VENDOR TO REGULATORS & GLOBAL FINANCIAL INSTITUTIONS

AI-driven platform for regulatory change, policy management & regulatory compliance

FinregE helps regulators and institutions automate end-to-end regulatory compliance, from horizon scanning, rule interpretation, to policy mapping, control monitoring, and audit-ready reporting.

FinregE wins contract to design and host FCA Handbook.

VENDOR TO REGULATORS & GLOBAL FINANCIAL INSTITUTIONS

AI-driven platform for regulatory change, policy management & regulatory compliance

FinregE helps regulators and institutions automate end-to-end regulatory compliance, from horizon scanning, rule interpretation, to policy mapping, control monitoring, and audit-ready reporting.

FinregE wins contract to design and host FCA Handbook.

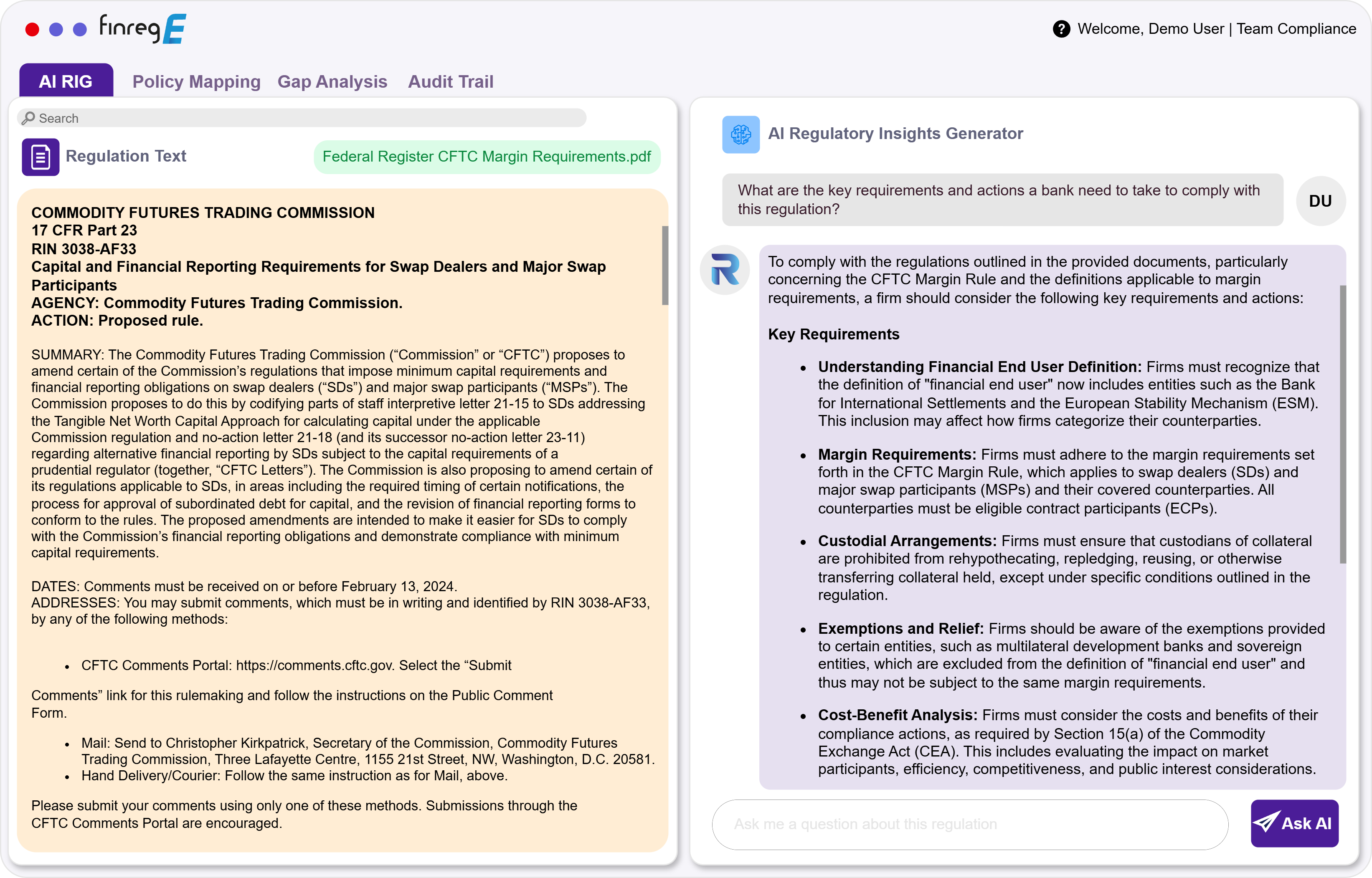

Meet AI RIG - Regulatory Insights Generator

A powerful large language model (LLM) trained on over a million data points from structured legal and regulatory texts.

