The financial industry is facing increased regulatory scrutiny on the use of Artificial Intelligence (AI) and Machine Learning (ML) in regulatory compliance, particularly in the area of regulatory change management (RCM). Integrating these technologies is no longer just a competitive advantage but an expectation as regulators raise the bar on accuracy, efficiency, and transparency.

Guidelines and Standards for Regulatory Change Management

Regulators are issuing guidelines that emphasize transparency, accountability, and risk mitigation when using AI and ML in regulatory processes. For example, the EU AI Act mandates strict oversight of AI models in financial services, ensuring compliance with transparency, safety, and ethical standards. In regulatory change management, AI must meet these standards by enabling financial institutions (FIs) to trace decisions, log interpretations, and explain outcomes.

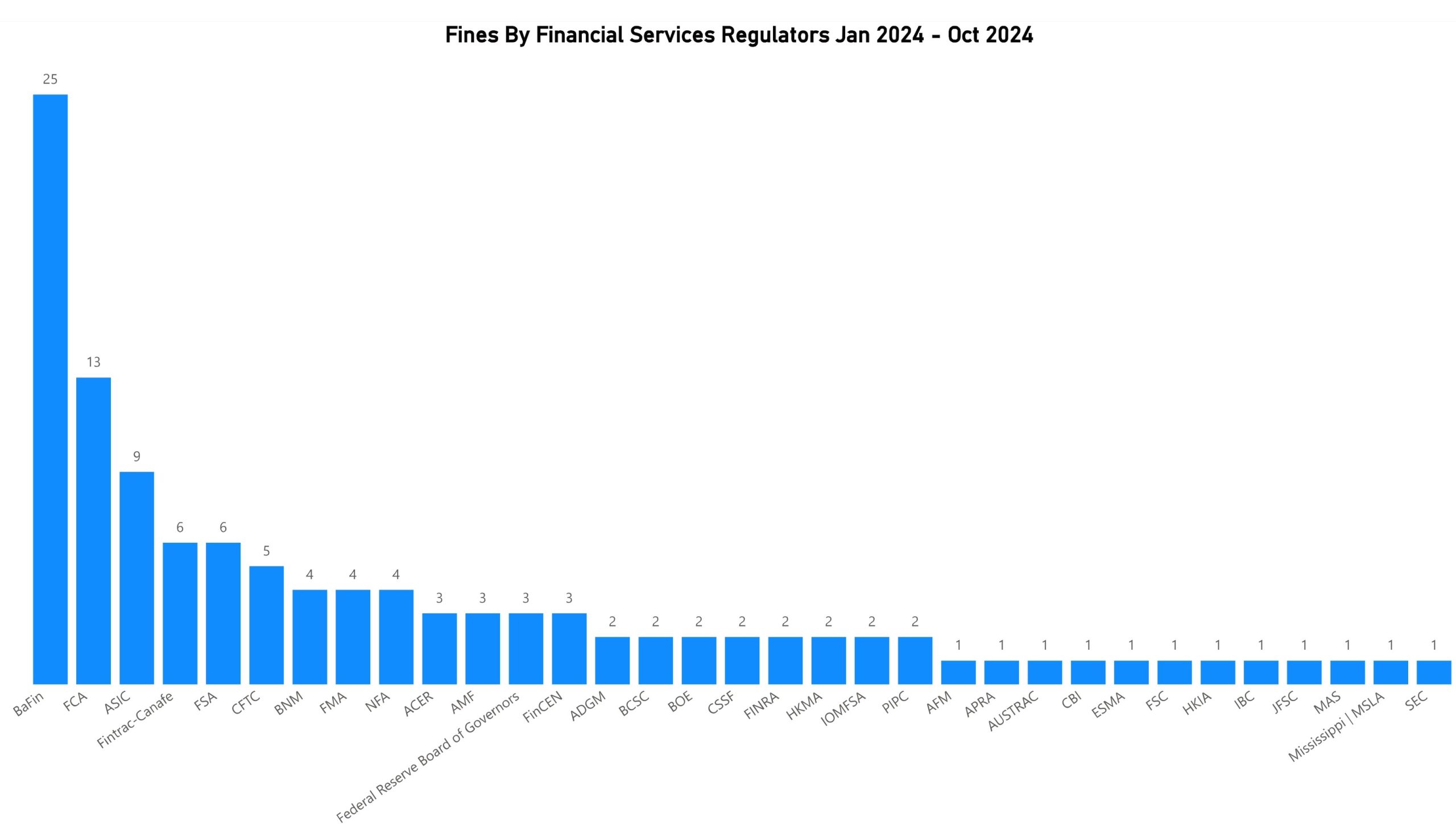

Penalties for non-compliance can be steep. For instance, regulatory fines imposed by the Financial Conduct Authority (FCA) in the UK for inadequate governance and oversight over compliance models demonstrate that institutions must not only capture regulatory updates but also ensure those updates are integrated properly across internal processes.

