On February 8th, 2024, the FCA published its update on their three-year strategy to reduce and prevent financial crime. This report serves as a crucial reminder that financial crime compliance applies uniformly to all financial firms, regardless of size or complexity. While mitigating these risks is essential, achieving consistent compliance presents numerous challenges. This report underscores a critical reality: financial crime compliance is not optional, it’s an absolute necessity for all financial firms.

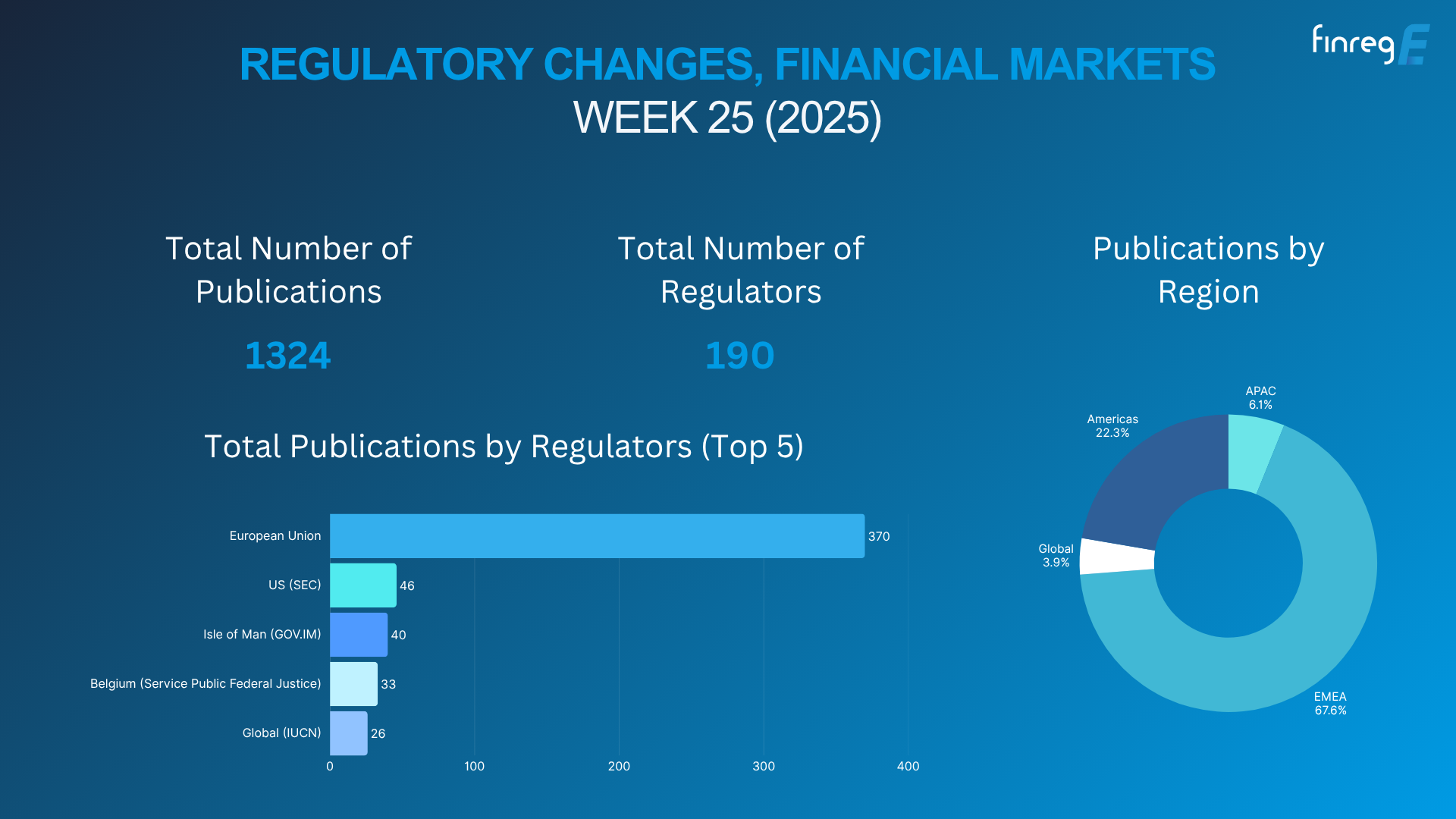

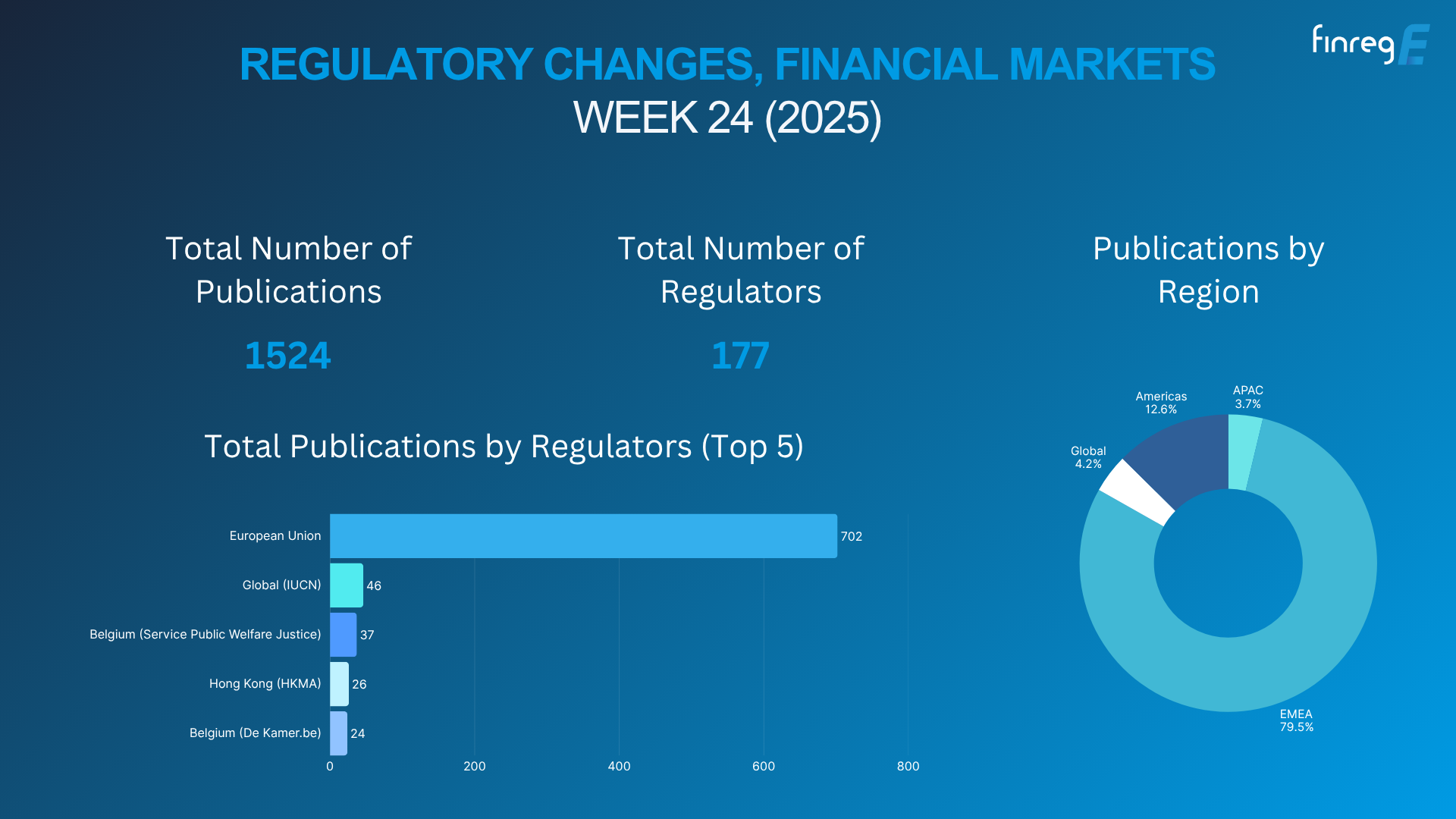

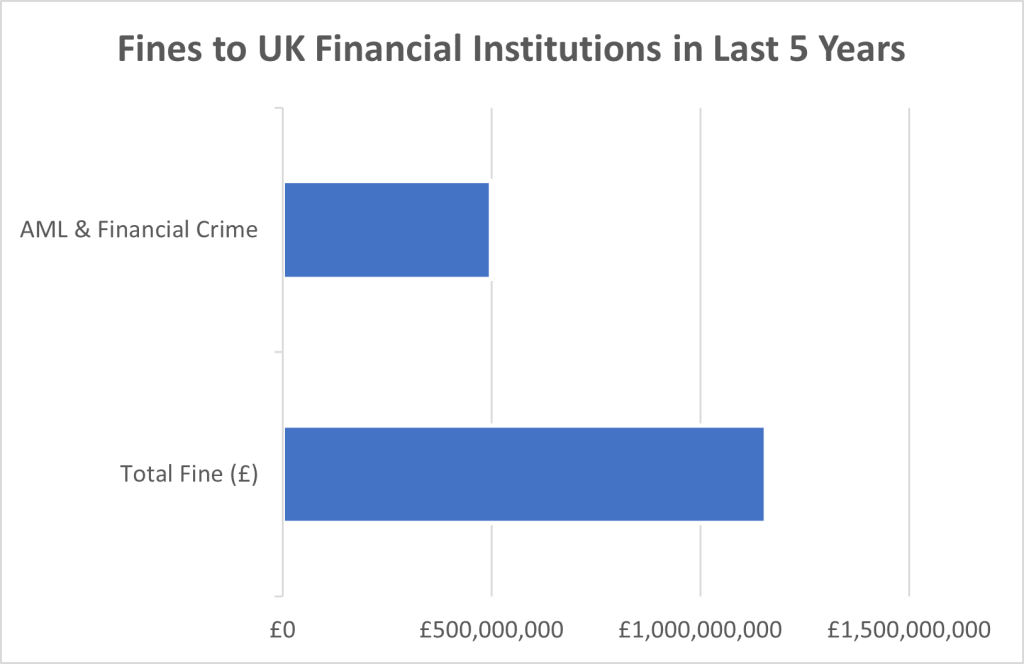

The sheer volume and dynamic nature of regulations, guidance, speeches and more from regulatory and government authorities on the topic of financial crime, money laundering and sanctions make staying ahead a constant battle. Rules evolve rapidly, interpretations