Level 39

One Canada Square

Canary Wharf, London

United Kingdom

Phone: +442045370860

Email: info@finreg-e.com

Social: Linkedin

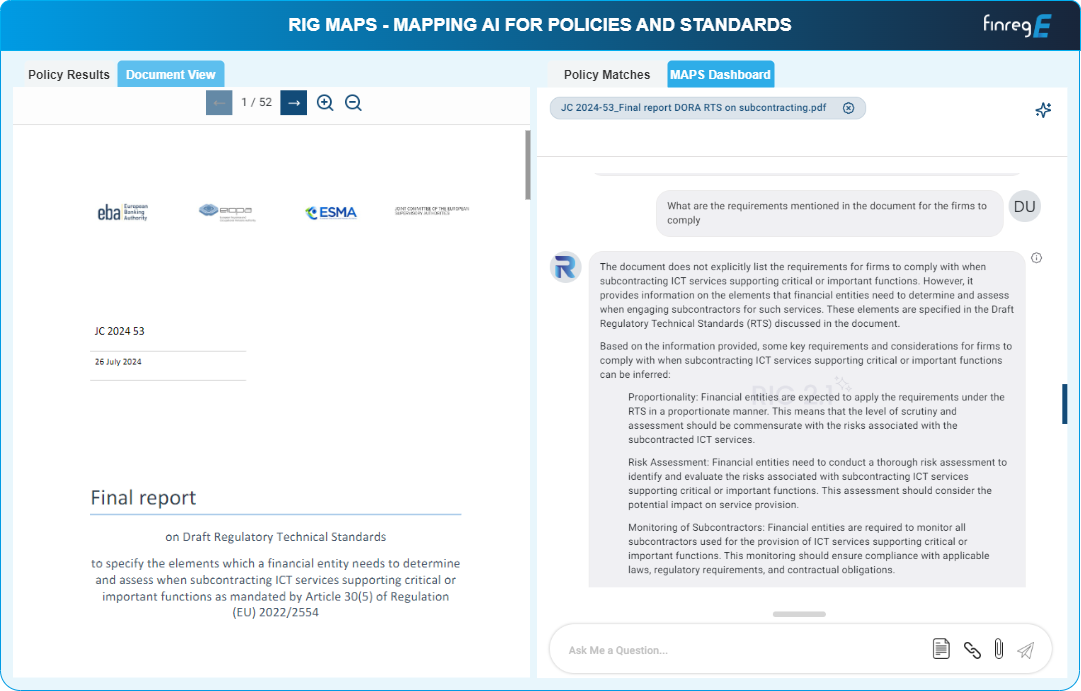

Compliance Controls Mappings

Compliance Self Assessments

Controls Management

Digital Rulebooks

Governance, Risk & Compliance (GRC)

Machine Readable Regulations

Horizon Scanning

Regulatory Change

Automated Compliance

Regulatory Horizon Scanning

Regulatory Change Management

Regulatory Impact Assessments

Risk Management

Regulatory Obligations

Compliance Auditing

Compliance Gaps AnalysisRegulation Obligations

Regulatory Impact Assessment

Compliance Management

Automated Compliance

Compliance Workflows

Digital Rulebooks

Regulatory Horizon Scanning

Regulatory Change

Automated Compliance

Regulatory Change Management

Internal Regulation Management

Project Management

Regulatory Affairs Management

Regulatory Policy Management

Regulatory Change Management

Regulatory Public Policy

Regulatory Alerts

Regulatory Publications

Regulatory News

Regulatory Alerts

Regulatory Analytics

Regulatory Developments

Regulatory Updates

Fast Compliance

Regulatory Optimisation

Regulatory Obligations

Regulatory Technology (RegTech)

Compliance Automation

Risk Management

Rule Inventories

Copyright © 2024 FinregE | All rights reserved