Building a common shared regulatory data ontology and machine-readable regulation in financial services.

On the 03rd April, the Basel Committee on Banking Supervision (BCBS) published their announcement on the “Deferral of the final implementation phases of the margin reform rules for centrally cleared derivatives”. Table 1 summarises how this regulatory response was published by some of the national regulators in Europe, Asia and America. Data extracted from Finreg-E Horizon Scanner.

|

Jurisdiction |

Regulator |

Published Date |

Last modified |

Title |

Type |

Document Reference |

Topic |

|

Global |

BIS[1] |

03-Apr-20 |

|

Basel Committee and IOSCO announce deferral of final implementation phases of the margin requirements for non-centrally cleared derivatives |

|

|

|

|

UK |

FCA[2] |

08-Apr-20 |

08-Apr-20 |

BCBS and IOSCO announce a one-year deferral of the remaining global initial margin requirements in response to coronavirus challenges |

Statements |

|

|

|

EU |

ESMA[3] |

04-May-20 |

|

ESAs 2020 09: EMIR RTS on various amendments to the bilateral margin requirements in view of the international framework |

COVID-19, Joint Committee, Post Trading; Report |

ESMA71-99-1324 |

Post Trading |

|

EU |

EIOPA[4] |

04-May-20 |

|

Joint RTS on amendments to the bilateral margin requirements under EMIR in response to the COVID-19 outbreak |

News |

|

COVID-19 |

|

EU |

EBA[5] |

04-May-20 |

|

Joint RTS on amendments to the bilateral margin requirements under EMIR in response to the COVID-19 outbreak |

Press Releases |

|

|

|

Singapore |

MAS[6] |

07-Apr-20 |

|

MAS Takes Regulatory and Supervisory Measures to Help FIs Focus on Supporting Customers |

Media Releases |

|

|

|

US |

CFTC[7] |

18-May-20 |

|

Statement of CFTC Chairman Heath P. Tarbert in Support of Extending Relief for Initial Margin Requirements for Uncleared Swaps |

Speeches & Testimony |

|

|

[1] Bank of International Settlements, which includes the Basel Committee on Banking Supervision (BCBS), Committee on the Global Financial System (CGFS), Committee on Payments and Market Infrastructures (CPMI) and Markets Committee

[2] Financial Conduct Authority

[3] European Securities and Markets Authority

[4] European Insurance and Occupational Pensions Authority

[5] European Banking Authority

[6] Monetary Authority of Singapore

[7] Commodity Futures Trading Commission

Each regulator published the information on their individual webpage, with their own title and type attached to their publication. While perhaps a minor point for a compliance expert, it is still worth highlighting that there was also the difference in the way the common topic of margin reform on centrally cleared derivatives was noted in the titles, which includes “bilateral margin reforms”, “margin requirements”, “non-centrally cleared” and “uncleared”.

Impact of this Update on Financial Institutions: For a financial institution operating in multiple jurisdictions, this lack of standardisation across regulators causes delays, duplication, and increases implementation costs.

They are often left to rummage around across various email alert subscriptions, website pages and RSS alerts to understand which of their regulators have published what and when. The problem on delays, duplication, and implementation costs is not only unique to financial institutions, but all the regulators/publishers developing and enforcing the regulatory change or publication. This is perhaps evident in the timing differences observed across the regulators above in publishing their adoption of delay to margin rules.

The development and implementation of a common regulatory publications structure across global regulators can bring huge benefits and reductions in time, costs, interpretation and errors in the implementation of regulatory change. We believe it is one of the first, and probably, the easiest step that global financial services standard-setting bodies can take in using technology to standardise financial services regulatory data, build a common shared regulatory data ontology in financial regulation and build machine-readable and machine-executable rules.

Regulatory authorities around the world have understood that modern companies are subject to more stringent and complex regulatory requirements.

They are also in acceptance of the fact that in order to prevent economic collapse, they must help organisations reduce the growing costs of compliance, which is especially important given that a volatile macroeconomic environment impacts the profitability of economic players.

This realisation has pushed regulatory bodies around the world to ease regulations to promote operational resilience and business continuity.

There key problems in processing non-standardised regulatory publications data are:

1. Operational inefficiency: In a time where operational efficiency and responsiveness are key, the lack of standardisation in the format and time of publications presents a barrier in achieving efficiency and speed.

2. High Costs: The lack of standardisation also increases costs for processing simple, repetitive information. Our studies show, to process the above information, it would cost as average financial institution £4,000 to £13,000, purely for relevant subject matters to identify and read the information. If the information was standardised this cost would be reduced by at last half.

3. Slow Response: The lack of standardisation probably presents a problem for regulators themselves in terms of operational efficiency and responsiveness in adapting global regulatory change. This could be seen to be evident in varying timestamps across which the same information was published across jurisdictions,

4. Slower Traceability: All the regulatory websites operate in a completely different structure, so to go back and look for this publication is extremely difficult and time consuming due the structure, shape and searchability of historic content across the websites.

