The sheer volume of regulatory updates is overwhelming, without the right technology in place to manage anti-money laundering (AML) compliance, firms are at risk of missing critical gaps.

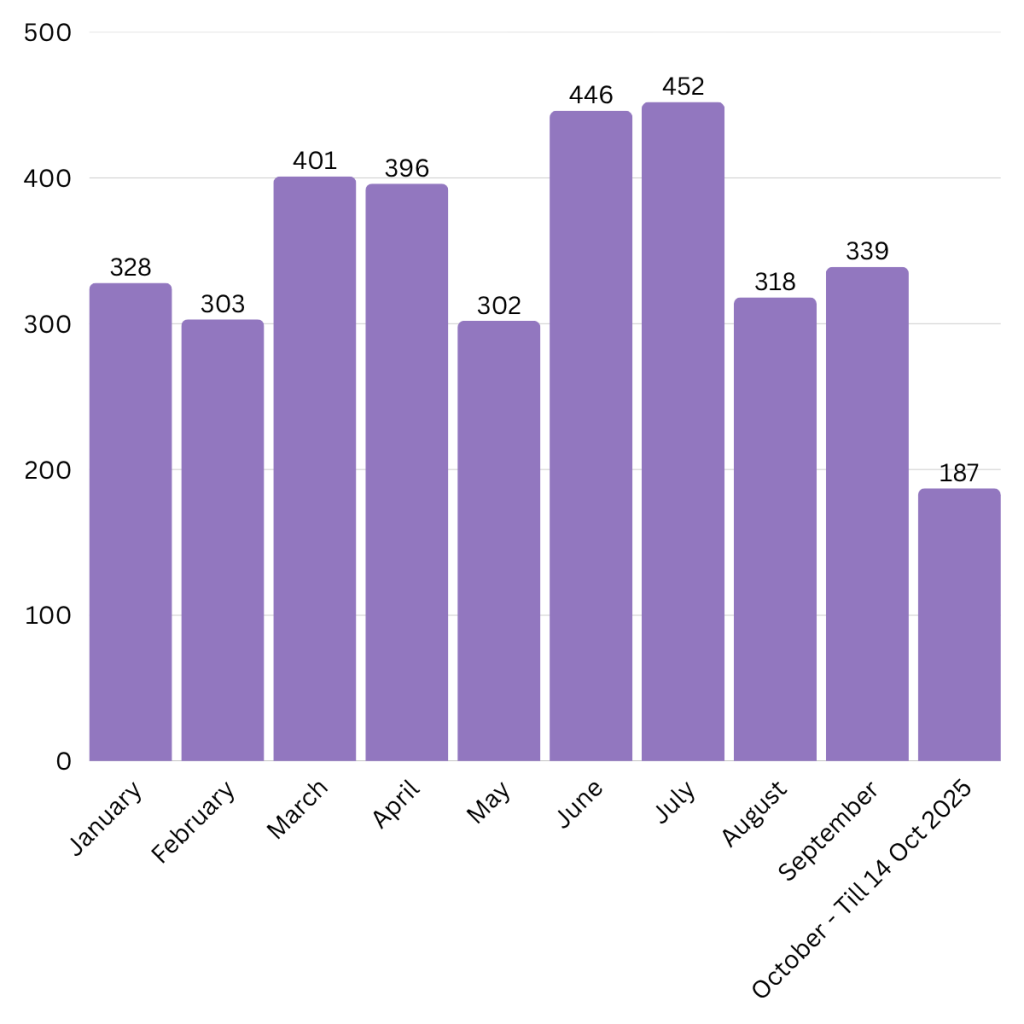

From January to October 2025, FinregE’s AI-powered platform tracked nearly 3,000 regulatory publications, an average of 365 per month.

In 2025 alone, fines have ranged from $27k to $500m and most were linked to failures in monitoring regulatory changes and implementing controls in time.

The number of enforcement fines suggest current regulatory systems are not working for some firms. Most legacy or single-point systems can’t process the volume and complexity of AML rules, laws and regulations.

Common AML regulatory compliance failings include:

- Siloed tools

- Manual mapping

- Missed alerts

- Poor integration with onboarding and monitoring systems.

AML in Numbers

Total Publications from 1st Jan 2025 to 14 Oct 2025 – 2919

July 2025 had the highest number of publications (452 in one month), suggesting a mid-year spike in AML/financial crime regulatory activity.

To avoid being blindsided by these waves of publications, firms need real-time horizon scanning.

