See every change. Prove every decision.

Regulatory horizon scanning

We monitor global rules, laws and regulations 24/7 and use AI to help organisations understand what’s relevant, what’s impacted and what action is needed. All with clear ownership, full audit trails, and direct links to your policies, controls and risks in one platform.

See every change. Prove every decision.

Regulatory horizon scanning

We monitor global rules, laws and regulations 24/7 and use AI to help organisations understand what’s relevant, what’s impacted and what action is needed. All with clear ownership, full audit trails, and direct links to your policies, controls and risks in one platform.

End-to-end traceability, NOT JUST NEWS ALERTS

The complete regulatory horizon scanning solution

FinregE replaces fragmented, manual horizon scanning with a single, automated system that captures regulatory developments across all relevant jurisdictions and sources, and filters them down to what actually matters.

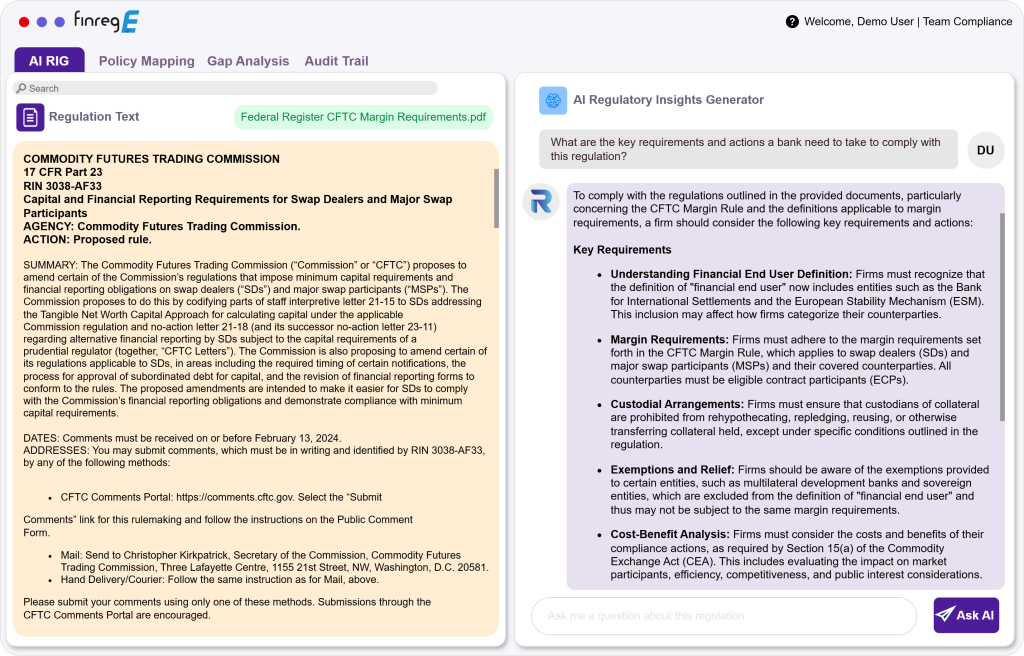

Regulatory change is routed into clear, structured workflows so teams can assess impact, assign ownership and track actions with confidence. Our AI Regulatory Insights Generator (RIG) supports this process by summarising regulatory changes in plain language, extracting key obligations and highlighting potential gaps.

Every decision, action and outcome is recorded with full traceability, creating a clear audit trail from initial identification through to implementation.

Global regulatory coverage mapped to your footprint

- Monitor 2,000+ regulatory and legislative sources across 160+ countries.

- Configure coverage by jurisdiction, regulator, topic, and publication type to match your regulatory footprint

- Capture updates in a consistent, review-ready format, with source context available for validation

Noise reduction with layered filtering and topic libraries

- Filter updates by regulator, jurisdiction, publication type, and topic so only relevant regulatory alerts reach your teams.

- Create topic libraries that automatically group incoming publications by themes such as AML, consumer duty, operational resilience, outsourcing, conduct risk, or payments.

- Teams can sort, group, and scan content in structured views, making it easy to separate what is informational from what requires action.

Triage and impact assessment with ownership

- Apply a consistent triage approach to decide whether an update is not applicable, for information, or requires assessment

- Move relevant items into a structured impact assessment that captures key takeaways, business relevance, and next steps

- Assign owners and deadlines so actions are accountable, progress is measurable, and handoffs are clear across teams

Track regulatory developments over time

- Follow related publications as they evolve, so teams keep context as rules progress and change

- Reduce duplicate review by keeping continuity across related updates

- Support forward planning by keeping teams aware of what’s emerging vs what’s final

Multilingual regulatory intelligence for global teams

- Access publications in local languages while supporting consistent review across regions

- Enable collaboration between local and central compliance teams without slowing the workflow

- Translate key content when needed to support faster triage and shared understanding

Audit trail, dashboards, and governance reporting

- Maintain traceability of review decisions, assessments, ownership, and outcomes

- Track status of reviews and actions across teams, including deadlines and overdue items

- Provide management-ready reporting to support governance forums and audit expectations

AI-Powered regulatory intelligence

- FinregE integrates AI RIG, our state-of-the-art AI tool to understand and interact with regulatory changes.