The solution – A Standardised Regulatory Publications Schema And Taxonomy

Some regulatory authorities (e.g Bank of England, FCA) have set themselves an agenda to build machine-readable and machine-executable regulation over the next decade. The first sensible step to this will be to build a common, shared regulatory data ontology to provide a shared common understanding of the structure of regulatory data.

Regulatory change publications present itself with a great, living, right-here-right-now starting point for regulators to start building a shared regulatory data ontology towards building machine-readable rules. This is how it can be achieved –

1. Standardised publications schema for regulatory publications: To start with, regulators and standard-setting bodies should conform to a common table format in which to publish their regulatory publications on their websites. This format should also be simple and contain the key data points or information required to digest a regulatory publication. As a starting point, this format can be restricted to the following schema:

a. Publish Date

b. Title

c. Type

d. Topic

e. Description

2. Normalisation of “Types” of regulatory publications: In the majority of cases, regulatory rules can broadly be categorised into the following normalised types:

a. Consultation

b. Final Rule

c. Q&As

d. Speeches

e. Enforcement/fines

While it may be a requirement for regulatory authorities to have their own types based on national regulatory standards-setting processes (e.g. the Bank of England PRA has Supervisory Statements “SS” as binding rules, the FCA has “Call for Inputs” or “Feedback Statements”, European legislation has Regulatory Technical Standards and Implementing Technical Standards), regulators should use a normalised/parent publication type which highlights what stage a regulatory publication is at in its rulemaking to allow users to quickly understand what stage of a rulemaking a particular publication is at. This significantly reduces the burden on firms processing this information, such as in terms of priority and operationalisation, and in practice also marry up how many financial institutions currently record and report regulatory change internally.

3. Assigning shared regulatory topics to global publications: One of the most common techniques in machine learning is topic analysis, which organises and understands large collections of text by assigning tags or categories according to each individual text’s topic or theme. One of the biggest but the most useful steps that regulators can take is building a common, shared regulatory rule topic taxonomy that can be used to uniformly tag publications to common regulatory rule topics. The advantages of this are plenty fold-

a. It increases the speed and efficiency and reduces costs in firms understanding what a regulatory publication relates to and who is accountable.

b. It automatically allows for regulators to start building a shared regulatory data ontology

c. It allows both firms and regulators to organise their regulatory publications in a consistent and meaningful manner throughout their life cycle.

A call for input to regulators – Working with Finreg-E Machine Learning Regulatory Change Analytics

Finreg-E provides real-time regulatory horizon scanning and changes management across global financial services regulations. We have been examining the web content, publication schema and mechanisms of multiple regulatory authority and standard-setting bodies for years. Through this, we have built a deep understanding of how a regulatory publication should be made in order for it to be consumed readily by users. We have built a standardised schema for regulatory publications that work across multiple regulatory sources. We have collected data on publication types across multiple standard-setting bodies, examined this data to come up with a normalised publication type that can work across multiple regulators. And using techniques such as topic modelling, natural language processing and machine learning, we have analysed regulatory publications and rulebooks across global financial services regulators and legal text to come up with a finite common regulatory rule topic taxonomy that works with a 100% accuracy in classifying and identifying regulatory rules and publications.

We call on global regulators and standard-setting bodies to engage with Finreg-E to understand how their current publication structure:

1. Can be standardised against their peers.

2. Can be streamlined to provide easier access and understandability of their regulatory rules and content.

3. Can be tagged to a common regulatory topic taxonomy that applies to their national implementation of global regulation.

Reach us on info@finreg-e.com to take the first step in tacking the pain points in publishing and managing your regulatory publications.

Background

The implementation of regulatory change in financial services typically involves:

1. Global standard-setting bodies developing and promoting regulation and policy at an international level.

2. National financial services authorities adopting, implementing and supervising global regulation within their jurisdiction.

3. Financial services firms tracking regulation at a global and national level to implement and comply with the rules as per a combination of global and national requirements.

This process results in:

1. A large number of financial services regulators and standard-setting bodies publishing the same regulatory information on rules in their individual websites but presented in a different format.

2. Financial services firms monitoring a variety of regulatory publication websites to keep track of and understand the information being published by their applicable regulatory sources.

Currently, most financial services regulators publish their regulatory changes or publications in their own taxonomy and website structure. This results in the same regulatory change or publication being published by

multiple regulators around the world, often at the same time, but classified, categorised and published in a different format.

The current structure of regulatory publications in financial services – The problem

Let’s look at how six financial services regulators publish their regulatory information/publications on their websites. Table 1 provides details on:

1. Update Source: The number of weblinks on each regulator’s website across which they publish their regulatory news.

2. Publication Schema: The table schema in which they organise their publications.

3. Type of Publication: The number of different “types” by which they classify their publications e.g. news, events, speeches, consultations etc.