Financial Penalties for Non-Compliance with Regulations

Penalties for non-compliance can be severe. Regulatory fines imposed by authorities such as the Financial Conduct Authority (FCA), the Bank of England (BOE), and various U.S. regulators highlight the need for financial institutions to not only capture regulatory updates but also ensure that these updates are integrated correctly across internal processes. For instance, in May 2024, the Prudential Regulation Authority (PRA) fined a bank’s trading division £33.9 million, emphasizing the importance of being responsive to regulatory guidance and expectations. The PRA underscored its expectation that firms continuously assess and adapt their controls to align with evolving regulatory requirements.

Another penalty issued in January 2024 to a large bank by the PRA further illustrated the expectation that firms must continuously adapt their systems and controls to keep pace with regulatory changes. This includes staying updated on regulations, such as those related to deposit protection. The PRA stressed that it is crucial for firms to understand regulatory requirements, such as the Depositor Protection Rules, and to implement systems and controls that meet these standards. This involves ensuring the integrity of critical information that regulators depend on.

Many penalty notices also reference the expectation that firms link regulatory requirements to their internal policies and controls. This entails assigning clear ownership for compliance processes and holding senior management accountable for maintaining the integrity of information related to regulatory compliance. UK regulatory fine notices highlight the need for senior managers to take responsibility for compliance with regulatory requirements and to maintain accurate documentation and reporting mechanisms that demonstrate adherence to the rules. This includes producing finalized reports that confirm compliance with regulatory standards.

Fines from U.S. authorities like FINMA emphasize the importance of maintaining a supervisory system and Written Supervisory Procedures (WSPs) that ensure compliance with relevant regulations. These requirements include updating WSPs in a timely manner following regulatory changes, implementing effective monitoring mechanisms, and integrating regulatory notices into compliance workflows. To strengthen regulatory change management, firms should adopt a structured framework for identifying and implementing regulatory changes, provide regular training, maintain comprehensive documentation, and engage with regulatory bodies to stay informed.

Similarly, fines issued by the Federal Reserve for breaches of AML laws stress the need for institutions to establish a comprehensive compliance framework that aligns with BSA/AML obligations. The Federal Reserve emphasizes the importance of continuous monitoring of regulatory changes and timely updates to internal policies and procedures. Institutions must map regulatory requirements to internal controls, ensuring proper documentation for both compliance and audit purposes. Additionally, the Federal Reserve highlights the need for systematic compliance systems that utilize technology for effective monitoring and reporting, as well as conducting regular assessments to identify and address gaps in compliance management.

The Evolution of Regulatory Change Management in Financial Institutions

Historically, financial institutions have relied on spreadsheets and manual workflows to track regulatory updates. However, this method is becoming obsolete as regulators expect more sophisticated systems that capture, analyse, and integrate regulatory changes in real-time. Financial institutions are moving toward adopting automated solutions that perform regulatory change impact assessments, which allow them to:

- Assess regulatory changes against existing compliance controls and frameworks.

- Track actions taken, including documentation of decisions on what rules apply and what don’t.

- Implement a structured process to demonstrate how regulatory updates affect internal policies, procedures, and controls.

Such systems enable a full audit trail of how changes are managed, reviewed, and applied, meeting regulatory requirements for transparency and accountability.

Anticipating Evolving Regulatory Expectations

Financial institutions can anticipate regulatory expectations by transitioning away from manual processes and adopting technology to provide:

- Increased process visibility: AI and ML can automate regulatory horizon scanning, monitoring global regulatory developments in real-time.

- Proactive management: Leveraging AI can help firms stay ahead by assessing upcoming regulations, providing early warnings, and assigning compliance responsibilities well in advance of deadlines.

The expectation is that AI solutions can also improve operational efficiency by reducing human errors, decreasing costs, and minimizing the risk of non-compliance. Institutions that continue to rely on manual processes risk regulatory fines and inefficiencies.

Ensuring Comprehensive Regulatory Impact Assessments

For financial institutions to meet regulatory requirements, their regulatory change impact assessments must:

- Engage all necessary stakeholders, including compliance, risk, legal, and business units.

- Integrate policy, procedures, and controls data, ensuring that every impacted area is thoroughly examined.

- Perform gap analysis to identify discrepancies between current practices and new regulatory obligations.

FinregE’s AI-driven platform is uniquely positioned to assist firms in automating these processes, ensuring that all relevant data points are captured, and stakeholders are involved in real-time decisions.

Adapting Regulatory Change Frameworks to Meet Evolving Expectations

To ensure compliance while maintaining business-as-usual (BAU) activities, financial institutions must:

- Enhance collaboration across departments by centralizing the regulatory change management process.

- Implement real-time monitoring and automated workflows that track compliance activities, deadlines, and tasks assigned to various teams.

- Utilize AI-powered impact assessments to accurately analyse and document the implications of regulatory updates on internal controls.

