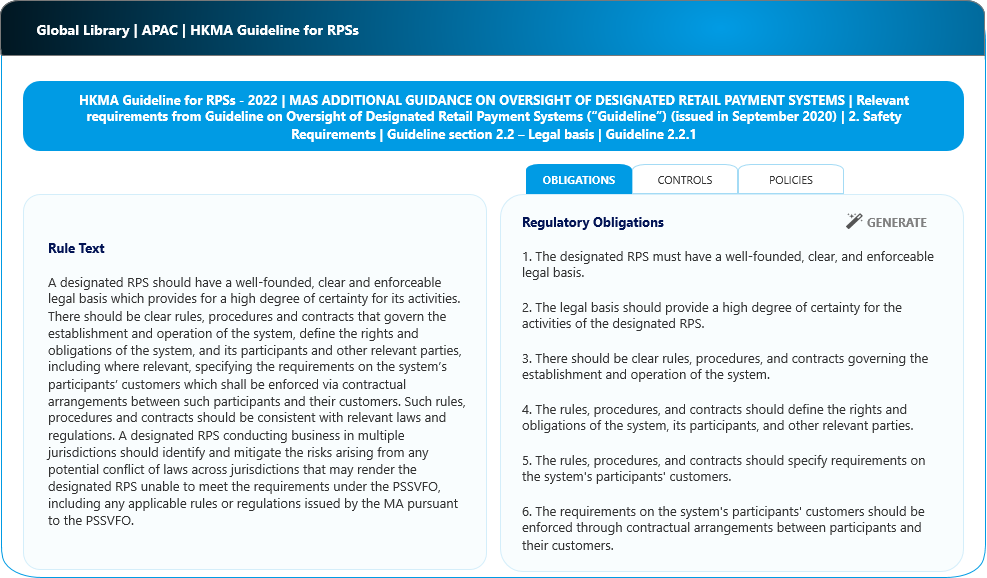

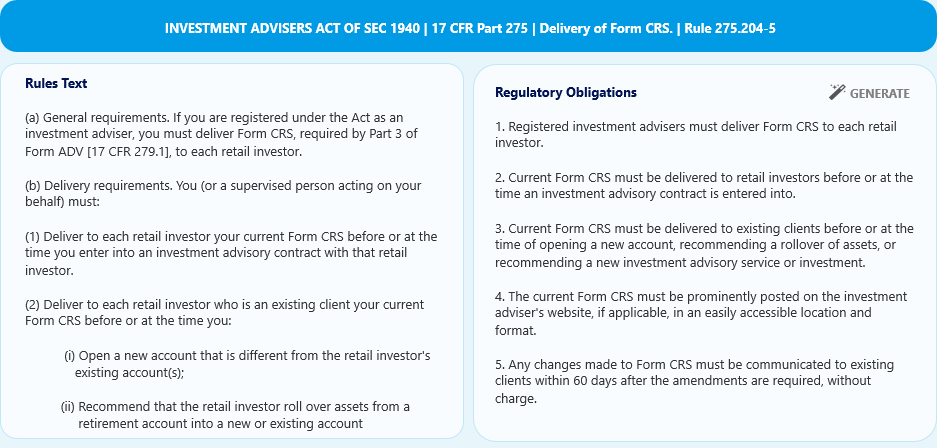

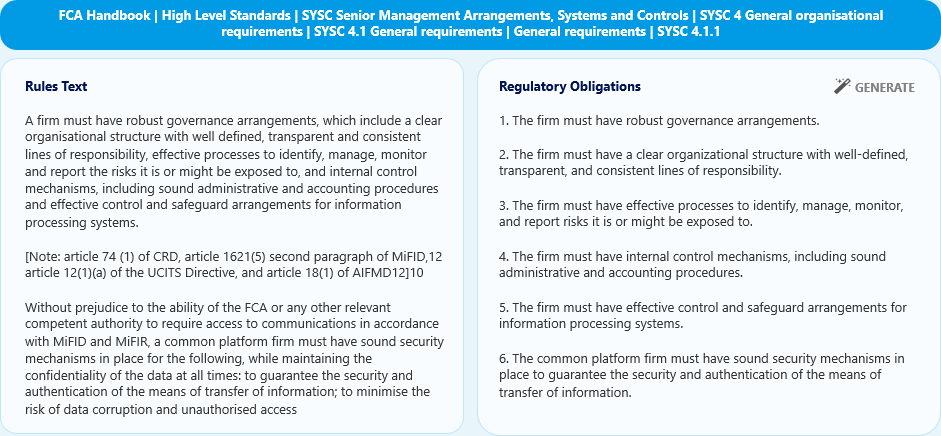

Our Regulatory Insights Generator (RIG) thoroughly analyzes regulatory texts using natural language processing and machine learning. RIG identifies and extracts key obligations and required actions with precision.

What are Regulatory Obligations?

Regulatory obligations are the specific requirements that institutions must follow as dictated by laws, regulations, and guidelines within their operational jurisdiction. Regulatory obligations define:

- Legal Mandates: Compliance with laws from legislative and governmental bodies.

- Regulatory Directives: Authority-set standards for fair, safe, and compliant operations.

- Compliance Standards and Management: Industry benchmarks for quality, risk, and ethics.

- Policy Requirements: Internal policies to meet regulations and manage risks.

- Operational Procedures: Processes to meet daily regulatory requirements.

- Regulatory Reporting Obligations: Duty of submitting compliance evidence to authorities.

- Ethical and Conduct Guidelines: Standards exceeding legal requirements for responsible practice.