4. Topic of Publication: The number of different “topics” under which they organise their publications e.g. credit risk, money laundering, governance, other, retail, MiFID Investor protection, etc.

|

Jurisdiction |

Regulator |

Count of weblinks for regulatory publications |

Schema of regulatory publications |

Count of publication “type” classification |

|

UK |

FCA |

3 |

Title, Published Date, Last Modified Date, Type |

47 |

|

EU |

ESMA |

8 |

Title, Published Date, Document Reference, Type, |

441 |

|

UK |

BoE |

1 |

Title, Published Date, Type, Topic |

8 |

|

EU |

EIOPA |

5 |

Title, Published Date, Type, Topic |

220 |

|

EU |

EBA |

5 |

Title, Published Date, Type |

13 |

|

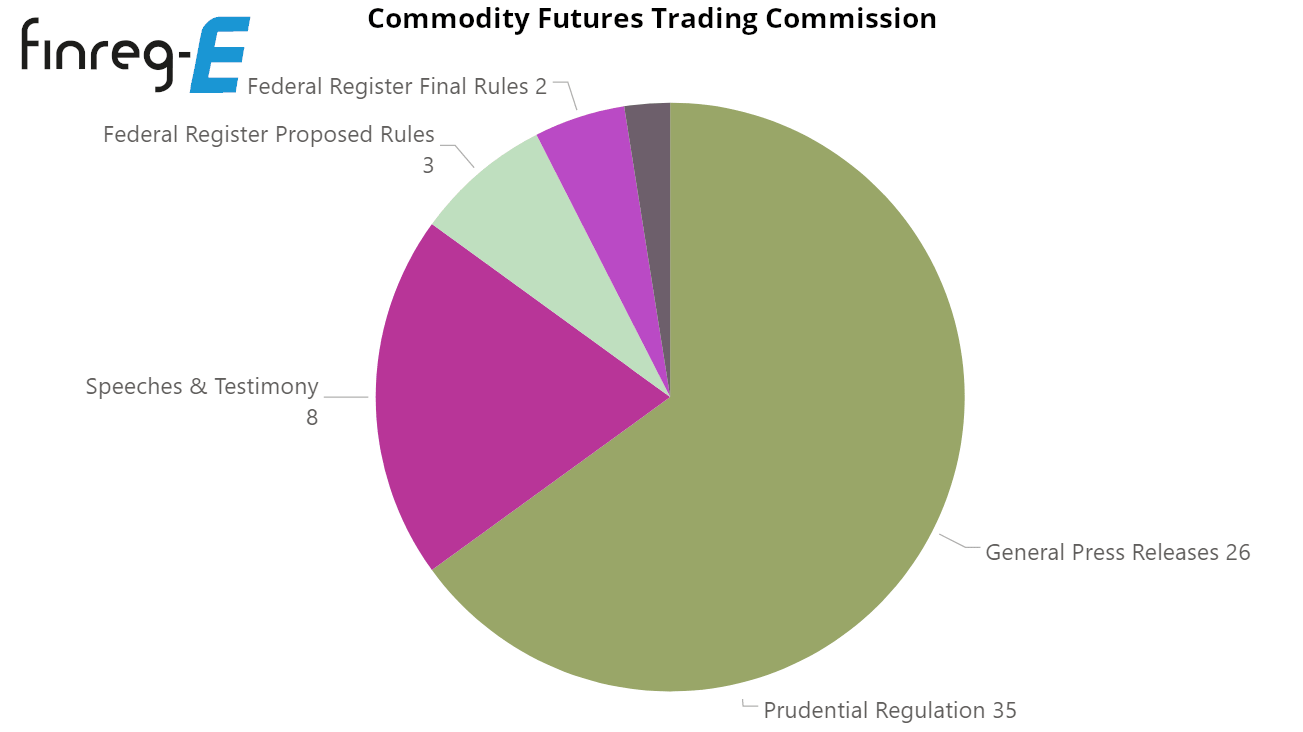

US |

CFTC |

9 |

Title, Published Date, Type |

6 |

|

Singapore |

MAS |

3 |

Title, Published Date, Sector, Focus Area, Type |

285 |

|

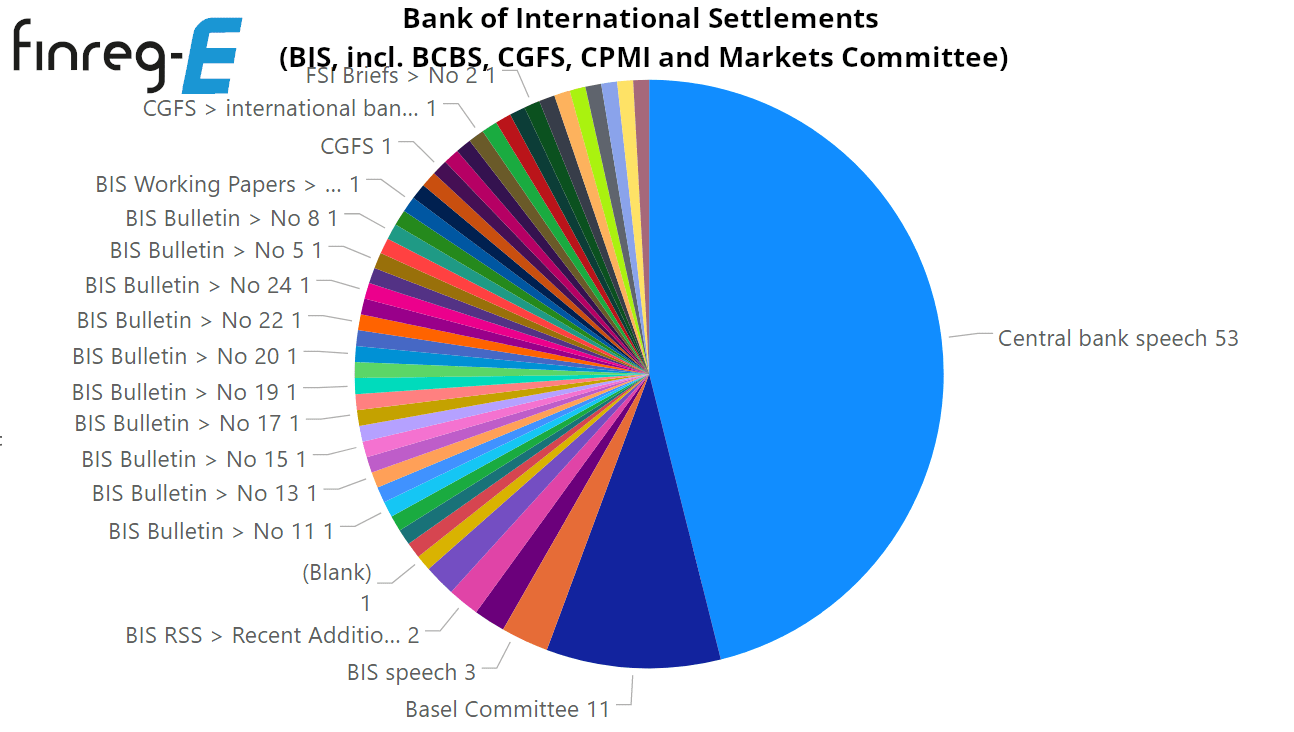

Global |

BIS |

11 |

Title, Published Date, Type, Status, Topic |

104 |

Over the last five years, regulatory authorities and officials around the world have acknowledged that firms must deal with greater regulatory requirements and meet higher regulatory standards. They also acknowledge that to avoid economic and social collapse, they have a key role to play in helping firms reduce rapidly growing compliance costs while an uncertain macroeconomic and financial environment puts pressure on the sector and economic profitability. This is evident in the recent regulatory responses having involved easing regulatory/policy requirements in certain prudential and markets regulation, to focusing supervisory and firms’ efforts on operational resilience and business continuity.

To put the problem in context, we can look at how these regulators responded to publishing their regulatory information to firms on Covid-19.