often remain ambiguous, and the sheer volume of data to be analysed can be overwhelming. The consequences of non-compliance are significant. In the last five years alone, the UK Regulators has imposed over £1.15 billion in fines, with 43% specifically targeting anti-money laundering (AML) and financial crime violations. These fines can have a devastating impact on a firm’s financial health, reputation, and operations.

Finreg’s analysis shows the most cited reasons for enforcements and litigations in relation to financial crime and AML are:

- Companies often find it difficult to fully understand and comply with regulatory rules and obligations, leading to unintentional rule breaches.

- Firms may fail to stay updated with the latest changes in regulations.

- A major challenge for firms is the lack of sufficient time and resources to meticulously go through extensive AML regulations to ensure nothing is overlooked. The number of employees in a firm is proportional to its size, but it’s often insufficient to handle the volume of regulations that need to be complied with. This implies that most financial institutions, if not all, are understaffed in their compliance departments relative to the demands of regulatory compliance.

In addition, human processing cannot compete with AI. Research shows it takes a human lawyer approximately 15 minutes to read and digest a single page of legal text with around 70% comprehension. In contrast, AI can read hundreds of pages per second with 95%+ accuracy.

This is why FinregE created RIG, its AI-powered Regulatory Insights Generator. Unlike traditional systems, RIG doesn’t just summarize regulations; it analyses, interprets, and delivers actionable insights, tailored specifically to your business needs.