- Risk Management Protocols: Systems to identify, assess, and mitigate compliance risks.

- Record-Keeping Rules: Documentation of activities as compliance proof.

- Audit and Assurance: Regular audits to confirm adherence to regulations and reporting accuracy.

- Licensing and Certification: Holding necessary credentials for legal industry operation.

FinregE and RIG Pinpoint Regulatory Obligations with Precision

RIG analyzes regulatory texts to identify and extract key regulatory obligations, requirements and actions. This is achieved by combining:

- Natural language processing – Interprets regulatory documents

- Text analytics – Structures unstructured text for insights

- Topic modeling – Uncovers key themes and relationships

RIG Obligation Delivers

By utilizing these outputs, institutions can develop a comprehensive understanding of regulatory expectations and integrate this knowledge into their operational and compliance frameworks.

Compliance Tasks

Specific actions that need to be taken to adhere to regulatory requirements.

Policy Updates

Adjustments or new policies that need to be implemented to be in line with current regulations.

Control Framework Enhancements

Recommendations for improvements or additions to internal control mechanisms to mitigate risks identified through regulatory changes.

Risk Assessments

Identification and evaluation of potential risks arising from new or amended regulations.

Gap Analysis Reports

Detailed accounts of where current practices fall short of new regulatory standards.

Training Requirements

Identification of areas where staff need additional training to comply with new regulations.

Regulatory Change Summaries

Simplified explanations of regulatory changes for quick understanding and dissemination within the organization.

Impact Analyses

In-depth analysis of how new regulations will affect current operations, products, and services.

Compliance Roadmaps

Step-by-step guides on how to achieve compliance with new regulations within a given timeframe.

Due Diligence Checklists

Lists of due diligence steps required to ensure all aspects of the regulation have been considered and addressed.

Regulatory Calendars

Timelines and schedules for when specific regulatory requirements come into effect and when compliance measures must be completed.

Audit Trails

Records of actions taken to comply with regulations, which are crucial for demonstrating compliance in regulatory audits or examinations.

Legal Interpretations

Expert analysis and interpretation of the legal implications of regulatory texts.

Board and Management Reports

Regular reports tailored for senior management and board members summarizing compliance status and issues.

Compliance Metrics

Quantitative measures to track compliance efforts and effectiveness over time.

Benefits of FinregE Automated Obligations versus Manual Efforts

Enhanced Efficiency and Cost Optimization

- Increased Efficiency, Scalability, and Cost-Effectiveness: Streamlines the process across jurisdictions, drastically cutting down the time for obligations identification.

- Resource Efficiency: Frees up human resources from routine tasks, allowing a focus on strategic areas of compliance and risk management.

- Real-Time Obligation Updates: Connected with FinregE’s Horizon Scanning, provides immediate, up-to-date compliance information, expediting the update of compliance processes.

- Customization: Tailors insights into regulatory obligations to fit institutional regulatory profile and permissions, enhancing results and relevance.

Strengthened Regulatory Risk and Compliance Management

- Improved Decision Making: Provides access to strategic data that informs decision-making related to compliance and operational risk.

- Risk Mitigation: Decreases the likelihood of non-compliance and potential regulatory penalties through precise obligation identification.

- Consistency and Accuracy: Ensures uniformity in regulatory interpretation, mitigating variability and human error risks.

- Cross-Linking of Related Regulations: Identifies and correlates obligations across various regulations, ensuring a comprehensive compliance view.

- Data-Driven Insights: Discovers patterns and correlations in obligations that are not immediately apparent through manual analysis.

- Enhanced Knowledge Management: Establishes a centralized, searchable, and accessible knowledge base of regulatory obligations.

- Integration with Other Systems: Facilitates a seamless compliance ecosystem by syncing with existing enterprise systems.

FinregE comes with several useful features that can help manage your regulatory obligations.

By using the platform, you can:

- Analyse, extract, and provide a unique visual representation of key compliance obligations and regulatory requirements.

- Access an extensive financial ontology for different jurisdictions around the globe using NLP and network analysis.

- Perform multiple functions in one platform such as topic classification and network connections to map obligations.

- Organise rules based on different criteria such as ruletopic taxonomy, country and regulator to meet regulatory rules.

FinregE Weekly Regulatory News Alerts

Stay up-to-date with the latest regulatory changes. Sign up to FinregE’s weekly regulatory alerts news.

FAQs

Why use FinregE?

What are tax compliance and regulatory reporting requirements?

Tax compliance and regulatory requirements tend to differ based on local and regional jurisdictions. Regardless of these differences, however, all financial firms need to maintain a meticulous record of their internal and external data to ensure that they are in line with regulatory policies.

Maintaining a thorough record makes it easier to process the necessary data to support compliance reporting.

What are the techniques used for monitoring regulatory compliance?

Techniques used for monitoring and maintaining regulatory compliance depend on the model or framework financial institutions use for this purpose. Regardless of the framework used, however, RegTech can optimise and enhance existing capabilities through the power of AI-driven automation.

How do you maintain compliance with regulatory requirements using automated systems?

Automated systems make it easier to meet regulatory requirements by scanning the latest updates from regulatory bodies and relaying the information back to financial teams. Thereafter, these systems assess existing procedures to identify any compliance gaps and may even recommend remedial action.

This insight allows organisations to be more agile and responsive when it comes to meeting financial regulatory requirements.

What are examples of compliance issues?

Compliance issues span various aspects of financial operations, ranging from anti-money laundering procedures to data security measures. Other examples of compliance issues cover consumer protection measures, operational resilience, and fraud.