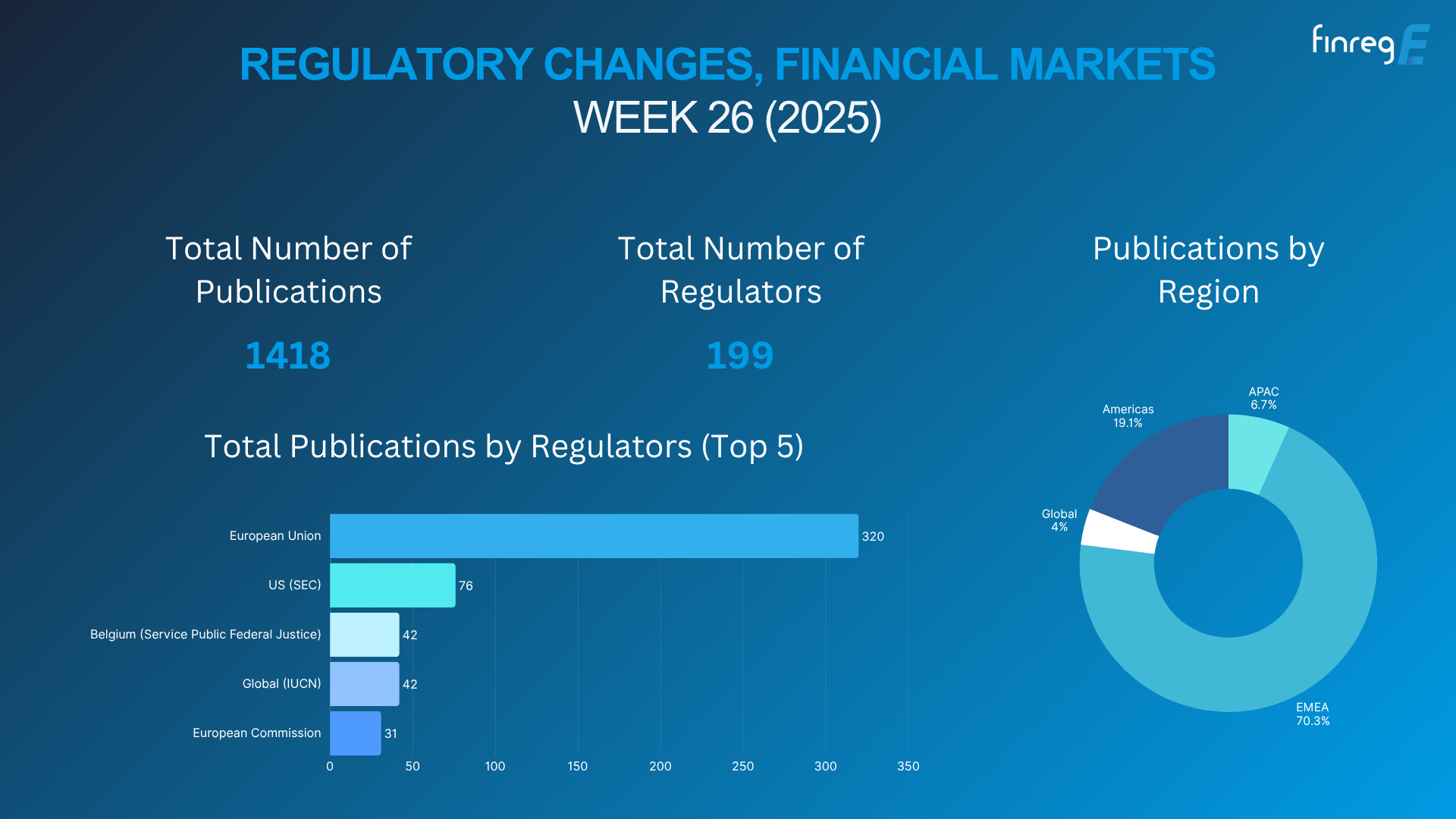

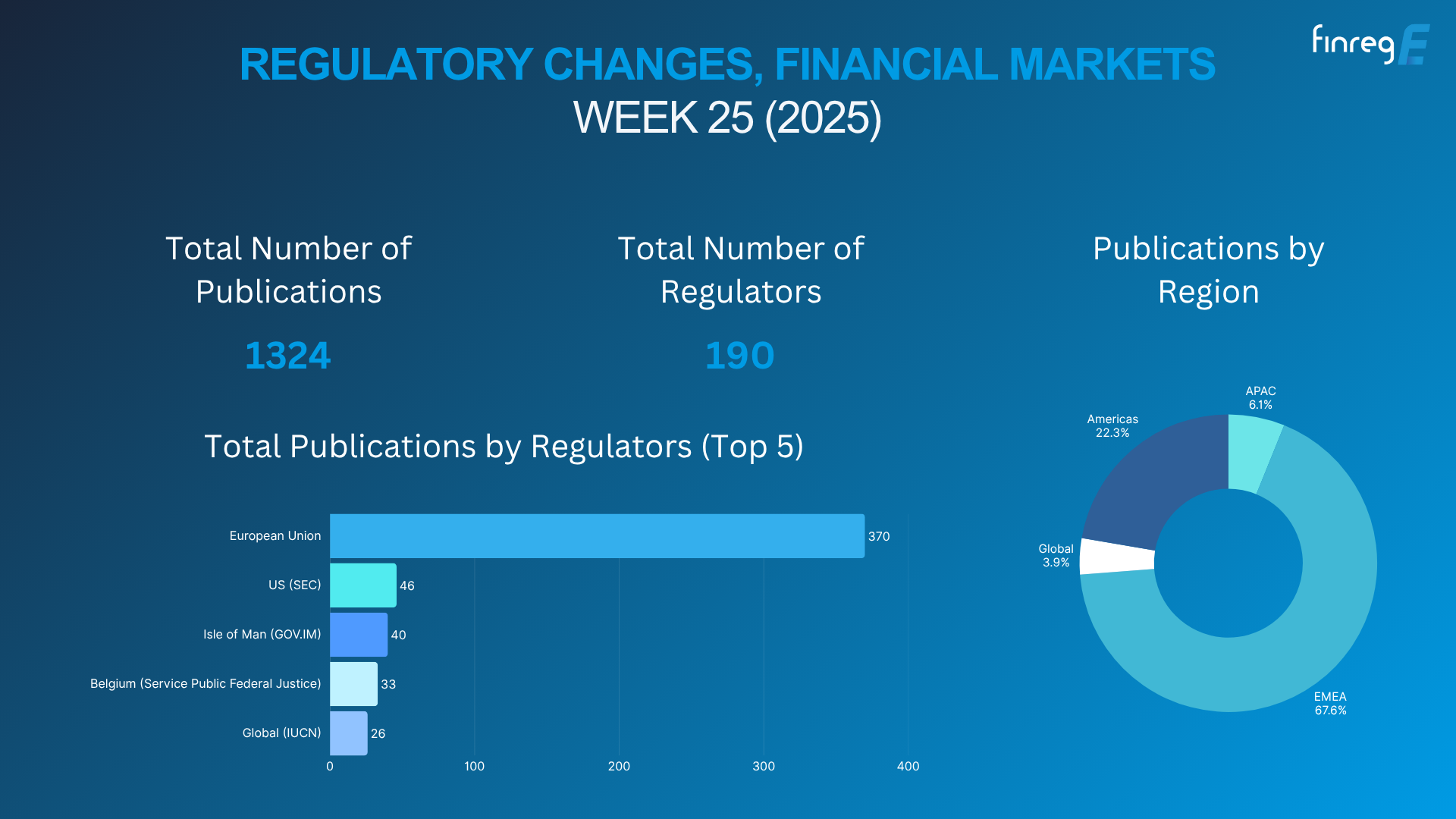