- Increased speed of processing regulations for understanding by extracting regulatory requirements and actions which in turn reduces the burden of manually analysing vast texts to ensure no gaps in understanding requirements.

- Provides recommendations on processes and actions based on regulatory requirements that can be taken to meet compliance.

- Can compare existing policy documentation to regulations to identify gaps.

RIG achieves this by leveraging AI that research shows performs better than humans in comprehensively extracting pertinent information from regulatory texts. AI can process large amounts of data quickly and accurately, which can revolutionize regulatory compliance. A human might spend hours processing a single page of regulation with a certain level of accuracy, while an AI system can accomplish the same task in much less time and with higher accuracy.

Proof of AI’s Power

We asked FinregE’s AI RIG a series of questions to understand these priorities. What would traditionally require hours of intensive analysis by a human expert is accomplished by RIG in a mere 40 seconds. We are happy to share our results.

Q1. Tell me what does this text is about?

The text is about the FCA’s focus on supporting government proposals to reform the AML (Anti-Money Laundering) supervisory regime. The FCA acknowledges the raised standards of PBS (Professional Body Supervisors) supervision by OPBAS (Office for Professional Body Anti-Money Laundering Supervision) but highlights the complexity and lack of consistency in the current framework. The FCA supports the government’s rationale for reforming the AML supervisory regime and believes that a Single Professional Service Supervisor offers the best opportunity to deliver on the aims of the reform.

Q2. What are the FCA’s top financial crime priorities right now?

The current top financial crime priorities of the FCA, as mentioned in the document, include fraud, money laundering, sanctions evasion, and terrorist financing. These activities are considered to cause significant damage to society, undermining market integrity and consumer confidence. The FCA recognizes that tackling financial crime requires a collective effort from regulated firms, the government, law enforcement, and regulatory partners. The FCA has identified reducing and preventing financial crime as a priority in its 3-year strategy and is actively working towards achieving this goal. The FCA, along with the Office for Professional Body Anti-Money Laundering Supervision (OPBAS), leads or supports 20 of the 43 actions identified in the second Economic Crime Plan.

Q3. What are the future focus areas?

The FCA (Financial Conduct Authority) will focus on four areas in the future to reduce and prevent financial crime. These areas are:

- Data and technology: The FCA recognizes the importance of utilizing data and technology in combating financial crime. They have established the Synthetic Data Expert Group (SDEG) to explore how financial markets can use synthetic data to overcome the challenges of accessing and sharing data in financial services. The SDEG consists of experts from various sectors and will run for at least 18 months. The FCA encourages firms to embrace innovative data projects and participate in data sharing initiatives while ensuring the protection of personal data.

- Collaboration: Tackling financial crime requires a collective effort from various stakeholders, including the FCA, regulated firms, government, law enforcement, and regulatory partners. The FCA is actively involved in the public-private national Economic Crime Plan 2 (2023 to 2026) and Fraud Strategy, which aim to reduce financial crime. The FCA and the Office for Professional Body Anti-Money Laundering Supervision (OPBAS) lead or support 20 of the 43 actions identified in the second Economic Crime Plan.

- Consumer awareness: The FCA recognizes the importance of raising consumer awareness to prevent financial crime. They aim to educate consumers about the risks of fraud, money laundering, sanctions evasion, and terrorist financing. Initiatives like ScamSmart and the Inside FCA Podcast: Fighting fraud and financial crime are part of their efforts to increase consumer awareness.

- Metrics – measuring effectiveness: The FCA emphasizes the need to measure the effectiveness of efforts to reduce and prevent financial crime. They are focused on developing metrics to assess the impact of their actions and initiatives. By measuring effectiveness, they can identify areas of improvement and ensure that their strategies are achieving the desired outcomes.

These four areas of focus demonstrate the FCA’s commitment to combating financial crime and protecting market integrity and consumer confidence.

Q4. What are the next steps mentioned?

