In the last two decades, the business landscape has gone through significant changes. Everything from customer acquisitions to service delivery has seen a systematic shift, and all of this is thanks to the advent of sophisticated information technology.

The finance industry has, perhaps, been one of the biggest beneficiaries of this technology, having since enjoyed a significant reduction in its transaction processing times and operational costs.

The World Wide Web has also powered financial institutions to implement better risk assessment processes, effective fraud detection systems, and introduce modern financial technologies to facilitate better financial services.

Despite this, however, modern financial institutions are under more pressure than ever due to changes in customer preferences, regular disruptive innovations in the industry, and increased clampdown from regulators.Today, they are subject to more complex and stringent regulatory requirements that have forced them to reinvent their compliance workflows. Technology, again, is at the core of this change.

In this post, we explore how regulatory technologies (RegTech) are transforming the face of financial regulatory global compliance in the current landscape.

Financial compliance documentation and analytics

Traditional compliance workflows depend on human resources to collect compliance requirement data from disparate guidelines and document them to power regulatory analytics.

This process generally involves multiple forms of unintegrated software solutions that make streamlining compliance processes much harder. Moreover, financial institutions struggle to report data lineage information as mandated by regulators.

RegTech solutions, on the other hand, use advanced machine learning algorithms to collect, process, and centralise compliance data from separate sources and store it in structured datasets to power automated compliance workflows.

These solutions minimise human intervention across standard compliance processes by automating the documentation of compliance requirement changes, creating tasks to ensure compliance, and generating reports that include data lineage information as per the latest requirements.

Anti-money laundering detection

Many compliance leaders across the finance industry consider Anti-money Laundering (AML) regulations one of the greatest compliance risks facing modern financial institutions.

The digitisation of financial products, the introduction of complex payment systems, and the increased sophistication of money laundering practices have made policing the issue much harder.

In fact, according to money laundering statistics from the United Nations, 2%-5% of global GDP, which amounts to anywhere between $800 billion-$2 trillion, is laundered annually.

In line with these statistics, some of the biggest financial non-compliance issues across the globe have involved money laundering allegations—the 1MDB and Goldman Sachs saga, The Global Laundromat scheme, and the Australian Westpac scandal are just a few.

RegTech solutions help financial institutions incorporate Artificial Intelligence in their AML compliance processes, allowing them to utilise centralised AML lookback rules to detect anomalies in transaction data and take necessary measures to police and monitor these transactions.

Artificial Intelligence-powered compliance monitoring

Compliance workflows require continuous compliance monitoring to ensure regulatory compliance. This, however, is easier said than done.

