Integrate Regulatory Compliance Management Software Into Your Business Processes

The financial industry is one of the most heavily regulated industries in the world. Government policies and regulations ensure that companies in this sector operate responsibly and ethically, protecting the interests of their investors, customers and other stakeholders. As such, any business operating in the financial sector must adhere to various laws, regulations and standards.

REGULATORY SOLUTIONS

Regulatory Compliance Management Software

Managing regulatory compliance can be complex, time-consuming and costly for many organisations. This is where regulatory compliance management software comes into play. A regulatory compliance management tool provides organisations with an automated solution for monitoring and managing their regulatory requirements.

Monitor compliance in real-time: both your status and processes

Access machine-readable libraries of financial global rulebooks

Extract insights on regulatory actions and requirements across rules

Map rule requirements automatically across your compliance policies

Use workflows to action and record the life cycle of regulatory compliance

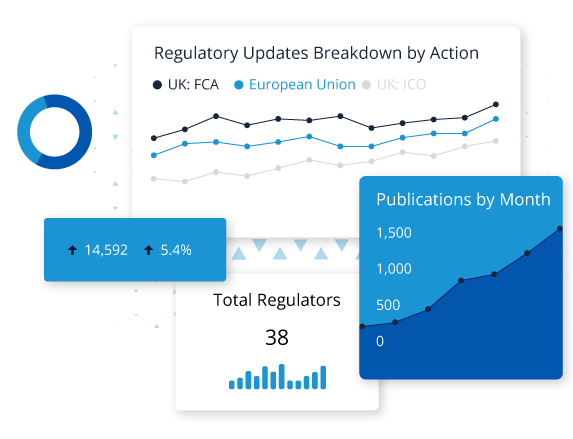

Conduct compliance reporting with dashboards to view your landscape

Reasons to Implement Regulatory Compliance Management Software

With these tools at their disposal, businesses can quickly identify gaps or non-compliance areas before they become problems. As a result, companies can better protect themselves from potential legal or financial repercussions associated with failing to comply with governing regulations.

Other benefits of regulatory compliance management software include increased visibility into the organisation’s legal and financial standing, improved staff efficiency, cost savings and an overall reduction in risk.

By leveraging these powerful tools, businesses operating in the finance sector can ensure they remain compliant with all relevant regulations while improving their operational effectiveness.

NEWSLETTER

FinregE Weekly Regulatory News Alerts

Stay up-to-date with the latest regulatory changes. Sign up to FinregE’s weekly regulatory alerts news.

Regulatory Management Software Key Features

When it comes to selecting the best regulatory compliance management software for your organisation, there are several features that you should consider.

Automated Alerts and Notifications

Regulatory compliance management software should be able to provide automated alerts and notifications whenever there are changes in regulations or other requirements. This ensures that all staff are up-to-date with the latest rules and regulations.

Customisable Reports and Dashboards

The software should be able to generate customised reports that meet specific requirements and provide visibility into key risk factors such as financial exposure and insider trading. There should also be dashboards that can be used to monitor performance, review trends and track progress over time.

Real-Time Data Tracking

The software should also enable users to track their regulatory compliance issues in real-time to identify any potential non-compliance areas before they become problems quickly.

Workflow Automation

These automated workflows should include internal regulatory change management, external regulatory interactions, self-assessment and period compliance monitoring.

Natural Language Processing

It is also important to look for software that includes natural language processing capabilities so you can quickly identify any new regulatory requirements or changes in existing regulations through text and information extraction.

The Solution to Your Compliance Woes

With the right solutions, businesses operating in the finance sector can protect themselves from potential legal or financial repercussions of failing to comply with governing regulations. FinregE’s regulatory compliance management system helps streamline the process while improving operational efficiency.