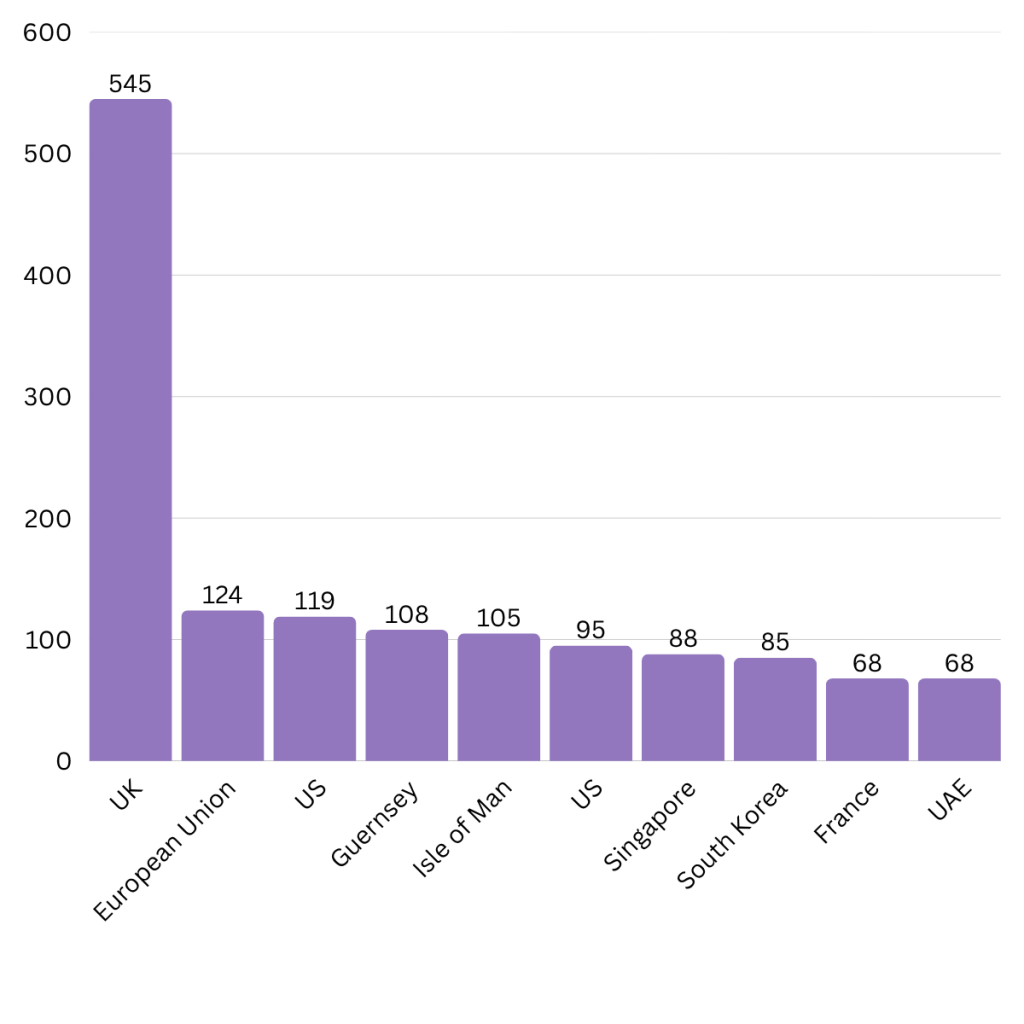

Leading regulators

- UK’s GOV.UK alone published 545 AML compliance documents. A large number of these consist of republished sanctions.

- US states and federal regulators (214) are shifting AML focus to beneficial-ownership transparency, sector-specific rules, and targeted sanctions actions.

- The EU’s numbers (124) reflect the 6AMLD and broader EU AML focus.

- Guernsey (108), Isle of Man (105): even smaller jurisdictions are publishing significant AML guidance, underlining their role in global regulatory ecosystems including offshore banking and funds. Guernsey is strengthening ML investigations and SAR quality following MONEYVAL review; updated country-risk lists. The IIsle of Man is re-baselining customer and country risk scoring under its revised AML Handbook.

- Singapore MAS (88) is a global financial hub and raising standards in APAC. It is Integrating proliferation-financing risks and faster STR timelines into AML programs.

- South Korea (85) is tightening crypto AML through stablecoin regulation, cross-border transaction reporting, and stricter Travel Rule enforcement.

- France (68) is updating vigilance and STR expectations under new ACPR-Tracfin guidelines aligned with AMLA’s framework.

- United Arab Emirates (68): Implementing a new federal AML law, enhancing FIU powers, and expanding coverage to virtual assets.

AML compliance standards are no longer driven just by the UK, US or EU, regulators worldwide are upping their game and tightening regimes.

Future-proof AML compliance

Shift 1: From manual monitoring to real-time horizon scanning

Regulators release changes constantly. Firms must anticipate rather than react.

Shift 2: From fragmented controls to end-to-end rule mapping

AML obligations shouldn’t sit in policy documents, they need to be embedded into onboarding, KYC, and monitoring workflows.

Shift 3: From defensive compliance to proactive intelligence

AML shouldn’t just be about preventing fines but enabling better decision-making (e.g., risk-based onboarding, cross-border expansion, investor confidence).

How FinregE enables this future

This data shows the impossible task compliance teams face without intelligent automation and that enforcement is not slowing down.

Banks with the wrong regulatory technologies can be lulled into a false sense of security, they might have the tools, but not the right intelligence. This can lead to compliance gaps, misaligned policies, and eventually fines.

FinregE’s AML solutions ensure nothing falls through the cracks, no matter how many updates regulators publish.

- AML Horizon Scanning: FinregE’s AI RIG flags new FATF, FCA, EU AMLD changes in real time.

- Digital Rulebooks & Mapping: AML obligations turned into machine-readable rules linked to your onboarding and monitoring systems.

- Risk Alerts & Automated Controls: When a high-risk customer is flagged or rules update, alerts flow directly to compliance teams, with actions logged for audit.

- AML Audit Trails & Defensibility: Every decision from EDD downgrades to policy changes is captured for regulators.

- Global Scalability: Supports multiple jurisdictions (FATF, 6AMLD, POCA, BSA, MAS, AUSTRAC).