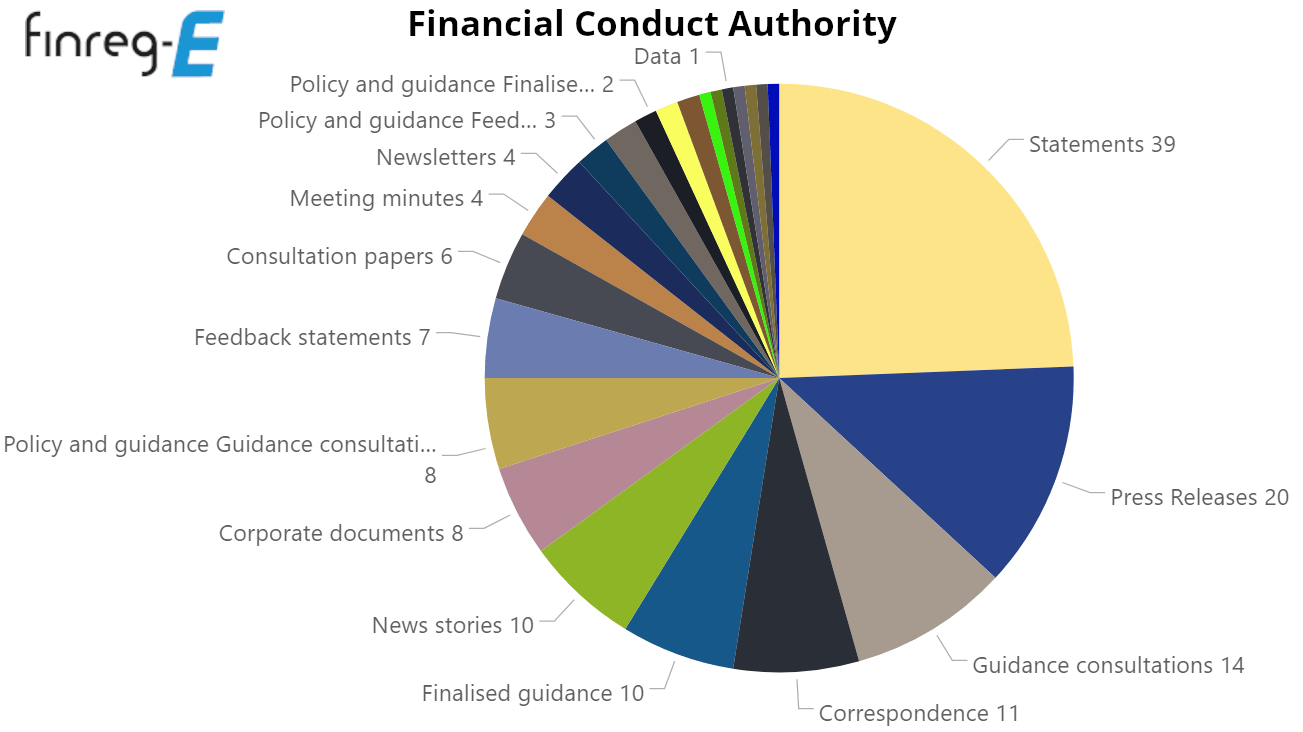