RIG is a chatbot-style assistant, designed to guide businesses through complex regulatory landscapes, answer questions in any language. You can:

- Summarise long documents and consultations in seconds.

- Extract obligations, risks and control recommendations mapped to your frameworks.

- Interpret and contextualise obligations.

- Compare versions and highlight what changed and why it matters.

- Connect the dots across regulations and craft compliant policies.

- Search securely across internal and external sources with context-aware, cited answers.

- Engage in multilingual Q&A with high-quality translations.

END-TO-END REGULATORY COMPLIANCE

What sets FinregE apart

AI that's production ready

We help businesses at every stage of their AI adoption journeys. Our responsible and auditable AI models deliver explainable, transparent, and regulator-ready insights. We’ve supported many financial institutions and regulatory bodies in adopting their first AI solutions, proving our AI is tested, trusted, and deployed in production for years.

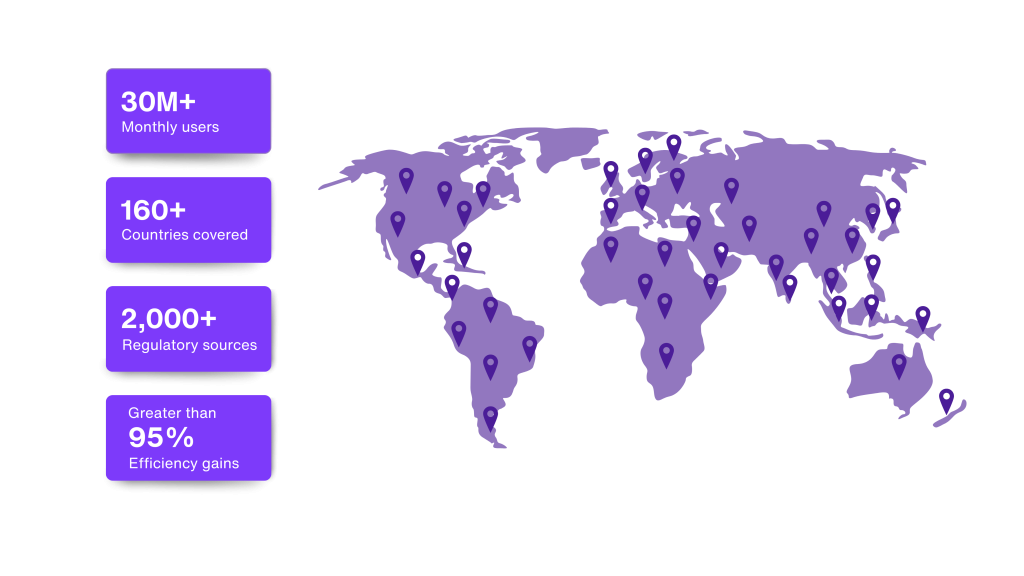

Clean, structured regulatory data

Our accurate, machine-readable regulatory data is drawn from over 2,000+ global sources across 160+ countries. Recently, our data capabilities were used to modernise, host and manage the Financial Conduct Authority’s Handbook website.

Built by regulatory experts, for compliance

We design regulatory compliance technology that mirrors how regulators think, translating complex rules into actionable insights and automated workflows. That’s why FinregE clients achieve ROI faster, realising 90% efficiency gains and cost savings of $100k per month.

Responsible AI for compliance automation

At the core of FinregE is our commitment to responsible AI, ensuring every output can be explained, traced, and complies with standards. We help firms to align with AI governance frameworks, enable transparent decision-making and provide audit-ready evidence for every compliance action.

Our regulatory compliance solutions

Our clients report 100k monthly savings after successfully mapping regulatory requirements to internal policies and controls on a fully integrated, AI-powered platform. FinregE takes care of every step of the regulatory compliance lifecycle, ensuring no gap is missed and offering remediation tips when required.

AI-driven horizon scanning

FinregE tracks regulatory sites across your chosen jurisdictions in real-time, translates regulatory updates, and alerts you to every relevant regulatory change.

AI MAPs – Mapping AI for policies, risks & controls

FinregE’s proprietary NLP-powered framework maps regulations to internal policies, controls and risks, enabling precise gap identification and remediation planning.

Compliance monitoring plan with AI control testing

Record and map risks, controls, and tests with AI-driven control testing, creating a self-sufficient, rolling compliance monitoring plan linked and driven by your regulatory obligations.

