Your Guide to Financial Regulations Compliance

Following the UK’s exit from the European Union, there has been an increasing emphasis on pressuring financial regulators to do more to promote and support economic growth. The government and various stakeholders recognise that a healthy and thriving financial sector is vital for overall economic prosperity.

Businesses have expressed concerns about the burden of regulatory compliance. Financial regulators are urged to simplify and streamline regulations without compromising the necessary measures. To effectively address the pressure to boost growth, there is a growing recognition that collaboration and dialogue between regulators, government bodies, industry stakeholders and businesses are essential.

In this article, we’ll discuss the current state of financial regulatory compliance and what organisations need to ensure that they are operating in a balanced and responsible manner—-despite all the pressures and changes in the industry.

What is Financial Services Regulatory Compliance?

Financial regulations compliance refers to adhering to the laws, rules and standards set by regulatory authorities in the finance industry. These regulations are designed to ensure fair practices, transparency and stability within the financial sector. Compliance involves implementing and maintaining policies, procedures and controls to meet the requirements of these regulations.

The Importance of Compliance

Compliance with financial regulations is crucial for several reasons. First, it helps your business avoid legal and regulatory risks. Noncompliance can lead to hefty fines, reputational damage, and even legal consequences that can severely impact your organisation.

By complying with regulations, you demonstrate your commitment to ethical business practices and gain the trust of stakeholders, including customers, investors and regulators.

Second, financial regulations compliance enhances operational efficiency. Establishing robust compliance processes will streamline your operations, ensuring that your activities align with regulatory requirements. This minimises the risk of errors or oversights and lets you focus on your core business activities, driving growth and success.

WHAT WE OFFER

FinregE’s Compliance Solutions

Stay on top of regulatory changes across various regulatory guidelines

Access a growing library of up-to-date machine-readable digital rulebooks

Enjoy automated regulatory requirement identification across major rulesets

Automate regulatory rule mapping across all your compliance processes

Execute efficient and effective compliance workflows to ensure compliance

Enjoy a comprehensive view of your entire compliance management system

Financial Regulators

In the United Kingdom, finance is regulated by several entities. Here are some key regulatory bodies responsible for financial regulation in the UK:

- Financial Conduct Authority (FCA): The Financial Conduct Authority is the primary regulatory body responsible for the conduct of financial firms in the UK. The FCA regulates various financial services and markets, including banking, insurance, investments and consumer credit.

- Prudential Regulation Authority (PRA): The Prudential Regulation Authority is a subsidiary of the Bank of England responsible for the prudential regulation and supervision of banks, major investment firms, insurers and building societies.

- Bank of England: The Bank of England, as the UK’s central bank, plays a crucial role in financial regulation. It sets monetary policy, regulates payment systems and oversees the financial system’s stability. The Bank of England works closely with the FCA and PRA to ensure the overall stability and integrity of the financial sector.

Your Financial Regulatory Checklist

Regulatory entities conduct checks and examinations to ensure compliance with financial regulations. They assess various aspects of your operations, such as risk management, internal controls, data security, anti-money laundering measures, customer protection and more. They may also require you to submit reports, disclosures and certifications to demonstrate compliance.

Being prepared and having robust compliance measures will help you navigate these checks smoothly.

Ensure Financial Regulatory Compliance with a Trusted Team and Tools

Financial regulations can be overwhelming and complex. At FinregE, our dedicated team is here to help. With our expertise and scalable solutions, you can confidently navigate the regulatory landscape. By outsourcing your compliance functions to our team, you’ll benefit from cost savings, access to specialised skills and the assurance of staying up-to-date with regulatory changes.

Book a demo or contact us for more information about our services.

