The Prudential Regulation Authority (PRA) released CP12/25 – Pillar 2A Review: Phase 1, marking the start of a strategic overhaul of how UK firms calculate and manage Pillar 2A capital requirements. This consultation is a key milestone in the UK’s journey to implementing Basel 3.1 standards. Here’s what firms need to know—and how FinregE can help.

Key Changes Proposed by the PRA

The CP introduces targeted reforms across five major risk areas. The goal? Align Pillar 2A with the new Basel 3.1 Pillar 1 framework while enhancing clarity, proportionality, and transparency.

- Credit Risk

- Removal of the IRB benchmarking methodology.

- New systematic methodologies for:

- Exposures to central governments, central banks, and local authorities.

- Retail revolving exposures that are unconditionally cancellable (UCCs).

- New expectations for firms to use credit scenarios in their ICAAP.

- Operational Risk

- Clear expectations for scenario analysis.

- Enhanced transparency in PRA methodologies.

- Updates to reporting templates (FSA072–FSA075).

- Pension Obligation Risk

- Removal of PRA-defined stress scenarios.

- Simplified reporting for firms with well-funded or bought-in pension schemes.

- Market and Counterparty Credit Risk

- Updates to PRA methodologies for assessing capital requirements—aligning more closely with market practices.

Who Is Impacted?

This consultation applies to:

- All PRA-regulated banks, building societies, and designated investment firms.

- Includes Small Domestic Deposit Takers (SDDTs)—though their capital treatment will be finalized in a separate policy due in Q4 2025.

Key Implementation Dates

- Consultation deadline: 5 September 2025

- Implementation dates:

- 2 March 2026: Pension obligation risk and market/counterparty risk changes go live.

- Basel 3.1 alignment date (TBC): Credit risk and operational risk changes will take effect in sync with Basel 3.1 implementation.

Actions Firms Need to Take

- Review impact on ICAAP: Incorporate proposed scenario expectations and new credit risk methodologies.

- Reassess Pillar 2A capital needs: Evaluate how the new models could affect capital buffers.

- Update internal reporting: Align templates and reporting processes to reflect upcoming changes.

- Engage with PRA feedback loop: Respond to the consultation by the deadline.

How FinregE Helps Firms Stay Compliant

As firms navigate these complex changes, FinregE offers end-to-end support for proactive regulatory compliance:

Real-Time Regulatory Horizon Scanning

- Monitor over 1,700 sources globally, including the PRA, HM Treasury, and the Bank of England.

- Enables proactive identification of capital-related regulatory changes from inception to final rule.

Automated Impact Assessment Workflows

As the PRA calls for detailed scenario analysis and enhanced operational risk methodologies, FinregE’s configurable workflows allow institutions to:

- Conduct materiality and risk impact assessments,

- Collaborate across business lines,

- Assign accountability, and

- Track implementation progress with full audit trails.

This functionality directly supports the PRA’s expectations for transparent and accountable capital adequacy assessments.

Machine-Readable Digital Rulebooks

- FinregE provides structured, version-controlled regulatory text.

- Highlight changes between versions of regulations like the PRA Rulebook or Basel 3.1, enabling gap analysis.

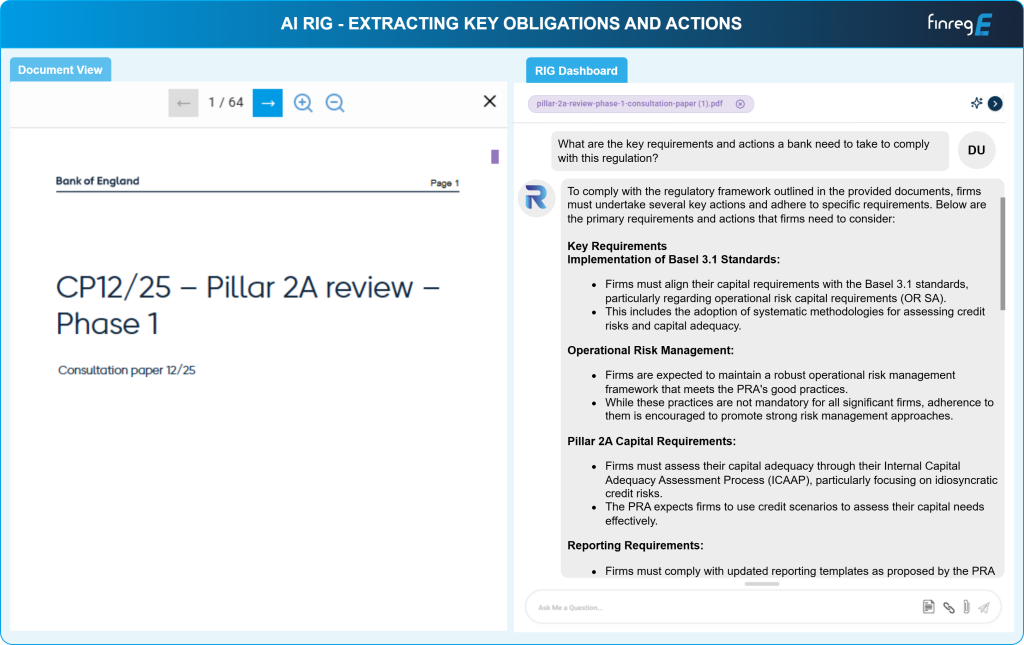

AI-Powered RIG (Regulatory Insights Generator)

Using FinregE’s Regulatory Insights Generator (RIG), firms can automatically interpret new regulatory text (like Pillar 2A updates), extract key obligations, and generate recommended controls and policy adjustments. This supports rapid compliance with emerging PRA guidance while reducing the need for extensive manual review.

Final Thoughts

The PRA’s Pillar 2A proposals are more than a technical refinement—they’re a foundational shift to ensure that capital adequacy remains robust in a post-Basel 3.1 world. By acting early and leveraging innovative solutions like FinregE, firms can reduce their compliance burden, enhance transparency, and build a forward-looking capital framework.