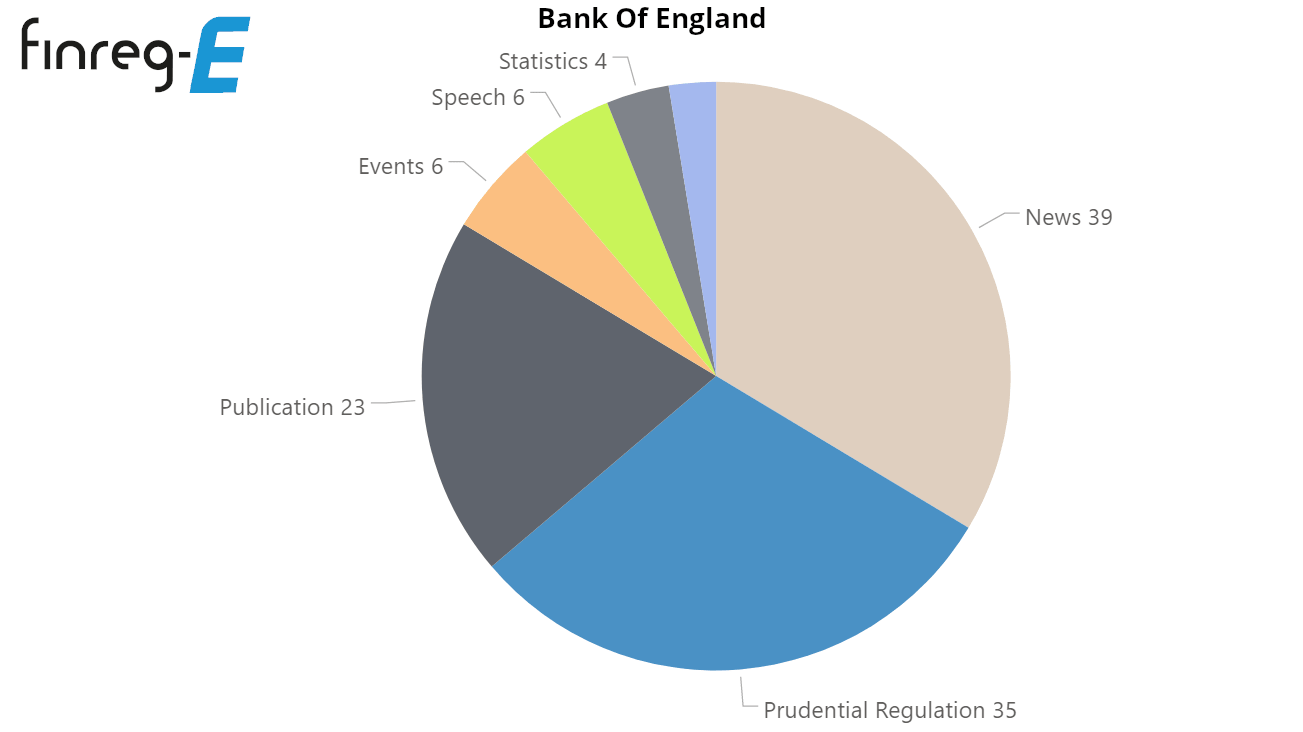

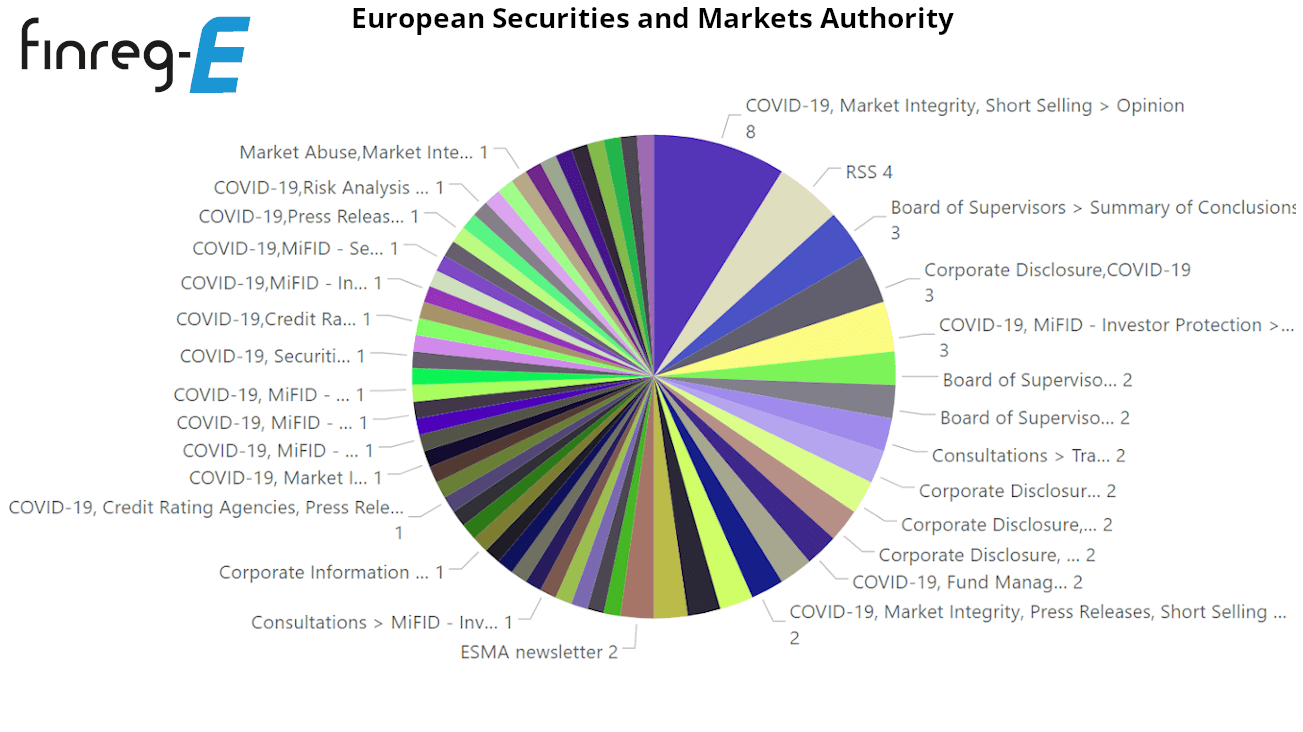

