Regulatory and Compliance Workflows by FinregE

Institutions often follow complex workflows to meet their legal and regulatory obligations. These workflows ensure that tasks are performed systematically and efficiently, helping organizations comply with regulations, avoid penalties, and maintain a strong governance framework. FinregE offers a wide range of Regulatory and Compliance Workflows designed to streamline processes like regulatory change management, compliance monitoring, and regulatory interactions, all while enhancing enterprise collaboration.

Regulatory and Compliance Workflows in FinregE

FinregE provides digitized workflows that automate key regulatory and compliance processes. These workflows cover everything from internal regulatory change management to interactions with regulators, compliance self-assessments, regulatory remediation, and ongoing monitoring. By using FinregE’s platform, organizations can streamline these workflows, making them more efficient and less prone to error.

FinregE also offers custom, bespoke workflows for organizations with unique or complex regulatory requirements. These tailored workflows can automate repetitive processes, improve decision-making, and enable seamless task management, all while maintaining transparency and accountability.

Types of Regulatory and Compliance Workflows

Compliance Workflows for Regulatory Change Management

Managing regulatory changes can be a daunting task, especially for institutions operating across multiple jurisdictions. FinregE’s Regulatory Change Management Compliance Workflows help streamline the process of tracking, assessing, and implementing changes to laws and regulations.

- Track Regulatory Changes: Automatically monitor changes in regulatory rules and map them to your internal policies and processes.

- Impact Assessment: Assess the effect of regulatory changes on your business and identify necessary actions.

- Task Assignment: Assign tasks related to implementing regulatory changes and track progress to ensure compliance deadlines are met.

Compliance Workflows for Regulatory Horizon Scanning

Anticipating future regulatory changes is critical to staying ahead of compliance risks. FinregE’s Regulatory Horizon Scanning Workflows automate the monitoring of upcoming regulations and provide early insights on changes that may impact your organization.

- Early Detection: Identify potential regulatory changes before they take effect.

- Planning and Action: Develop proactive strategies to address future compliance requirements.

- Cross-Department Collaboration: Facilitate the distribution of information across relevant teams to ensure a coordinated response.

Workflows for Compliance Self-Assessments (SIF Attestations)

Self-assessments, such as Senior Manager and Certification Regime (SIF) attestations, are vital for maintaining regulatory compliance and governance standards. FinregE’s Compliance Self-Assessment Workflows automate the process of gathering attestations, ensuring all relevant personnel complete their compliance tasks on time.

- Automated Attestations: Automate the collection of attestations from responsible parties.

- Evidence Tracking: Upload and store supporting documentation to verify compliance.

- Reporting and Notifications: Track the status of attestations, with automated reminders to ensure deadlines are met.

Compliance Workflows for Regulatory Remediation and Regulatory Liaison

When compliance gaps or issues are identified, regulatory remediation becomes critical. FinregE’s Regulatory Remediation Workflows streamline the management of remediation projects, helping institutions document corrective actions, track progress, and report to regulatory bodies.

- Manage Remediation Tasks: Assign and track remediation tasks across teams, ensuring gaps are closed promptly.

- Regulatory Liaison: Coordinate communications and interactions with regulators, including managing documentation, requests, and responses.

- Audit-Ready: Maintain a full audit trail of actions taken for remediation, including supporting evidence and progress reports.

Workflows for Regulatory Compliance Monitoring

Compliance monitoring is essential to ensuring ongoing adherence to regulatory requirements. FinregE’s Compliance Monitoring Workflows provide a digitized, structured approach to regularly reviewing policies, controls, and operational infrastructure.

- Compliance Testing: Test policies, processes, and controls against regulatory requirements.

- Annual Monitoring Plans: Develop and manage an ongoing compliance monitoring schedule, with inbuilt capabilities to test compliance against internal and external requirements.

- Gap Analysis and Reporting: Identify gaps and areas for improvement, with real-time reporting on compliance performance.

Compliance Workflows for Case Management Against Operational Events

Operational risk events such as data breaches or process failures require immediate attention and documentation. FinregE’s Case Management Compliance Workflows automate the management of operational events, ensuring timely resolution and proper documentation.

- Incident Tracking: Log and track operational risk events from start to resolution.

- Action Plans: Develop and assign corrective actions to relevant personnel.