The document mentions that as the FCA passes the midpoint of its 3-year strategy, it is summarizing the work delivered over the last 18 months that is already having an impact in tackling fraud, money laundering, and sanctions evasion. Looking ahead, the FCA identifies four areas of focus where further collaborative effort can help shift the dial decisively on reducing and preventing financial crime. However, the specific details of these four areas of focus are not provided in the document.

Q5. What is the FCA’s expectations from the firms?

The FCA expects firms to maintain a robust and proportionate approach to authorisation. This means that firms must have the right standards and follow the guidance and expectations set out by the FCA. They must have sufficient anti-money laundering (AML) controls in place to ensure confidence in the financial system and prevent money laundering. Firms that do not meet these expectations can expect to be refused registration.

Additionally, the FCA conducts multi-firm reviews to share its expectations of how firms should ensure their controls are proportionate to the risk. These reviews include topics such as money laundering controls related to cash through the post office. Firms are expected to implement the recommendations from these reviews to improve their AML controls.

Furthermore, the FCA works with Professional Body Supervisors (PBSs) in the legal and accountancy sector to drive improvements in their anti-money laundering efforts. While professional bodies have demonstrated good levels of compliance with money laundering regulations, improvements in how effectively they supervise are still needed. The FCA expects PBSs to effectively supervise their members and ensure compliance with AML regulations.

Overall, the FCA expects firms to have strong financial crime controls, comply with AML regulations, and work towards continuous improvement in their AML efforts.

Q6. Can you provide a control framework for a financial institution to reduce and prevent financial crime and ensure compliance?

To reduce and prevent financial crime and ensure compliance, a financial institution can implement a comprehensive control framework that includes the following components:

- Risk Assessment: Conduct a thorough risk assessment to identify and understand the specific risks associated with the institution’s operations, products, services, and customer base. This assessment should consider both internal and external factors that may contribute to financial crime.

- Policies and Procedures: Develop and implement robust policies and procedures that outline the institution’s expectations and requirements for preventing and detecting financial crime. These policies should cover areas such as customer due diligence, transaction monitoring, suspicious activity reporting, and employee training.

- Customer Due Diligence (CDD): Establish a strong CDD process to verify the identity of customers, assess their risk profile, and understand the nature and purpose of their transactions. This may involve conducting enhanced due diligence for high-risk customers and implementing ongoing monitoring to detect any changes in risk.

- Transaction Monitoring: Implement a robust transaction monitoring system that can identify and flag potentially suspicious transactions based on predefined risk indicators. This system should be regularly updated to reflect changes in regulations, typologies, and emerging risks.

- Suspicious Activity Reporting (SAR): Establish a process for employees to report any suspicious activity they encounter during their duties. This process should include clear guidelines on what constitutes suspicious activity and how to escalate it to the appropriate authorities.

- Training and Awareness: Provide regular training and awareness programs to employees to ensure they understand their roles and responsibilities in preventing financial crime. This training should cover topics such as recognizing red flags, understanding regulatory requirements, and reporting suspicious activity.

- Internal Controls and Monitoring: Implement internal controls and monitoring mechanisms to ensure compliance with policies and procedures. This may include regular audits, independent testing, and ongoing monitoring of key controls.

- Technology and Data Analytics: Leverage technology and data analytics tools to enhance the effectiveness and efficiency of financial crime prevention efforts. This may include using artificial intelligence and machine learning algorithms to identify patterns and anomalies in customer behaviour and transactions.

- Collaboration and Information Sharing: Establish partnerships and collaborate with other financial institutions, regulatory bodies, and law enforcement agencies to share information and best practices in combating financial crime. This can help identify emerging trends and typologies and enhance the institution’s ability to prevent and detect financial crime.

- Continuous Improvement: Regularly review and update the control framework to adapt to changing regulations, emerging risks, and lessons learned from internal and external incidents. This should include conducting periodic assessments of the effectiveness of controls and making necessary enhancements.

It is important for the financial institution to regularly assess the effectiveness of the control framework and make adjustments as needed to ensure ongoing compliance and effectiveness in preventing financial crime.

Book a demo today and find out how FinregE’s AI RIG can simplify your compliance journey.