AI-powered policy management

FinregE’s new Policy Management module transforms static policies into structured, governed, and regulator-ready compliance assets. It enables teams to draft, review, approve, map, and audit policies – all in one platform.

Your advanced AI engine for regulatory compliance

We understand the pressure, complexity, and high stakes of managing regulatory compliance. Powered by AI, FinregE tracks relevant regulatory changes, connects these to your policies, risks and controls, maps impact and closes gaps so you can focus on what matters.

Complete visibility, 24/7

We provide global regulatory coverage, spanning every major jurisdiction and regulatory source, tailored to your footprint.

From US Federal and State regulations to the UK, EU, APAC, Middle East, Africa, and Latin America, your organisation can monitor all relevant rules, laws and regulations for full visibility.

Trusted by industry leaders

FinregE’s data and AI capabilities have earned global recognition from the world’s most respected financial institutions and regulatory bodies. We help regulated firms and governments worldwide transform how they manage, interpret and act on regulatory change.

UK FCA Handbook

Selected by the UK FCA to redesign, host and manage the official FCA Handbook to make it more accessible and easy to apply.

Moody's investment

Strategic investment from Moody's Corporation, one of the world's most renowned financial data and analytics companies.

Global partnerships

Trusted by the largest financial institutions and government agencies around the world in banking, asset management, crypto and more.

Regulatory themes we cover

Our coverage includes every major regulatory topic and theme, from data protection and competition to anti-money laundering, sanctions, and prudential regulations.

Data protection

Competition

Information security

Prudential & conduct

Markets & tax

Health & safety

Consumer protection

Human resources

Anti-money laundering

Sanctions

Risk & compliance

Legal & regulatory

Industries we support

FinregE powers AI-driven regulatory compliance for regulated industries, from banks and energy to healthcare and aerospace. Our platform can adapt to any organisation’s regulatory footprint, automating horizon scanning, change management, policy mapping, and compliance monitoring for faster, auditable outcomes.

Banking

Automate monitoring of prudential, conduct, liquidity, and capital adequacy regulations from global regulators like the PRA, ECB, EBA, Basel Committee, and SEC. Map obligations to internal policies, detect rule changes in real-time, and generate audit-ready compliance evidence across risk and control frameworks.

Payments

Track evolving payment services, PSD2, AML, data protection, and operational resilience rules. Our platform links regulations to controls covering fraud prevention, customer authentication, transaction monitoring, and cross-border compliance.

Insurance

Automate horizon scanning and compliance mapping for Solvency II, insurance distribution directive, operational resilience, claims handling and conduct obligations. We help insurers and reinsurers maintain clear policy-to-rule traceability, manage governance and control testing, and evidence compliance efficiently.

Asset & wealth management

Streamlines compliance with MiFID II, AIFMD, ESG and more by translating regulatory obligations into actionable policies and monitoring frameworks. Our AI identifies relevant regulatory changes, risk controls, and requirements, keeping firms audit-ready and aligned to investor expectations.

Fintech & digital assets

Monitor emerging digital finance regulations, including MiCA, DORA, AMLD6, and AI governance frameworks and map them to your operational controls. Gain real-time insights into evolving standards on data protection, cybersecurity, consumer duty, and digital conduct.

Lending & credit institutions

Automate compliance workflows across consumer credit, affordability, interest rate risk, and fair lending rules. Track changes in FCA, CFPB, SEC and prudential frameworks, linking them directly to credit policies and control procedures.

Accounting & tax

We empower firms to manage AML, audit independence, data governance, and client risk regulations. Our structured data enables efficient advisory delivery and supports clients with accurate, auditable regulatory interpretations.

Healthcare & pharma

Ensure policies keep pace with fast-changing health and data regulations with defensible audit trails. From regulatory texts to QA policies and SOPs. Compliance mapping at molecule-level precision.

Public sector & development finance

We build centralised regulatory libraries and custom taxonomies to streamline the analysis of national and international regulations. FinregE supports agencies to modernise regulatory approaches, ensure AI governance, digitise policies and improve transparency and oversight.

Energy

FinregE helps energy firms monitor and comply with evolving regulations such as emissions trading, grid access, ESG disclosure, REMIT, and energy market conduct by automating horizon scanning, regulatory mapping, and compliance workflows in one integrated platform.

Aerospace & defence

High-stakes compliance, zero margin for error. Know what’s changed, where it hits, and what to do next. Comply with complex global regulations, covering export controls, aviation safety, cybersecurity, ESG, and supply chain standards through automated horizon scanning, regulatory mapping, and compliance management in a single platform.