Adapting to these expectations requires institutions to move away from siloed, manual processes toward integrated, automated solutions that enhance oversight and traceability.

How FinregE Supports Regulatory Change Management

FinregE provides FIs with a fully integrated platform that automates the entire regulatory change process:

Regulatory Horizon Scanning: FinregE’s platform monitors real-time updates from regulatory bodies, ensuring that institutions receive immediate notifications of changes.

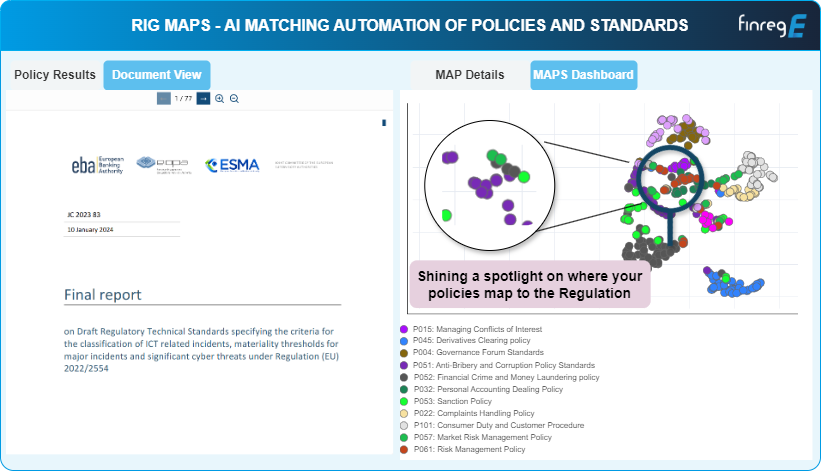

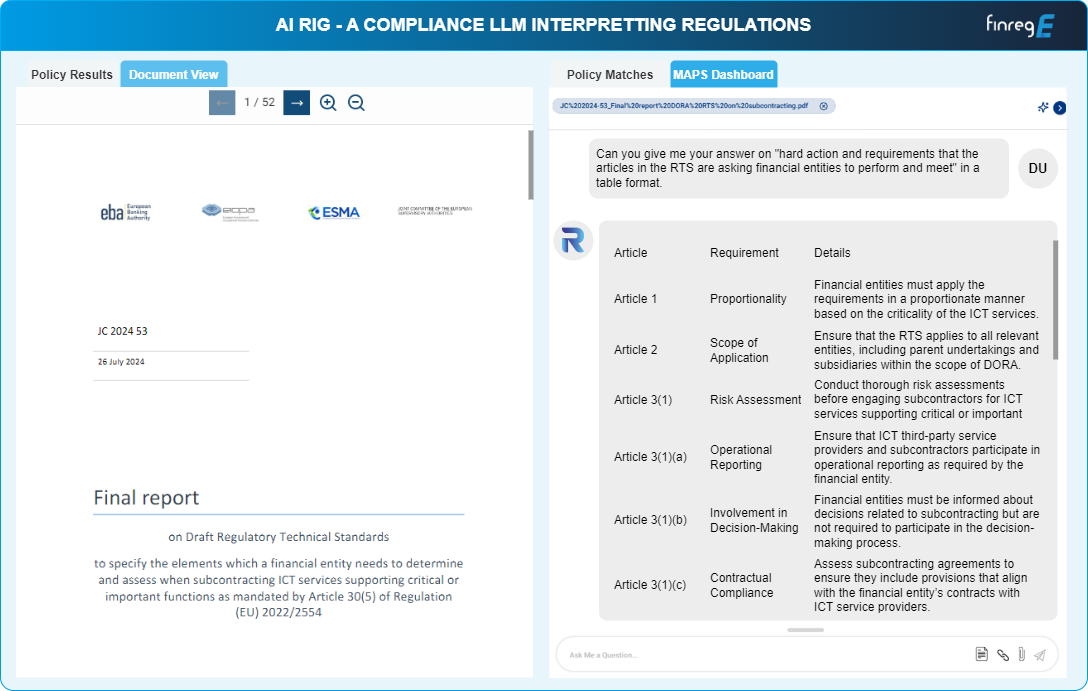

AI-driven analysis: FinregE’s Regulatory Insights Generator (RIG) uses machine learning to interpret regulatory texts, automatically identifying obligations and mapping them to internal controls.

Impact Assessments and Workflows: The platform offers comprehensive impact assessments, assigning tasks and managing workflows to ensure that all necessary actions are tracked and completed.

By leveraging AI and automation, FinregE ensures that financial institutions not only meet current regulatory expectations but also remain agile and responsive to future regulatory changes, reducing the risk of fines and enhancing operational efficiency.

In conclusion, regulatory expectations around integrating AI and ML into regulatory change management are evolving rapidly. Financial institutions must adopt advanced technology solutions like FinregE to stay compliant, reduce costs, and proactively manage regulatory risks. Book a demo today.