Financial institutions are constantly threatened by cyberattacks and confidential data leaks. According to Surfshark, the number of data breaches has increased for the Q3 of 2022, reaching around 72.8 million accounts.

For that reason, compliance requirements for financial services have been introduced to ensure a minimum data protection standard. Compliance in the financial services industry means that all security regulations must be followed to prevent incidents and data breaches.

The Rising Cost of Compliance in the Financial Services Industry

Statistics show that 44% of companies are expected to invest more in regulatory technology. With the cost of compliance rising, a large proportion of it is being spent on people as institutions are trying to solve the problem of a data breach with more skilled individuals, technology and resources.

Many banks have outdated systems that are difficult to change and maintain, which further requires finances for new technology and staff to operate it.

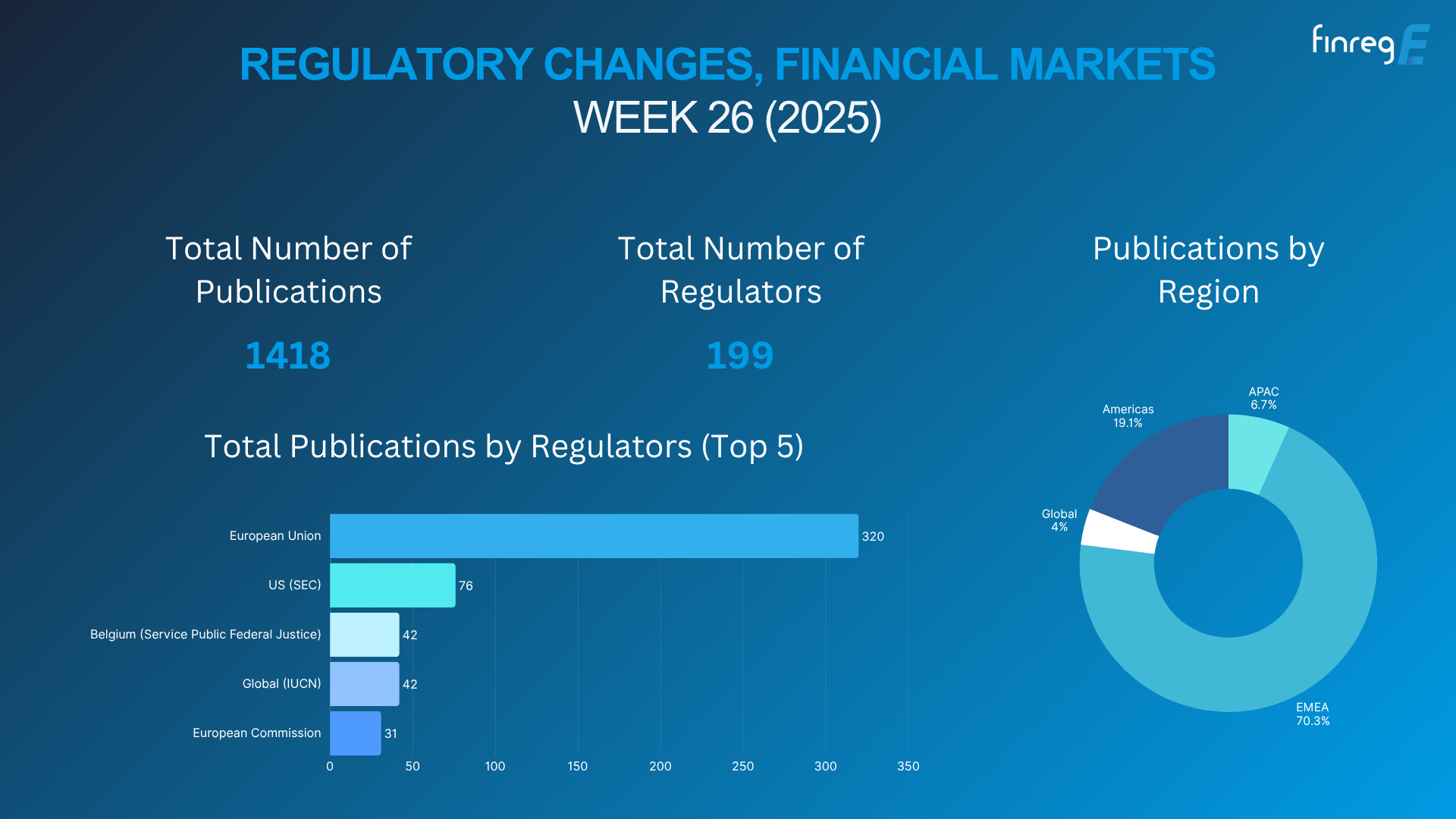

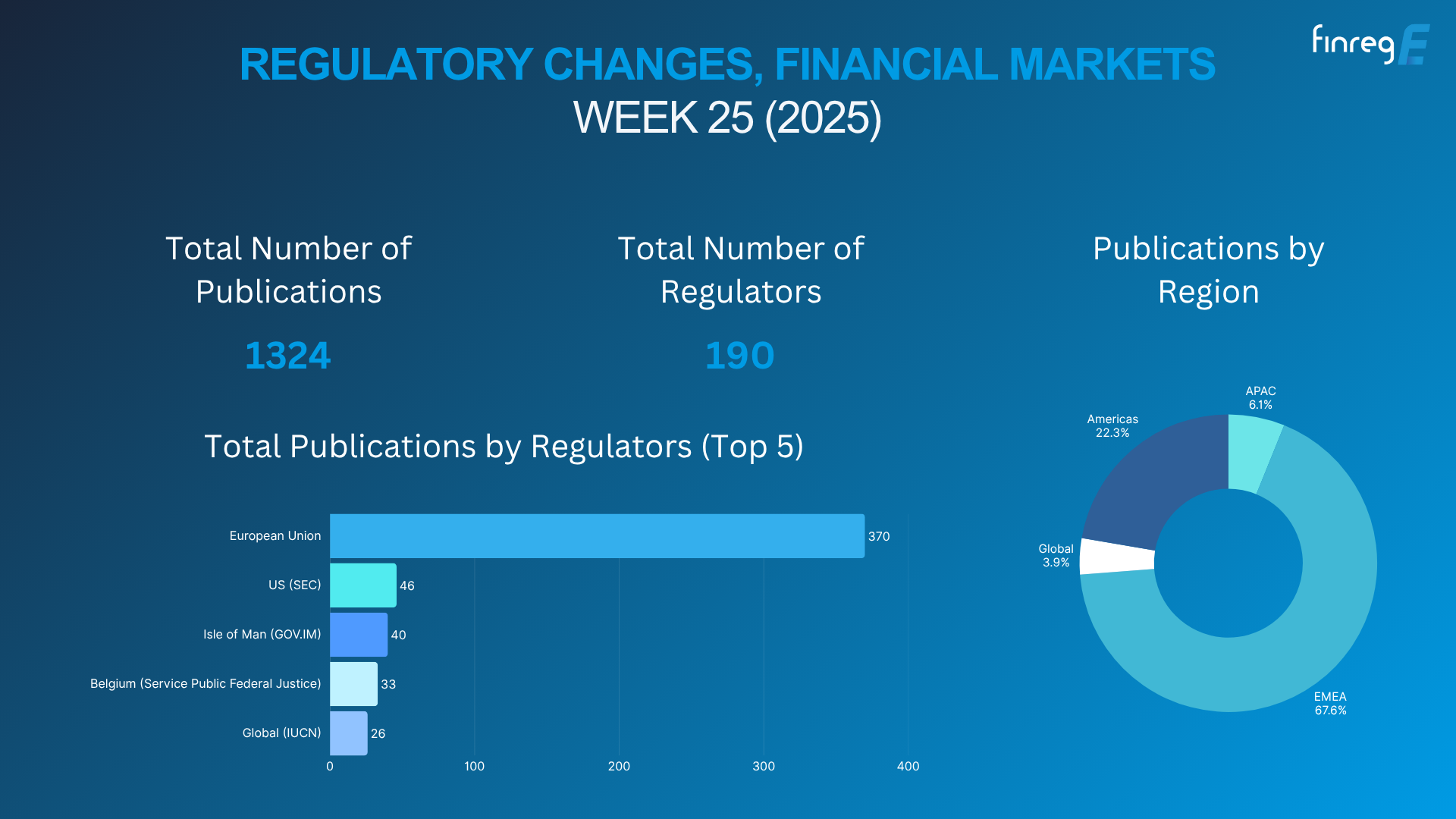

Also, the number of regulatory changes is rising, adding to the complexity of financial compliance and further driving up its cost. Financial institutions must find a way to go through these challenging times by implementing more innovative RegTech solutions and hiring talent to prevent data breaches.

Use of Technology in Financial Compliance

Software solutions are the only way to deal with these challenges successfully. Financial institutions need to transform the process of compliance using the latest technologies. Digital transformation must be facilitated to help enhance process efficiencies and guarantee the safety of their client’s data.

RegTech solutions will increase the agility of the system, speed up processes and constantly run analytics programs to analyse big data. Software applications that use machine learning have already been implemented in financial compliance and proved efficient in process automation.

Practices that Help Prevent Data Breaches

All financial institutions must provide compliance with data protection regulations, such as the GDPR, and adopt practices to ensure the safekeeping of company and client records. Some of these include:

- PCI DSS requirements – The 12 requirements include building a secure network and system, implementing access control measures and regular monitoring and testing networks.

- Tokenisation and encryption – Similar methods to secure information when being transmitted on the net or stored.

- Data redundancy – Keep separate records of all data in case something happens to one database.

- Never take unnecessary risks – Don’t transfer data or change storage unless absolutely necessary.

FinregE: Simplify Regulatory Compliance

Compliance challenges are a regular occurrence in the financial world. At FinregE, we have cutting-edge technology to simplify and accelerate regulation compliance processes.

Contact us to book a demo and see how we can help ensure compliance in the finance industry.