- RIG brings advanced Artificial Intelligence and Natural Language Processing (NLP) capabilities to your horizon scanning activities, providing quick insights and actionable intelligence from the vast ocean of regulatory texts.

- RIG is powered by a substantial language model trained on a vast dataset of global regulatory changes, news and events. Leveraging deep learning techniques, RIG understand regulatory text and user questions to provide informed, relevant answers like a regulatory expert.

AI RIG: Your AI companion for regulatory horizon scanning

At the heart of horizon scanning is RIG (Regulatory Insights Generator). Using large language models and algorithms, RIG scans and analyses millions of regulatory sources to generate clear, actionable intelligence for compliance, risk and legal teams.

Unlike GPT, RIG is designed to reject the unknowns and will not hallucinate. From experience we know how high stakes compliance is, so our insights are based on a clean, well-structured taxonomy.

Chat with all the rules. Ask “what’s changed?” or “who’s impacted?” Get precise answers back.

How AI RIG powers Regulatory Horizon Scanning

Plain English summaries

Complex regulations explained with structured sections for context, impacts, and dates

Obligation extraction

Pulls out specific duties, data requirements, and control expectations directly from text

Side-by-side comparisons

Compare versions between consultation and final rules, highlighting what actually changed

Conversational queries

Ask natural language questions and receive regulator-aware answers instantly

Compliance actions

Ask RIG to convert regulatory requirements into clear actions and controls to manage regulatory change implementation

Regulatory change impact assessments

Ask RIG to provide list of key mandatory and non-mandatory regulatory requirements and generate actionable requirements

Unmatched global regulatory coverage

FinregE’s horizon scanning software captures updates from every type of regulatory and supervisory body, ensuring full lifecycle visibility from consultation through to enforcement action.

Types of authority types monitored

- Financial regulators & supervisory authorities

- Central banks & monetary authorities

- Government ministries & treasuries

- Legislative bodies & parliaments

- Courts, tribunals & judicial authorities

- International standards bodies

- Data protection & cybersecurity authorities

Full lifecycle updates

- Consultations & discussion papers

- Drafts, proposals & technical standards

- Final rules, guidelines & supervisory statements

- Q&As, FAQs & regulatory clarifications

- Enforcement actions & penalties

- Speeches, announcements & thematic reviews

- Linked updates across the regulatory lifecycle

Automated & evidence-ready

How our Horizon Scanning works in practice

Capture & classify

Regulatory updates are picked up automatically, translated if needed, and organised using smart AI tagging, so you get the full picture, fast, without digging through the noise.

Triage & analyse

Your team gets one clear view of what matters, filtered to their focus, with helpful AI summaries and smart suggestions that make it easier to decide what needs action (and what doesn’t).

Assess & implement

Relevant updates flow straight into structured impact assessments and project plans, all linked to your policies, controls, and evidence, with live dashboards and a full audit trail to keep everything on track.

What you get out of the box

From day one, FinregE Horizon Scanning software gives you everything you need.

Near real-time capture

24-hour SLA from source publication to platform availability across thousands of sources worldwide.

Configurable filters

Dynamic libraries aligned to your entities, business lines, products, regulators, topics, and risk themes.

AI-generated insights

Summaries, comparisons, and obligation lists that can be iterated through prompts.

Smart separation

Distinguish 'for action' vs 'for information' content so triage queues stay focused.

Email digests

Stakeholder-friendly reports that push curated updates to people without platform access.

Executive dashboards

Visualise regulatory volumes, themes, jurisdictions, and assessment status for board reporting.

Benefits of FinregE horizon scanning

Clarity, not clutter

Replace dozens of regulator emails with one mapped, consolidated feed.

Speed to insight

First-pass AI summaries and applicability suggestions cut review time in half.

Defensible compliance

Every output is cited to source, linked to your policies and controls, and audit-ready.

Efficiency at scale

Save up to £67.5k per month in manual effort (client benchmark).

Complete change activity log

Full audit trail of every update and every action taken.

Smart thematic tagging

Thematic tagging and metadata for advanced filtering.

Easy integration

Integration ready via certified API connectors.

Data-driven foresight

Trend analysis and forecasting to anticipate shift.

Dynamic dashboards

Custom dashboards and management information reporting.

Regulatory Horizon Scanning with intelligent impact assessment

End-to-end governance, automation & auditability for managing regulatory compliance.

Automated launch

Convert regulatory updates directly into our Impact Assessments feature with one click.