Automative & transportation

FinregE supports automotive and transport firms in complying with regulations on vehicle safety, emissions, autonomous systems, supply chain due diligence, ESG, and data privacy, by automating regulatory tracking, impact analysis, and compliance workflows in one unified platform.

Our AI across the regulatory compliance lifecycle

We connect legal, compliance, risk, SMEs, and the business through AI-powered workflows, from regulation to control and back.

How FinregE works across the Enterprise

FinregE is the AI-native platform for enterprise regulatory compliance, connecting every team managing risk, governance, and regulatory obligations under one platform.

Built for scale, FinregE unifies horizon scanning, regulatory change management, policy management and mapping, control testing, and audit readiness. We empower collaboration across all three lines of defence.

Enterprise-wide regulatory horizon scanning

FinregE’s AI-driven regulatory horizon scanning gives every team a tailored, real-time view of the laws, regulations, and guidelines that affect their functions.

Risk & compliance

Monitor prudential, conduct, governance, and operational risk updates across jurisdictions.

Legal & governance

Maintain digital regulatory libraries and interpret evolving legislation, consultations, and enforcement actions.

Finance & tax

Track global capital, liquidity, accounting, and tax rule changes, automating impact assessments.

Human resources

Stay compliant with regulations on employment, remuneration, diversity, and whistleblowing.

Information security & data privacy

Monitor cyber, AI, data protection, and information governance regulations.

Procurement & third-party risk

Identify supplier, outsourcing, and critical vendor obligations from new outsourcing and resilience frameworks.

Operations & business units

Stay informed of conduct, consumer protection, product governance, and complaint handling rules.

ESG & sustainability

Track climate disclosure, green finance, and sustainability reporting regulations.

Internal audit & assurance

Leverage horizon scanning to plan audits and verify compliance readiness.

Board, executives & company secretaries

Receive concise, AI-generated insights to oversee compliance performance and governance assurance.

Structured workflows across three lines of defence

First line

Business & operations

Receives actionable insights and implementation tasks for regulatory updates.

Second line

Compliance, risk, legal

Performs impact assessments, assigns actions, and monitors progress through dashboards.

Third line

Internal audit

Validates control effectiveness through built-in evidence trails and test results.

Connected, intelligent, and enterprise-ready

Designed to work across the enterprise, we ensure trusted automation, clear accountability, quick ROI results and regulatory oversight in real-time.

Connected obligations across all functions

Build connected obligation maps that link regulatory requirements to your policies, procedures, and controls, creating a single source of truth across the enterprise.

- Links rules to policies, procedures, and controls

- Eliminates duplication and gaps in accountability

- Cross-domain visibility across Basel III/IV, DORA, GDPR, ESG, AMLD6

Collaboration across three lines of defence

Connect First, Second, and Third Lines through structured, automated workflows with clear accountability at every step.

- First Line: Actionable insights and implementation tasks

- Second Line: Impact assessments and audit-ready dashboards

- Third Line: Control effectiveness validation and evidence trails

AI at the core of every step

Transform how your enterprise interacts with regulatory data through advanced AI and natural language processing.

- AI reads and summarizes 1,900+ global regulatory sources

- AI-assisted search for complex regulation queries

- Automatic obligation identification and policy recommendations

- Complete traceability with explainable, auditable compliance

Compliance monitoring & control testing

Manage risk assessments, control testing, and remediation workflows efficiently with AI-powered monitoring.

- Links rules to policies, procedures, and controls

- Eliminates duplication and gaps in accountability

- Cross-domain visibility across Basel III/IV, DORA, GDPR, ESG, AMLD6

Client testimonials

Global Tier 1 insurance company

“FinregE acts more like a strategic technology partner than simply another technology vendor. The team really try to understand the compliance problem we are trying to solve and train and configure their software to meet our existing processes and teams and businesses enterprise set-up.”

Global legal professional services firm

“Many providers can provide you with a data feed on regulators developments that is either delayed, missing relevant updates or sources of information or the publications are unstructured and uncategorised. With FinregE, you get a fully customised, consistently structured and fully topic tagged data feed on regulatory developments across global sources. What has also been useful is being able to get access to this data via customised APIs and filtering based on our needs and requirements.”

UK Tier 3 payment services firm

“With FinregE, the biggest benefit to us has been reducing the manual effort and time taken for us to manage numerous messy email subscriptions and RSS feeds to keep on top of regulatory changes, as FinregE brings all the information we need to us in their platform.”

We’re here to answer all your questions

FinregE specialises in providing standard and bespoke regulatory compliance modules to help deliver automation, speed and efficiencies in managing regulatory compliance processes.

What is FinregE's software?

