Regulatory compliance has long been a complex and resource-intensive challenge for financial institutions, energy companies, and other highly regulated industries. With the increasing pace of regulatory change, organizations must continuously interpret evolving rules, extract actionable insights, and ensure their policies remain aligned with compliance obligations. Traditional approaches—often reliant on manual review and legal expertise—struggle to keep up. However, FinregE’s Generative AI LLM RIG presents a transformative opportunity to modernize regulatory compliance.

The Role of FinregE's AI RIG in Regulatory Understanding

FinregE’s LLM RIG, trained on vast corpora of legal and regulatory texts, acts as a powerful assistant in understanding and interpreting regulatory obligations. Unlike rule-based automation tools, FinregE’s AI can:

Extract Key Obligations: RIG can parse through lengthy regulations and identify key obligations, conditions, and exemptions that apply to a business.

Summarize and Contextualize Rules: RIG generates concise summaries of complex regulatory texts while preserving legal nuances.

Provide Interpretative Guidance: Through advanced natural language processing (NLP), RIG interprets regulatory provisions in the context of industry best practices and prior enforcement actions.

Automating Compliance Workflows with FinregE’s AI RIG

Beyond understanding regulations, FinregE’s Generative AI RIG enables organizations to automate compliance workflows, reducing manual effort and mitigating risks. Some key applications include:

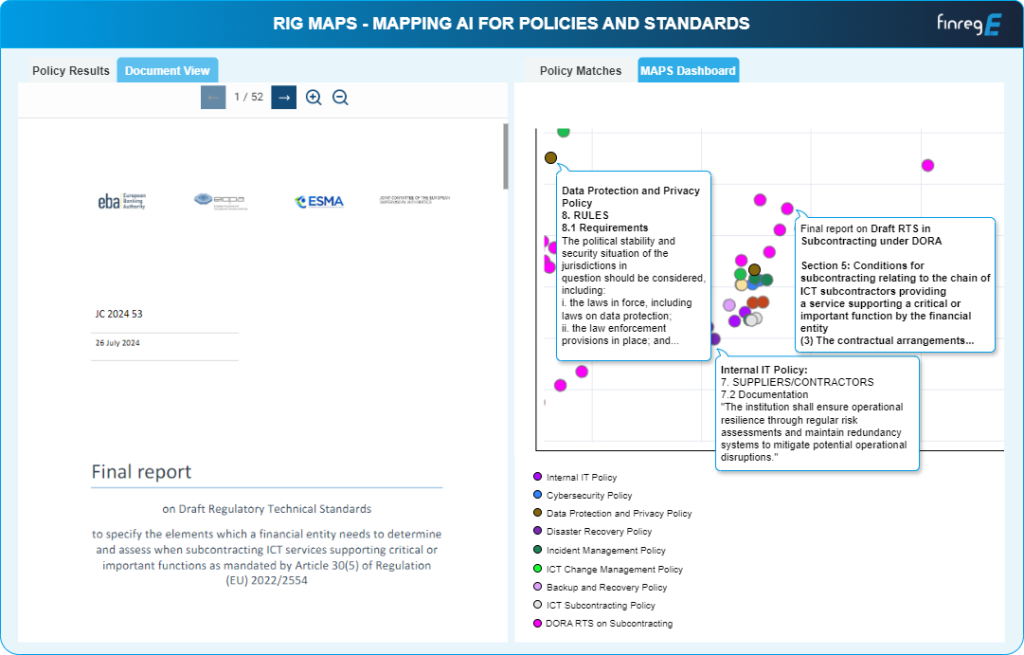

Mapping Regulations to Business Processes: RIG analyzes company policies and procedures against relevant regulations, highlighting compliance gaps and areas requiring updates.

Generating Business Actions and Controls: RIG suggests practical business actions, controls, and procedural adjustments required to align with new or updated regulations.

Automating Regulatory Change Management: FinregE’s AI continuously monitors regulatory updates and provides instant impact assessments for compliance teams.

AI-Generated Policy Writing with RIG: Ensuring Compliance by Design

Writing policies that are both compliant and operationally effective is another area where FinregE’s AI RIG adds value. AI-driven policy management solutions can:

Draft Policy Documents: Using predefined templates and regulatory inputs, RIG generates initial drafts of policies and procedures tailored to specific business functions.

Ensure Consistency and Standardization: RIG helps maintain a consistent structure and language across policies, ensuring alignment with regulatory expectations.

Facilitate Policy Reviews and Updates: RIG highlights outdated sections of policies and recommends revisions in response to regulatory changes.

Addressing AI Risks in Regulatory Compliance

While AI offers substantial benefits, organizations must address potential risks, including:

- Ensuring Accuracy: AI-generated interpretations must be validated by legal and compliance experts to prevent misinterpretations.

- Managing Bias: Regulatory AI models should be trained on diverse datasets to mitigate biases in regulatory interpretations.

- Regulatory Acceptance: Firms should engage with regulators to ensure AI-driven compliance processes align with supervisory expectations.

FinregE’s AI RIG as a Compliance Enabler

FinregE’s Generative AI LLM RIG is revolutionizing regulatory compliance by enhancing understanding, automating workflows, and streamlining policy management. Organizations that leverage FinregE’s AI effectively can achieve greater compliance efficiency, reduce operational risk, and proactively adapt to regulatory changes. However, AI should not replace human oversight; rather, it should augment the capabilities of compliance professionals, enabling them to focus on high-value strategic initiatives.

As AI continues to evolve, regulatory bodies and industry leaders must collaborate to establish frameworks that ensure responsible AI adoption while maximizing its potential to transform compliance management. By embracing FinregE’s AI-driven regulatory intelligence, businesses can navigate the complexities of compliance with confidence and agility. Book a demo today to see RIG in action.