AI pre-assessment

AI RIG generates summaries, extracts obligations, identifies impacts to your business automatically.

Structured forms

Flexible templates that capture what applies, the impact, and how to fix it.

Multi-team collaboration

Subject matter experts across Legal, Risk, IT, and Operations contribute to one shared assessment.

Workflow automation

Assignments, reviews, approvals with reminders and escalation paths.

Full audit trail

Complete traceability of every change, action and decision for regulatory defence.

Complete impact assessment workflow

Automated launch from Horizon Scanning

Every regulatory update captured in FinregE's Change Viewer can be reviewed, closed quickly using SMART CLOSE, or converted directly into an Impact Assessment with one click. Updates flow seamlessly with full metadata pre-populated.

AI-powered pre-assessment using AI RIG

The workflow leverages FinregE's proprietary AI engine to generate plain-English summaries, extract obligations, identify affected business units, and provide draft recommendations - drastically reducing analysis time and increasing consistency.

Structured, configurable assessment forms

FinregE provides standardized yet flexible templates capturing applicability, policy/process/system impacts, risk implications, implementation activities, impact ratings, business owners, and key dates, fully tailored to your governance structures.

- Applicability & relevance assessment

- Process and system implications

- Risk ratings & regulatory themes

- Policy, procedure & controls impact

- Data, reporting & operational impacts

- Implementation activities & remediation

Multi-team collaboration & SME contribution

FinregE supports collaboration across Legal, Compliance, Risk, IT, Operations, Data, Product, and business lines. Multiple SMEs can contribute with timestamped commentary, ensuring every impacted area feeds into a single unified assessment.

Workflow automation: assignments, reviews & approvals

FinregE orchestrates every stage with assignment to owners, delegation to SMEs, review and approval steps, automatic reminders, escalation paths, and SLA tracking. No task or deadline falls through the cracks.

Evidence upload, documentation & version control

Every stage supports evidence capture including supporting documents, analysis files, policy drafts, committee decisions, and audit commentary. All documents are version-controlled and linked directly to the regulatory update for complete auditability.

Action planning & implementation tracking

From each assessment, create implementation actions, assign owners, track remediation steps, set due dates and dependencies, and monitor progress at project and enterprise level. Large regulatory changes can be broken into granular, trackable tasks.

Full audit trail & regulatory defence

FinregE records every change, action, and decision—who assessed, what changed, when it changed, why it was actioned, evidence supporting decisions, and workflow routing history. Demonstrate complete compliance to regulators, auditors, and boards.

Enterprise-grade security and integration

Enterprise features

Single sign-on (SSO) Role-based access control API-first architecture

Security certified

ISO 27001 certified Cyber Essentials Plus Hosted on Microsoft Azure

Support & training

4-12 week implementation Role-based training 24/7 support desk

Why FinregE's

Horizon scanning

Unlike point solutions that stop at ‘news’, FinregE connects horizon scanning to policy and control change. The same platform that captures and triages a new regulation can map it to your internal documents, highlight gaps, create remediation actions and evidence closure – all under a human‑in‑the‑loop model that satisfies Legal, Risk and Audit.

Flag risks before they become a costly surprise.

Focus on what matters

What is regulatory horizon scanning and regulatory change management

Regulatory horizon scanning is the process of identifying and staying informed on upcoming trends and changes in legal and regulatory requirements that could impact your organisation.

It’s more than just monitoring. It involves:

- Identifying new and changing regulations and requirements.

- Analysing what regulatory changes mean for your business.

- Logging the requirements under each change.

- Allocating owners to manage and deliver required actions.

- Implementing actions to remain compliant, with recorded evidence of implementation at every step.

Performing regular horizon scanning gives businesses the time and organisation to proactively respond to regulatory developments, stay prepared for compliance impacts, and avoid last-minute tick-box exercises when new rules come into play.

Turn a patchwork of vendors and feeds into a single source of truth

Manage every step of the regulatory compliance process in one platform. Our clients reduce manual compliance effort by 95%, eliminate blind spots, and achieve ROI in as little as 4-12 weeks.

Discover useful articles and tools for you

Solutions

FCA partners with FinregE

FinregE named in RegTech 100

Join our newsletter

Built to anticipate regulatory shifts before they impact your organisation

No noise. No blind spots. Just intelligent horizon scanning.

FAQs

Frequently Asked Questions

What is horizon scanning?

Horizon scanning involves monitoring the regulatory landscape for developments that could impact a particular business. Such developments include new regulations, recently passed legislation, and updated regulatory guidance issued by countries and regulatory bodies from around the world.

Horizon scanning compliance is a proactive and futuristic strategy that anticipates regulatory changes that might come into play so a financial institution is ready to implement the update from the day the relevant regulations are passed. This approach seeks to make compliance more streamlined and effective by ensuring regulatory teams stay ahead of potential updates.