- Real-Time Reporting: Generate reports on operational incidents for internal review and regulatory submission.

Workflows for Project and Task Management

FinregE also offers workflows designed for Regulatory Change Project Implementation and task management, allowing organizations to manage complex regulatory change initiatives from start to finish.

- Task Assignment and Progress Tracking: Assign tasks to individuals or teams and track their progress through project completion.

- Project Planning and Milestones: Set deadlines and monitor key milestones to ensure timely project execution.

- Collaboration and Transparency: Enhance cross-departmental collaboration with transparent tracking and reporting of project tasks.

Enterprise Collaboration with FinregE Regulatory Compliance Workflows

FinregE’s workflows are designed to improve collaboration across an organization by ensuring clear roles and responsibilities, tracking task progress, and facilitating seamless communication between teams. Automated notifications, reminders, and alerts keep teams aligned and on track, while dashboards provide real-time visibility into task status, overdue actions, and priorities.

With FinregE’s enterprise collaboration benefits, multiple stakeholders across departments—from compliance officers to senior management—can access and contribute to workflows simultaneously. This makes managing complex, multi-faceted regulatory projects smoother and more efficient.

Custom Regulatory Compliance Workflows Tailored to Your Needs

Every organization has unique regulatory and compliance challenges. FinregE specializes in building bespoke compliance workflows tailored to your specific processes. Whether you need to automate regulatory change management, compliance self-assessments, or complex case management workflows, FinregE can design and implement custom workflows that meet your exact requirements.

Benefits of FinregE Regulatory and Compliance Workflows

Automation of Repetitive Tasks

Streamline manual compliance processes, reducing the risk of human error and saving valuable time.

Centralized Data Management

Consolidate all compliance-related data, regulatory obligations, and workflows in one platform for easy access and management.

Enhanced Collaboration

Improve cross-departmental communication and task coordination with transparent workflows and real-time updates.

Customizable Workflows

Tailor workflows to meet your specific regulatory requirements and business processes, ensuring a perfect fit for your organization.

Real-Time Monitoring and Notifications

Stay on track with automated alerts, notifications, and reminders for task deadlines and outstanding actions.

Comprehensive Audit Trails

Maintain full visibility and accountability with detailed audit logs of all actions, changes, and decision-making processes.

Dynamic Dashboards and Reporting

Generate real-time, interactive reports and dashboards to track workflow progress, assess performance, and make informed decisions.

Seamless Integration

Integrate workflows with other internal systems, such as risk management and policy libraries, for a unified compliance framework.

Risk Mitigation

Proactively identify and address regulatory risks with compliance monitoring and gap analysis workflows.

Regulatory Compliance Assurance

Ensure continuous adherence to legal and regulatory requirements with automated compliance testing and assessments.

Scalable for Enterprise Use

Suitable for organizations of all sizes, from single teams to large enterprises with complex, multi-jurisdictional regulatory needs.

Cost Efficiency

Reduce operational costs by automating and streamlining compliance workflows, leading to more efficient resource use.

Permission-Controlled Access

Easily control access to sensitive data and workflows, ensuring the right stakeholders have appropriate visibility and permissions.

Version Control and Document Management

Keep track of all versions, changes, and updates to compliance documents and workflows with built-in version control features.

Regulatory Preparedness

Always be audit-ready with structured, well-documented workflows and complete audit trails.

What is Compliance monitoring and self-assessments workflows?

FinregE can provide compliance monitoring workflows based on a review of regulatory requirements, company policies, procedures, controls and operational infrastructure.

