A mid-tier bank seeking to align internal policies with the Digital Operational Resilience Act (DORA).

The bank needed to map 15 key internal policies, including AML, IT, and order execution policies, to DORA’s Level 1 and Level 2 regulations and identify gaps in compliance.

FinregE implemented the following steps:

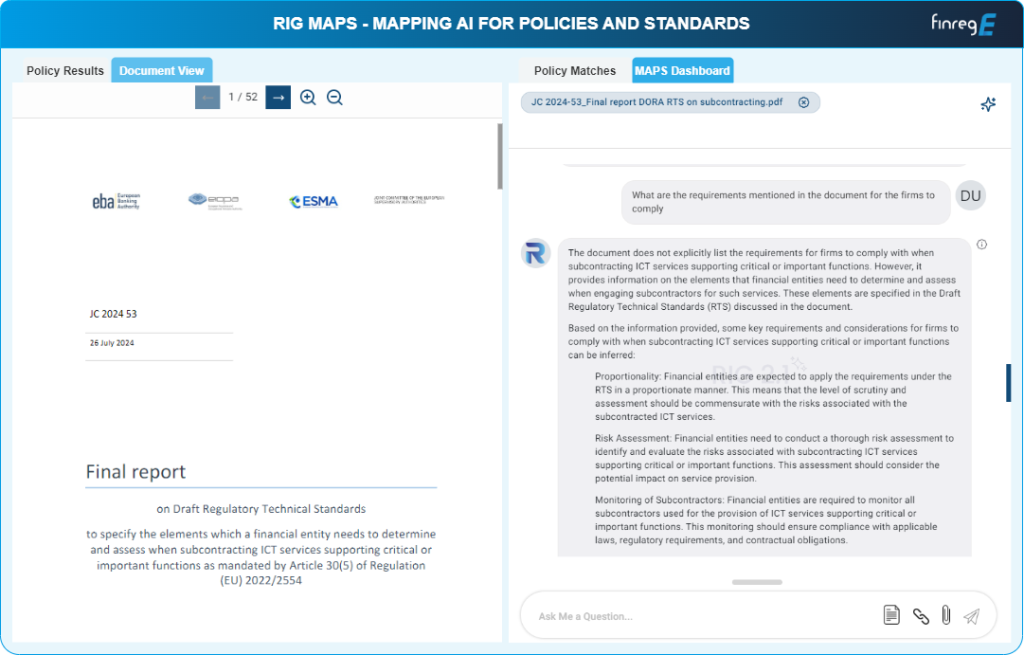

FinregE’s horizon scanning captured all DORA regulations, including Level 1 and Level 2 texts (RTS).

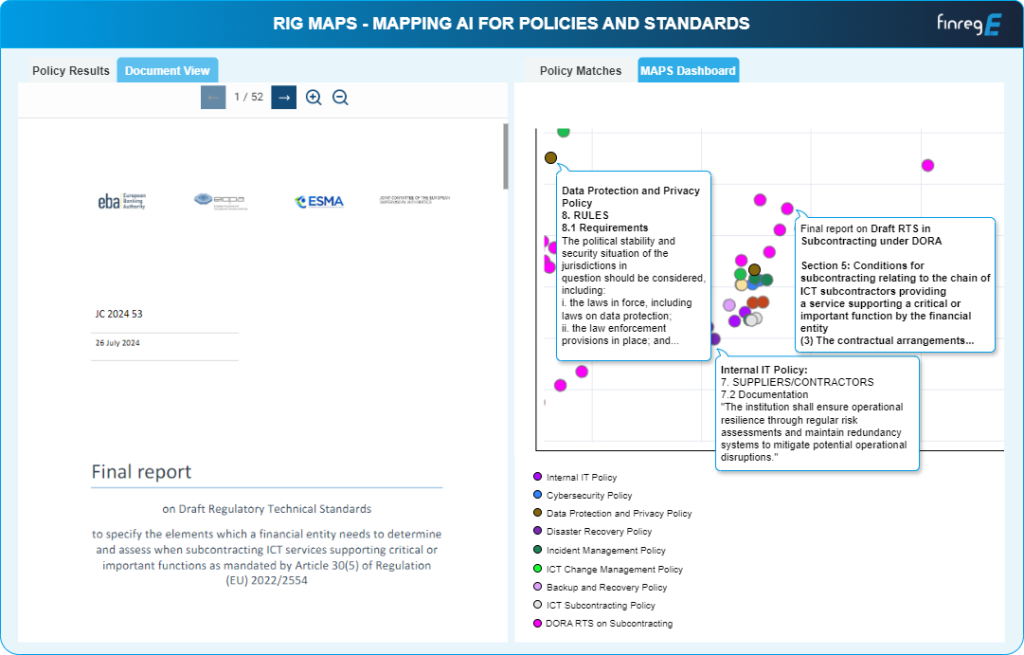

RIG mapped the bank’s policies—ranging from AML and IT to order execution—against the DORA requirements.