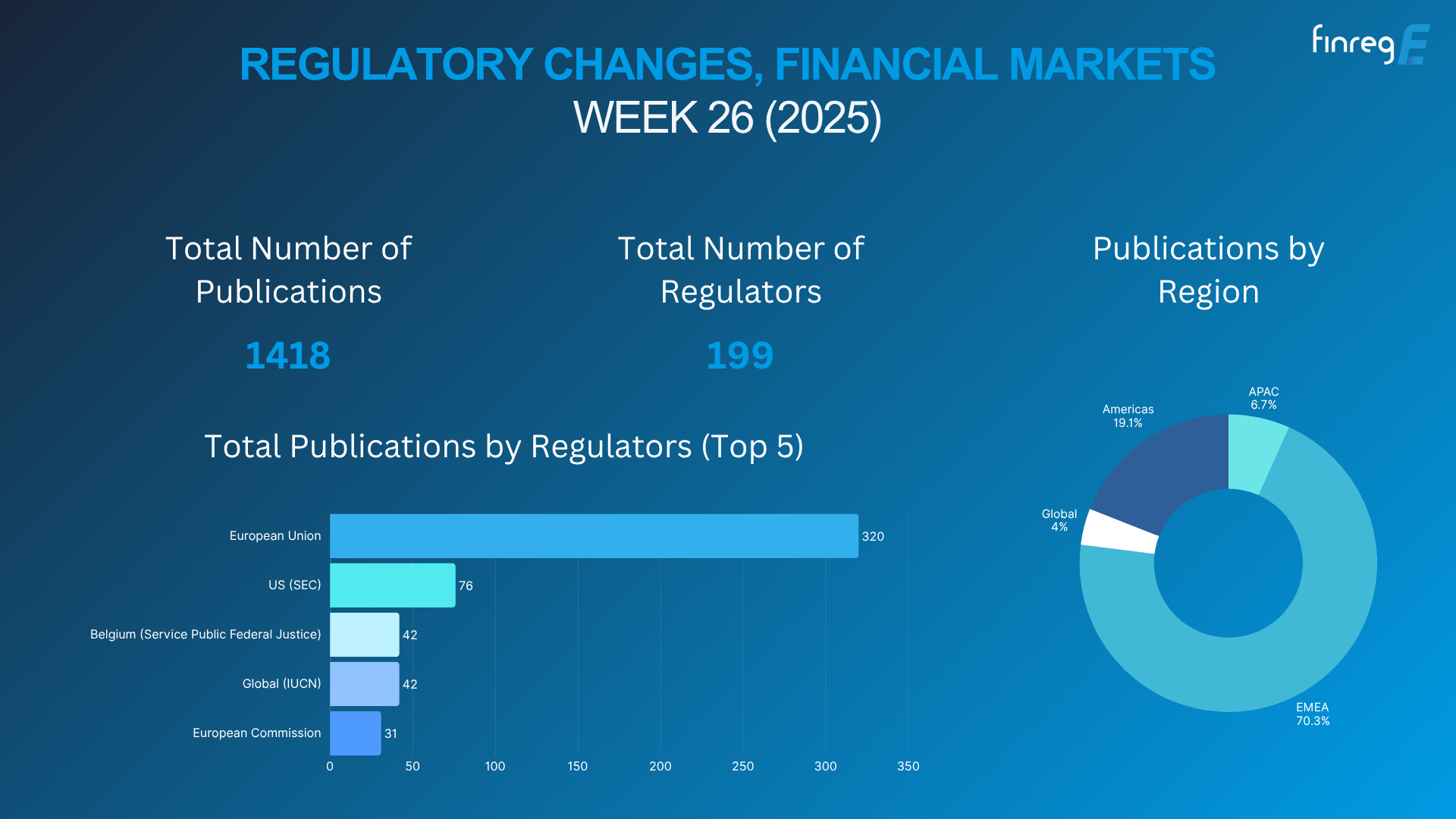

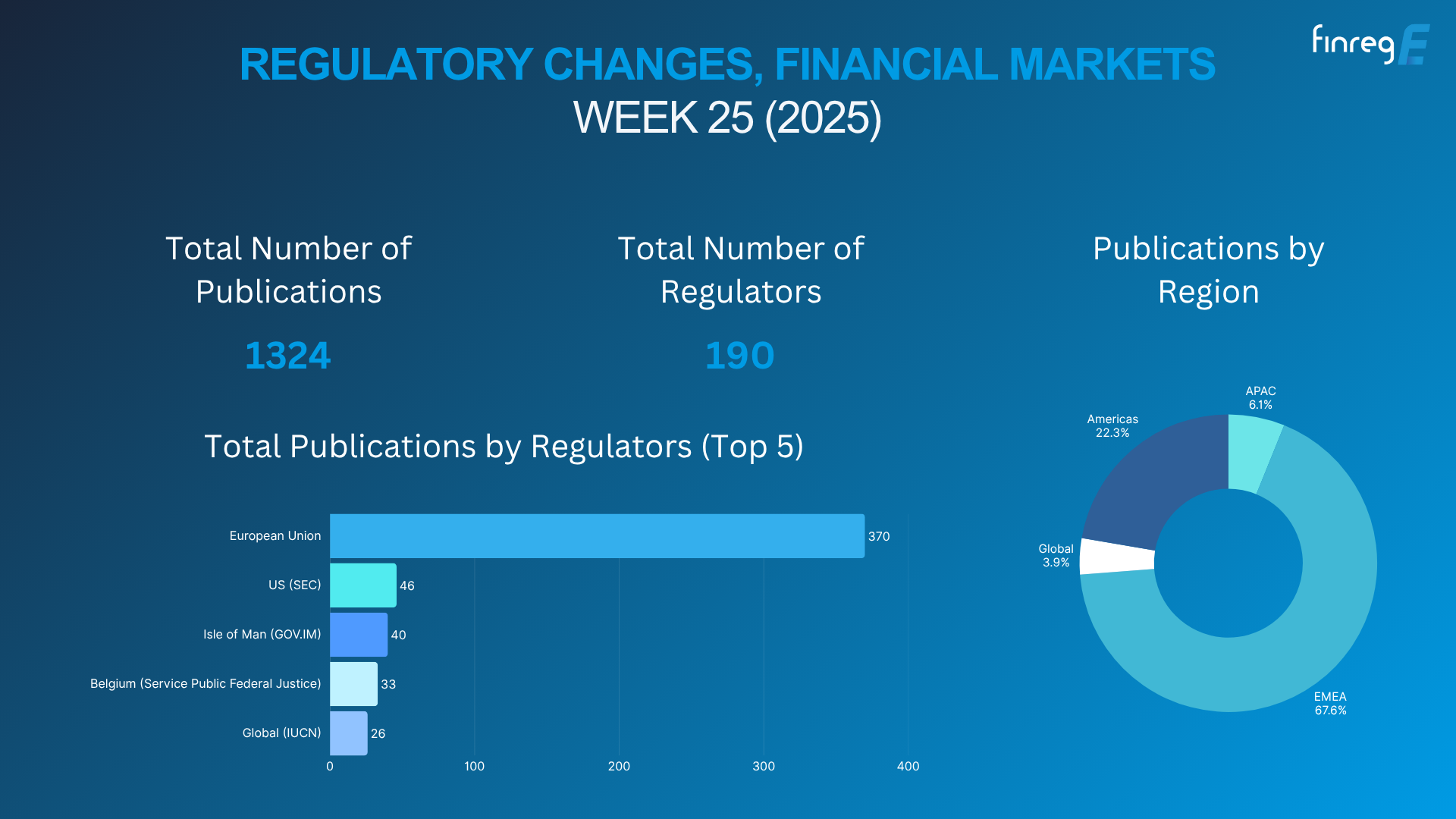

Regulators introduce new regulatory requirements at an almost breakneck speed, and not all financial institutions have the resources or expertise to stay on top of these changes, increasing the risk of non-compliance and hefty penalties.

Even institutions that have adequate resources to track changes in regulatory requirements face the risk of non-compliance as human capital is shown to be error-prone.

RegTech solutions, on the other hand, leverage predictive analytics to power automated regulatory horizon scanning, which allows financial institutions to implement proactive compliance workflows that take into account future regulatory changes.

These solutions eliminate human error by minimising human intervention in the compliance monitoring process.

RegTech solutions are changing the face of financial regulatory global compliance

The modern regulatory landscape demands financial institutions adopt novel approaches to compliance to ensure regulatory requirements are fulfilled.

RegTech solutions have emerged as one of the biggest weapons in almost any financial institution’s arsenal to ensure a more proactive approach to this critical business process.