Moreover, horizon scanning provides crucial information that can help businesses make adjustments on the fly, so they are not caught off guard when new regulatory imperatives come online. If your business is subject to hundreds of regulations (as many are), a proven horizon scanning service, like FinregE, can ensure you stay compliant and adapt to changes effectively. By staying informed and anticipating regulatory developments, businesses can maintain a competitive edge while ensuring compliance with the ever-evolving regulatory landscape.

The benefits of regulatory horizon scanning

Staying ahead of regulatory changes is crucial for businesses to maintain a competitive edge. FinregE’s horizon scanning service provides an effective way to monitor and anticipate regulatory change whilst addressing various other challenges. Some key benefits include:

Enhanced foresight methods and more actionable regulatory insights: FinregE helps your organisation consume and process new regulatory information efficiently, ensuring you stay informed about potential changes.

Improved assessment of regulatory change impact: FinregE enables you to evaluate the effects of regulatory changes on your business and develop strategies to adapt accordingly.

Streamlined integration of new regulations: With FinregE, you can incorporate new regulations without disrupting your business, maintaining operational consistency and integrity.

Identification of potential regulatory threats: FinregE helps you pinpoint regulatory changes that could negatively impact your organisation and develop early warning indicators for those changes.

Establishment of an early warning system: By understanding which types of regulatory change pose a threat and recognising the signs that such changes are likely to occur, FinregE assists in creating an early warning system that alerts key managers to take action.

Real-time monitoring of regulatory bodies: FinregE keeps you updated with the latest regulatory developments as they happen, ensuring you always have the most recent information.

Access to translated regulatory updates: Stay informed with regulatory updates in both local and translated languages as soon as they are published.

Organised regulatory content: FinregE categorises regulatory content into taxonomies for easier reading and comprehension.

Conversion of regulatory information into useful insights: FinregE turns voluminous regulatory data into actionable knowledge for your organisation.

Automated mapping of rule requirements: FinregE maps rule requirements across your compliance policies, simplifying the process of identifying and organising applicable regulatory content.

By leveraging FinregE’s horizon scanning service, your organisation can benefit from potential cost savings, increased efficiency, enhanced analytic capabilities, and more effective communication at all levels.

Why work with FinregE

Backed by decades of experience, we provide bespoke regulatory compliance solutions to the financial service industry by leveraging cutting-edge AI and automation to streamline regulatory compliance management.

Today, our solution leverages NLP, topic modelling, and deep learning to turn large volumes of complex information into easily actionable processes, effectively reducing the cost of compliance regulation by over 90%.

When you work with us, you’re also backed by a team with end-to-end expertise in working with innovative technology, regulatory policy, change implementation, and regulatory remediation across a competitive and evolving industry.

How does horizon scanning help in financial compliance?

Our regulatory horizon scanning tool can remove the complexity of financial compliance by bringing the latest updates from different regulatory bodies to your system. Our horizon scanning tool monitors regulatory news sources, providing alerts and regulatory updates on emerging issues and relays the latest information to relevant teams to ease the compliance process. The compliance horizon scanning platform is designed for client-facing, compliance, and capital-planning teams.

How can banks leverage horizon scanning?

Banks can leverage this approach to compliance by using AI-driven RegTech to scan upcoming updates and stay informed about potential rule changes. Scanning updates in this way makes staying in line with industry regulations a more streamlined and efficient activity because regulatory teams can make pre-emptive changes instead of reacting to new policies and standards after they’ve been passed.

How does regulatory horizon scanning mitigate compliance risks?

As regulators pass amendments and new rulings across financial compliance, it’s becoming more complex to stay up to date with the latest rule changes.

Given the existence of numerous authorities that issue edicts disparately, this reality places modern financial institutions at significant compliance risk because keeping pace with necessary changes is often impossible through manual efforts alone.

With modern compliance platforms, however, it’s much easier to transform this function into a more proactive part of your work.

Modern tools do more than just the bare minimum of helping you steer clear of regulatory censure and fines but also place you in good stead within the industry and among modern consumers who now demand more from their service providers.

At FinregE, our Regulatory Horizon Scanning solution can help you achieve this, eliminate uncertainty, and turn compliance into the cornerstone of your success.

Is your platform free?

While we do offer a FREE trial and demo, our platform, itself, is not. Please get in touch with us if you’d like to find out more.

Can I use your solution to map regulatory processes to internal company procedures?

Yes, you can use our bespoke regulatory change management solution to map internal company procedures against regulatory requirements, making it easier to keep up with compliance requirements by adjusting your operations to meet the latest rule changes.

Can I keep up with the latest updates from regulatory bodies around the world?

Yes. You can use our solution to keep up with the latest updates from local, national, and global regulatory bodies from around the world. If the updates come in a different language, our solution can translate them in real-time.