Strategic AI Integration: Elevating Compliance in Asset and Investment Management

In the fast-paced world of investment and asset management, staying ahead of compliance and risk management is paramount.

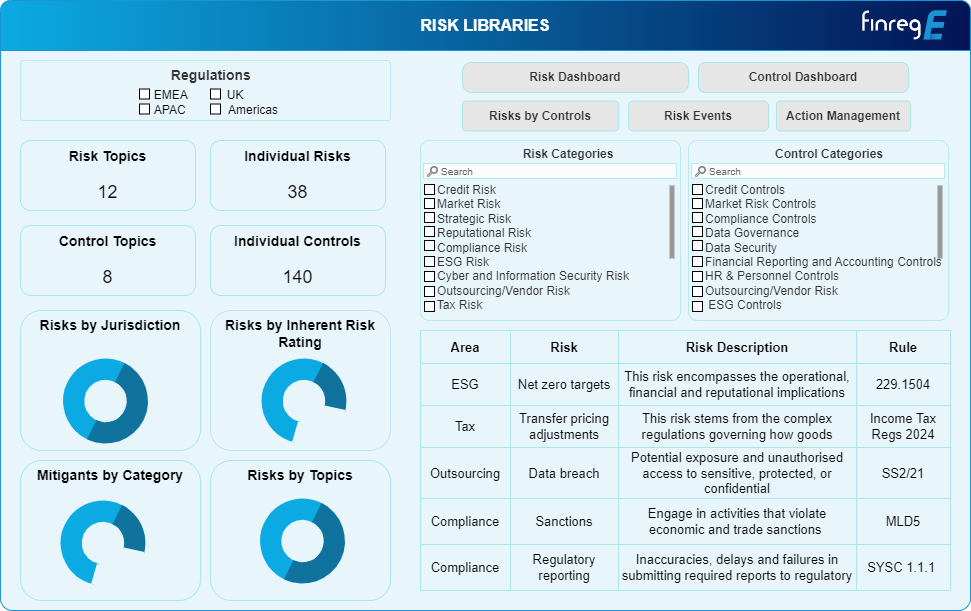

FinregE’s innovative and unique compliance software solutions empower asset management companies to monitor their compliance and risk programs effectively, providing real-time access to sophisticated reporting dashboards and significantly reducing the time spent on administrative tasks.

Transforming Compliance in Asset and Investment Management with Generative AI and NLP

At FinregE, we leverage cutting-edge generative AI and Natural Language Processing (NLP) technologies to redefine compliance processes in the asset and investment management sector. Our solutions harness the power of these advanced technologies to streamline and enhance the accuracy of compliance operations, bringing significant improvements to both efficiency and efficacy.

Central to our use of Gen AI is our Large Language Model, AI RIG, a first in a virtual regulatory compliance expert trained to assist with legal and regulatory texts.

RIG offers the following functionalities:

RIG excels in parsing and interpreting vast volumes of regulatory information. Utilizing NLP, RIG can automatically extract key obligations and requirements from complex regulatory texts and update compliance systems in real-time. This capability ensures that asset and investment managers are always aligned with the latest regulatory changes without manual oversight.

RIG can ingest internal compliance manuals and policies to assist in monitoring internal and external communications to ensure adherence to compliance standards. By analysing documents, the system identifies potential non-compliant behaviour or conflicts of interest, alerting compliance officers to areas that require immediate attention. This proactive monitoring helps prevent regulatory breaches and maintains high standards of ethical conduct.

RIG streamlines the creation of detailed compliance reports by synthesizing data from various sources into coherent, comprehensive formats. This not only saves valuable time but also reduces the risk of errors associated with manual report generation. Asset and investment managers can leverage these capabilities to generate real-time insights into their compliance status, enhancing decision-making processes.

FinregE’s asset management compliance software centralizes GRC (Governance, Risk Management, and Compliance) obligations, providing a holistic view of all regulatory requirements in one integrated location. This allows asset managers to quickly identify areas of concern, streamline compliance processes, and ensure nothing is overlooked.