FinregE’s software is a comprehensive compliance solution for financial institutions. It helps businesses stay compliant with all relevant regulations by providing a one-stop-shop for accessing regulatory news, publications and laws/leiglative material applicable to an institution. FinregE provides full regulatory traceability from the rule to the requirements, policies, processes, controls and regulatory changes in a single software to make it easier to meet regulatory requirements.

How much can financial institutions expect to save on average by using FinregE's regulatory compliance software?

FinregE’s software offers a significant return on investment compared to manual compliance processes. Manual processes can be time-consuming, error-prone, and resource-intensive, leading to increased costs and reduced efficiency. In contrast, FinregE’s software streamlines compliance efforts, reduces the risk of non-compliance, and provides real-time updates on regulatory changes, allowing businesses to stay ahead of the curve.

Let’s consider a compliance team of 5 people working 5 days a week and processing 12.5 regulatory publications each day, resulting in a total of 313 publications processed per week (12.5 x 5 x 5).

If each publication takes an average of 30 minutes to process manually, the total time spent on processing publications each week would be 156 hours (313 x 0.5 hours per publication).

Assuming an average hourly rate of $50 for compliance professionals, the cost of processing publications manually would be $7,813 per week (156 x $50). Over a year, this would amount to a staggering $406,250 ($7,813 x 52 weeks).

However, FinregE’s case studies across multiple clients have consistently shown that tasks can be completed 50%-60% faster than doing them manually. This is achieved through the automation of time-consuming manual tasks such as gathering information from regulatory websites, updating spreadsheets, and tracking changes. Assuming a 60% saving, financial institutions can reduce the cost of processing publications manually from $406,250 to $243750, saving $£121,875 per year.

Furthermore, the return on investment for the software purchase is 406.67%. This means that for every pound spent on the software, FinregE returns $4.06 to its client.

With FinregE, compliance and regulatory professionals can focus more on higher-value tasks such as analyzing and interpreting regulatory requirements. By streamlining these tasks, financial institutions can save valuable time and resources, while reducing the risk of non-compliance.

How does FinregE's software work?

FinregE’s software uses cutting-edge technology, such as generative AI and machine learning, to provide real-time updates on regulatory changes that may affect your business. It also offers a centralized repository for all your regulatory requirements, policies, and processes, making it easy for you to manage and monitor your compliance efforts.

What are the benefits of using FinregE's software?

The benefits of using FinregE’s software are numerous. It streamlines your compliance efforts, reduces the risk of non-compliance, and provides a single place to access all relevant regulatory information applicable to your business’s regulatory footprint. It cuts down the manual time and effort in access regulatory laws and information by bringing them to you so you can focus on performing compliance, rather than gathering data, structuring it and other manual processing tasks. FinregE takes away the burden of all manual processes around compliance and regulatory risk management. It also helps you identify areas that require attention and take action to address any issues.

What makes FinregE's software unique?

FinregE’s software is unique because it offers full regulatory traceability, allowing you to track every regulatory requirement and policy that applies to your business. It also successfully uses cutting-edge technology, such as generative AI and machine learning, to provide regulatory interpretations and action requirements to under what needs complying with.

How does FinregE's software help with regulatory compliance?

FinregE’s software helps with regulatory compliance by providing a centralized repository for all your regulatory requirements, policies, and processes. It also helps you identify any gaps against the requirements and any regulatory changes on the horizon against the rule and requirements, ensuring that you remain fully compliant with all relevant regulations.

What kind of support is available for FinregE's software?

FinregE offers a dedicated support team to help with any issues or questions you may have about the software. Additionally, the platform itself includes a range of features and tools to help you manage your compliance efforts.

Is FinregE's software customisable?

Yes, FinregE’s software is customizable to meet the specific needs of your business. The platform can be tailored to your unique regulatory and rules data, compliance management processes and against your compliance policies, and processes, ensuring that you remain fully compliant with all relevant regulations.

How easy is it to use FinregE's software?

FinregE’s software is designed to be user-friendly and intuitive, with a range of features and tools that are easy to navigate. Additionally, the platform offers extensive training and support to ensure that you get the most out of the software.

Is FinregE's software scalable?

Yes, FinregE’s software is scalable to meet the needs of businesses of all sizes. The platform can be tailored to your specific requirements, whether you’re a small startup or a large enterprise.

How can I get started with FinregE's software?

To get started with FinregE’s software, simply contact us to schedule a demo or learn more about our solutions. Our team will work with you to determine the best approach for your business and get you up and running in no time.

Book a tailored demo

FinregE provides an all-in-one solution to track, interpret, categorise and map regulatory developments across ever global jurisdictions. See exactly how FinregE would work for your team.