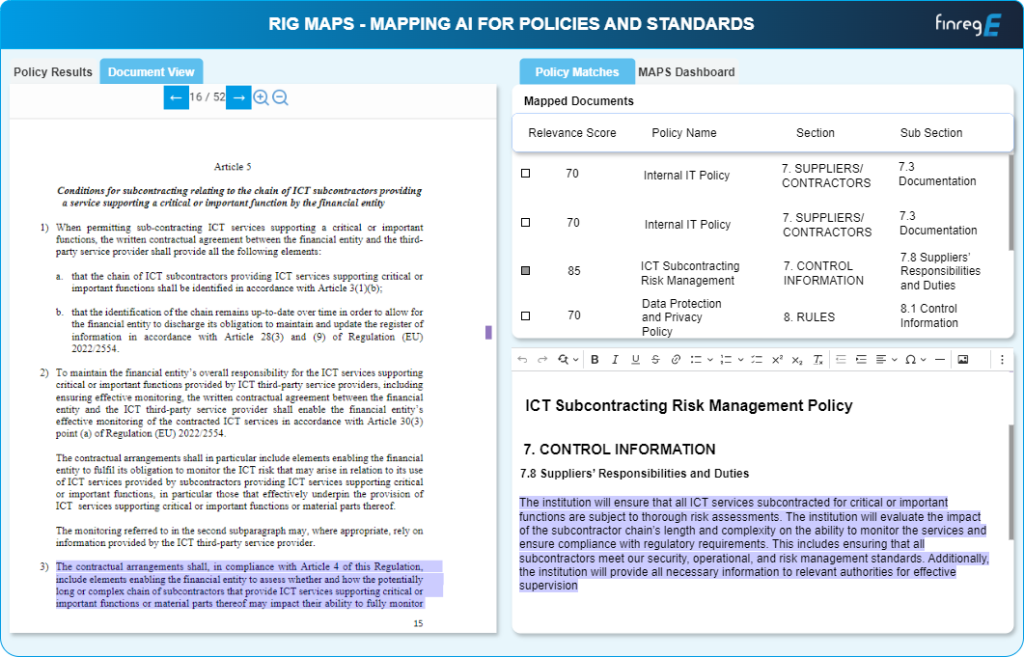

- RIG’s analysis revealed that certain paragraphs of the internal policies directly aligned with DORA’s text.

- However, there were several outliers—sections of policy that did not map to any DORA provisions.

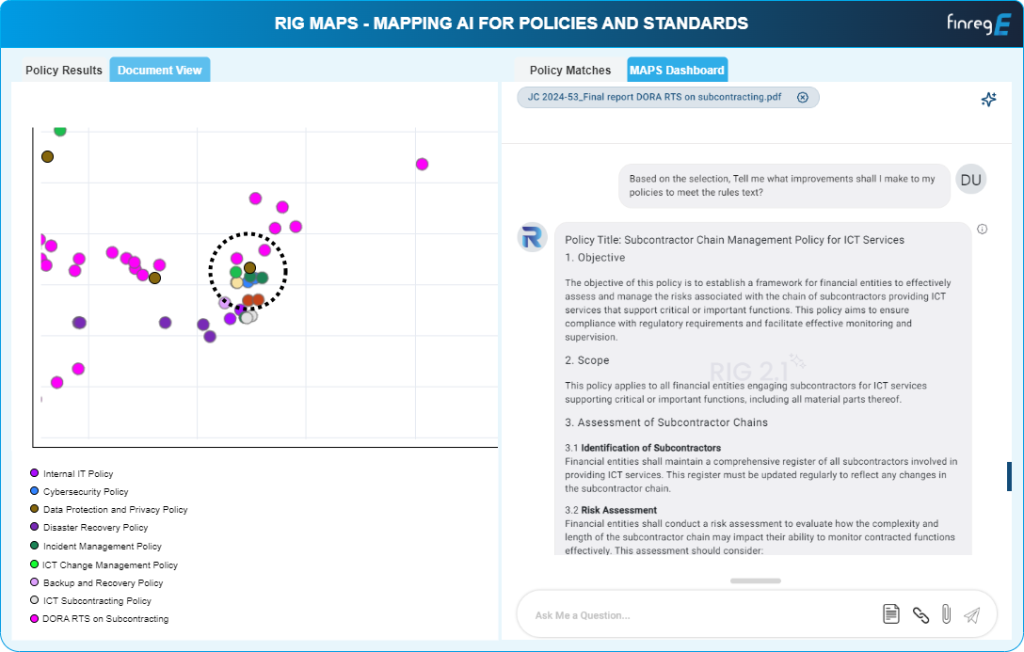

For the matches between internal policies and DORA, RIG suggested improvements, highlighting areas where the bank’s current practices needed updates to align with the new regulations. For example, certain IT policy sections required enhancements to meet DORA’s operational resilience criteria.

Where outliers existed, RIG recommended new wording for policy and control enhancements. For example, new sections were proposed for the AML and IT policies to meet DORA’s cybersecurity and reporting obligations.

Result

The automated mapping allowed the bank to swiftly identify policy gaps, improve existing controls, and ensure full compliance with DORA. By utilizing FinregE’s RIG, the bank was able to reduce manual compliance efforts and enhance its operational resilience, ultimately achieving a proactive stance in regulatory management.

Book a demo today and see how FinregE can streamline compliance processes and empower you to confidently and efficiently navigate the complexities of regulatory compliance.