Complete Compliance Solution for Asset Management Risk and Compliance Management

Centralised Rules, Risks and Controls Management

FinregE offers a comprehensive solution with its Centralized Rules, Risks, and Controls Management system, designed to streamline and fortify the compliance infrastructure of any financial institution. This robust platform brings together all regulatory rules, risk assessments, and control activities into a single, unified framework, enabling you to maintain a clear overview and tight management of their compliance landscape.

Key Features of FinregE’s Centralized Management System

Our platform serves as a central repository for all regulatory and internal rules applicable to your organization. This repository is continuously updated, ensuring that you are working with the most current information, helping your organization stay ahead of regulatory changes and reduce compliance risks.

Automatically identify and assess risks associated with non-compliance to regulations and internal policies. FinregE provides the tools to evaluate the potential impact and likelihood of risks, facilitating prioritized and informed risk mitigation strategies.

Align control activities directly with identified risks and regulatory requirements, ensuring that every control measure is traceable back to a specific rule or risk. This alignment is critical for demonstrating compliance during audits and regulatory reviews.

Streamline your compliance processes with automated workflows that guide risk assessments, control implementations, and regular compliance reviews. These workflows enhance efficiency, reduce the likelihood of human error, and ensure consistency in compliance practices across the organization

Gain real-time insights into your compliance status with dynamic dashboards and detailed reporting capabilities. These tools provide at-a-glance visibility of compliance levels, outstanding issues, and upcoming regulatory changes, empowering management to make informed decisions quickly.

Maintain detailed records of all compliance activities, including changes to rules, risk assessments, and control measures. This comprehensive audit trail supports accountability and transparency, simplifying audit processes and regulatory inspections.

Precision Compliance: FinregE’s Custom Horizon Scanning for Investment and Asset

FinregE’s Horizon Scanning solution is specifically designed for investment and wealth management firms, offering a sophisticated tool that effectively cuts through the regulatory noise to deliver highly relevant insights.

FinregE uses state-of-the-art filtering techniques by sector, regulations and semantic analysis versus each firm’s regulatory profile to sift through vast amounts of regulatory data, ensuring that you receive only the most pertinent information critical and tailored to your operations.

Key Features of FinregE’s Horizon Scanning Solution

Our solution employs intelligent algorithms that filter out irrelevant data based on NLP, regulatory profiling, sectors, themes, regulations and topics, allowing you to focus on regulatory changes that directly impact you specific business areas and jurisdictions. Recognizing that horizon scanning for investment management and asset management is a niche requirement, this targeted filtering significantly reduces the burden on compliance teams, enabling you to concentrate on implementing necessary changes rather than sorting through overwhelming amounts of information.

FinregE’s Horizon Scanning tool is equipped with customizable alert settings, enabling users to receive notifications based on predefined criteria that matter most to their business. Whether it’s changes in investment policies, new fiduciary responsibilities, or shifts in the regulatory landscape, our system ensures that you are the first to know, facilitating timely and informed decision-making.

This solution seamlessly integrates with existing compliance workflows, linking new regulatory developments directly to your internal policies and controls. This integration ensures that every change is automatically evaluated against current compliance frameworks, aiding in swift adaptation and continuous compliance.

Covering a wide array of global regulatory bodies and frameworks, FinregE’s Horizon Scanning provides comprehensive coverage that is essential for globally diversified investment and wealth management firms. This broad scope ensures that no critical regulatory update is missed, safeguarding firms against compliance risks.

Beyond simply notifying firms of regulatory changes, our solution provides detailed impact analyses workflows, helping you understand the implications of each change and the actions required to remain compliant.

Key Regulatory Areas Covered

- Fiduciary duties

- SEC filings requirements

- AML compliance

- ESG reporting standards

- Liquidity Risk Management

- Market Abuse Regulations

- Alternative Investment Regulations

- Real Estate Fund Management

- Securities Compliance

- Portfolio Management Standards

- Conflict of Interest Regulations including MNPI and Information Barriers

- Operational Risk

- Cyber Security

- Data Privacy

FinregE Weekly Regulatory News Alerts

Stay up-to-date with the latest regulatory changes. Sign up to FinregE’s weekly regulatory alerts news.