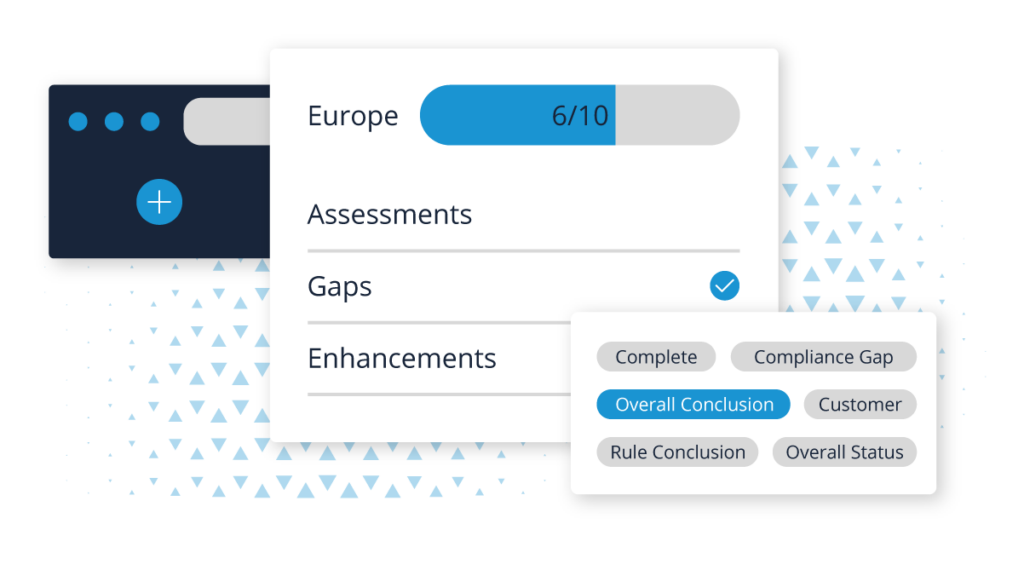

FinregE compliance monitoring workflow provides a joined-up, digitised solution for performing annual compliance monitoring for managing and maintaining an institutions compliance against its regulatory and legal requirements, and ensuring internal policies, procedures and operational infrastructure are designed in accordance with laws and regulations. FinregE’s compliance monitoring workflow provides inbuilt capabilities to define tests against regulatory requirements and internal processes and upload evidence confirm pass and fails of compliance tests, aswell as define gaps and enhancement required, and track them until resolved. FinregE also consolidates the outputs and results from an institution’s annual compliance monitoring activities to drive the a calendar of compliance monitoring testing for subsequent years.

FinregE compliance monitoring workflow comes with data visualizations and reporting to track, collate and present management information associated testing, with year on year comparative results and detailed focus on current year results. The workflow also provides an Overdue and Complete Assessment screens for workflow management to easily manage/track tests that are overdue their required complete dates and tests that are completed, versus tests which are on track and being assessed.

FinregE Regulatory Interactions Management Workflows

FinregE’s regulatory interactions management solution provides a workflow and record keeping related interactions with supervisory and regulatory authorities.

Our regulatory interactions workflow process deliver the following functionalities:

- Documenting and managing an organised response to interactions with regulatory and supervisory authorities such as enquiries, meeting requests, inspections, examinations.

- Sending workflow generated requests and notifications to responsible stakeholders across an institutions functions involved in interactions response process.

- The ability to use predefined workflow templates or custom create templates based on individual requirements under regulatory requests and interactions.

- The ability to link regulatory interaction events to regulatory rules and requirements under rules against FinregE global libraries.

FinregE Weekly Regulatory News Alerts

Stay up-to-date with the latest regulatory changes. Sign up to FinregE’s weekly regulatory alerts news.

FinregE’s Compliance Solutions

Real Time Rule Monitoring

Monitor compliance in real-time: both your status and processes

Digital Rulebooks

Access machine-readable libraries of financial global rulebooks

Regulatory Obligations

Extract insights on regulatory actions and requirements across rules

Rule Mappings

Map rule requirements automatically across your compliance policies

Compliance Workflows

Use workflows to action and record the life cycle of regulatory compliance

Compliance Dashboarding

Conduct compliance reporting with dashboards to view your landscape

Frequently Asked Questions

What is the best workflow management system for financial compliance?

There are many ways to optimise workflow management for financial compliance, including the use of automated technology.

Using automation, one way to create an effective compliance management system for your company is to focus on setting up a bespoke workflow. When automated, workflow management can reduce your costs while ensuring that your institution remains compliant with existing and emerging regulations.

Which financial compliance processes can be automated?

Depending on the type of software you use and your objectives, most financial compliance processes can be automated. That said, it’s recommended that you focus on automating practices that don’t require too much skill and those that otherwise take plenty of time.

One example is horizon scanning for regulatory change, which can be a complex, time-consuming task if done manually.

Automated regulatory horizon scanning tools, on the other hand, scan the regulatory landscape for updates and inform compliance teams in real-time, saving plenty of time and resources, and making this process ideal for automation.