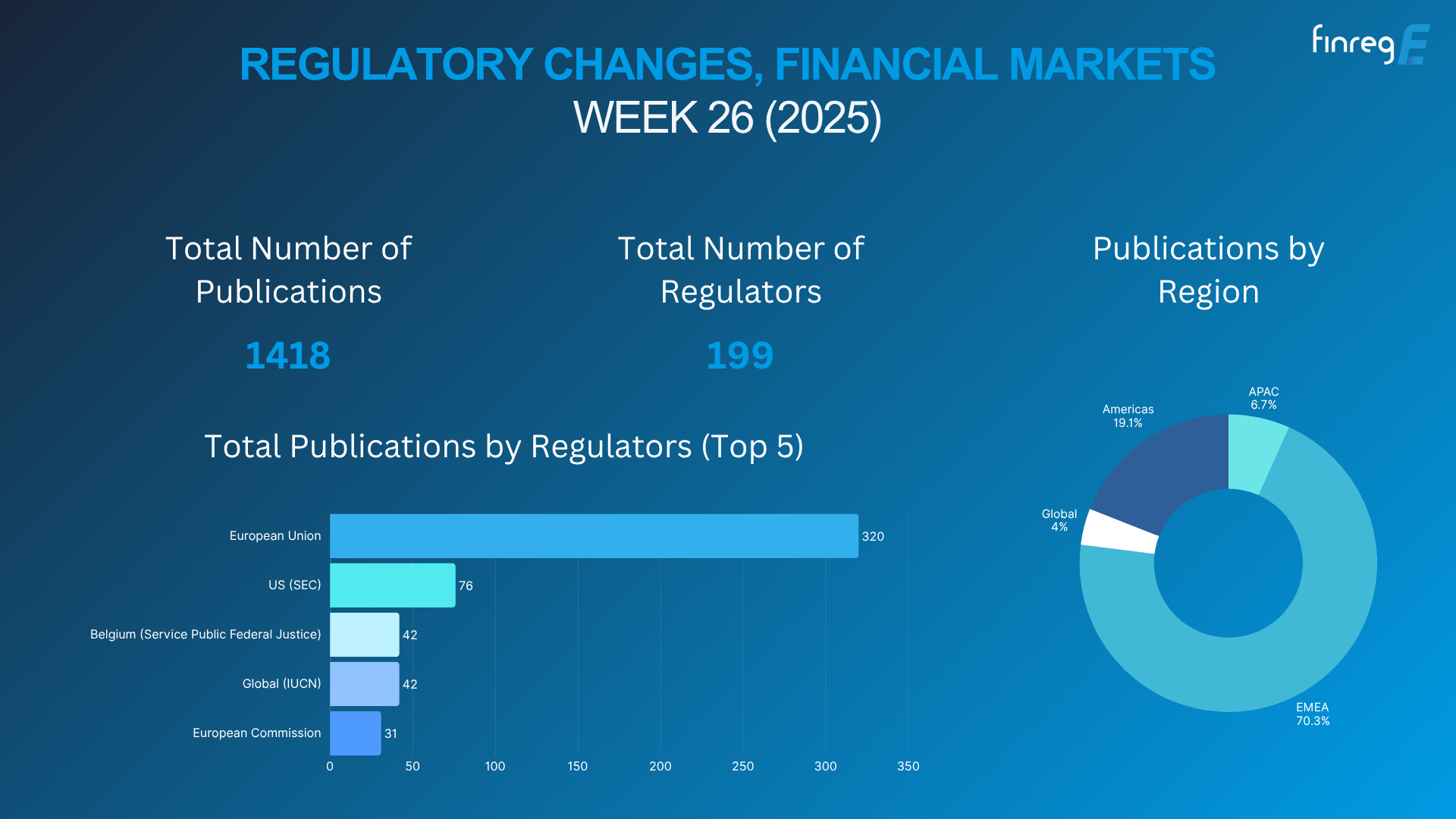

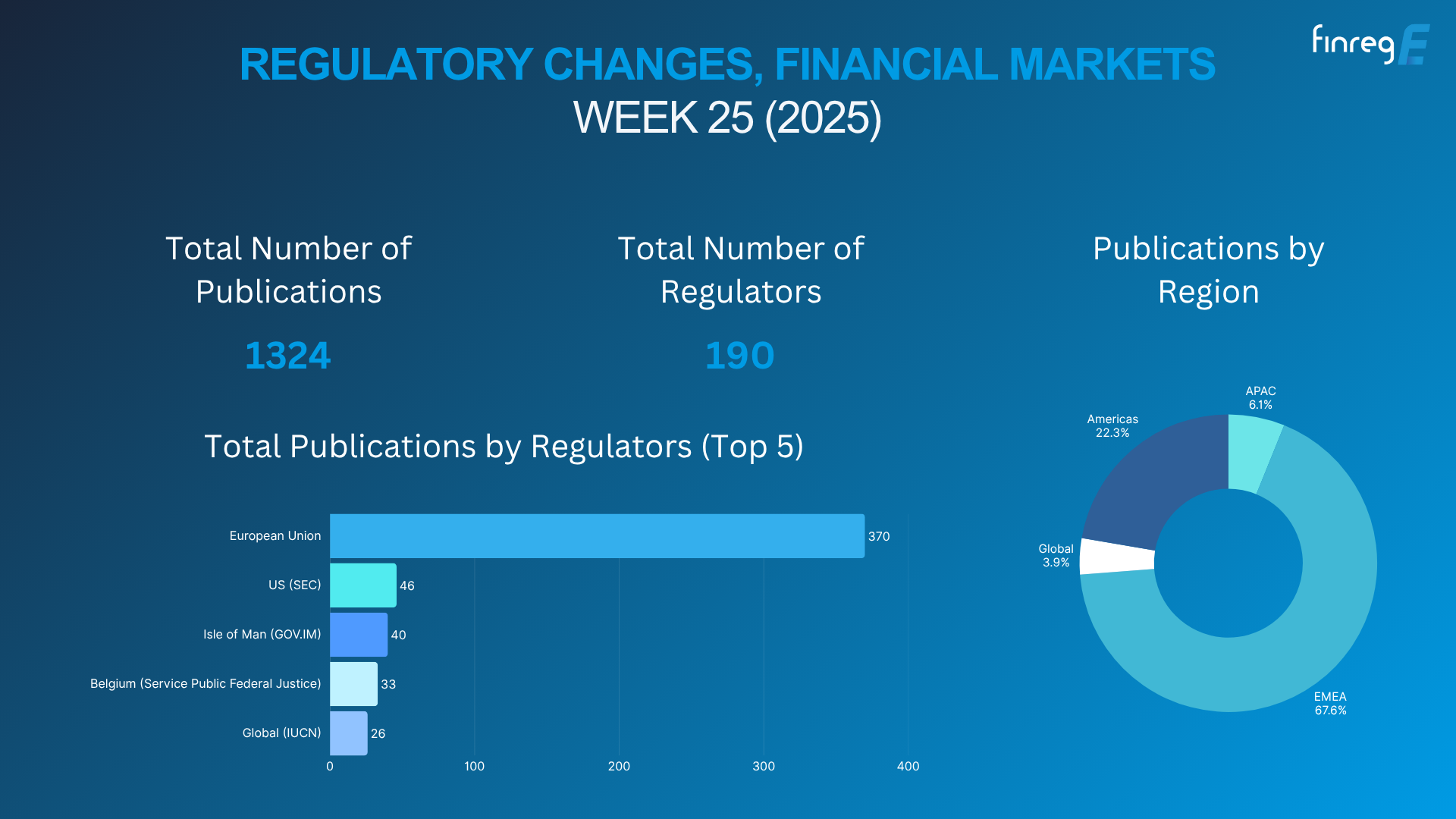

WEEKLY NEWSLETTER

FinregE Weekly Regulatory News Alerts

Stay up-to-date with the latest regulatory changes. Sign up to FinregE’s weekly regulatory alerts news.