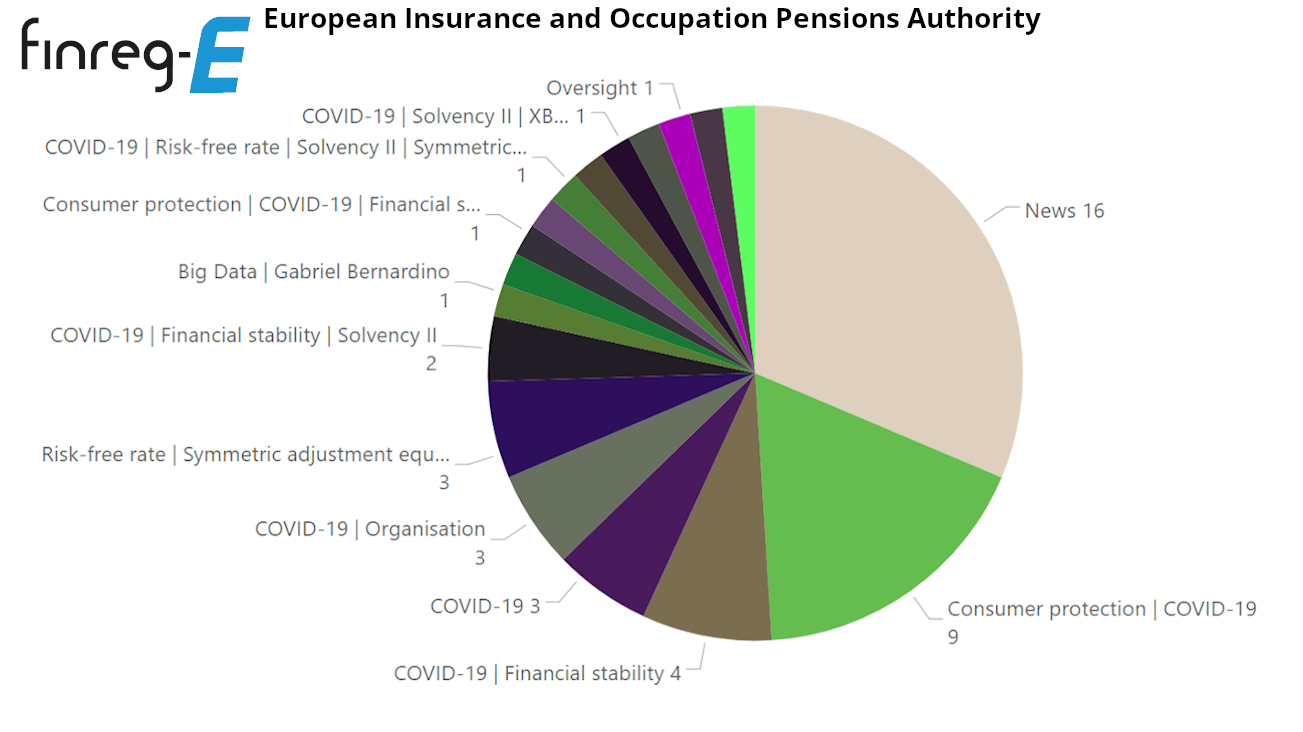

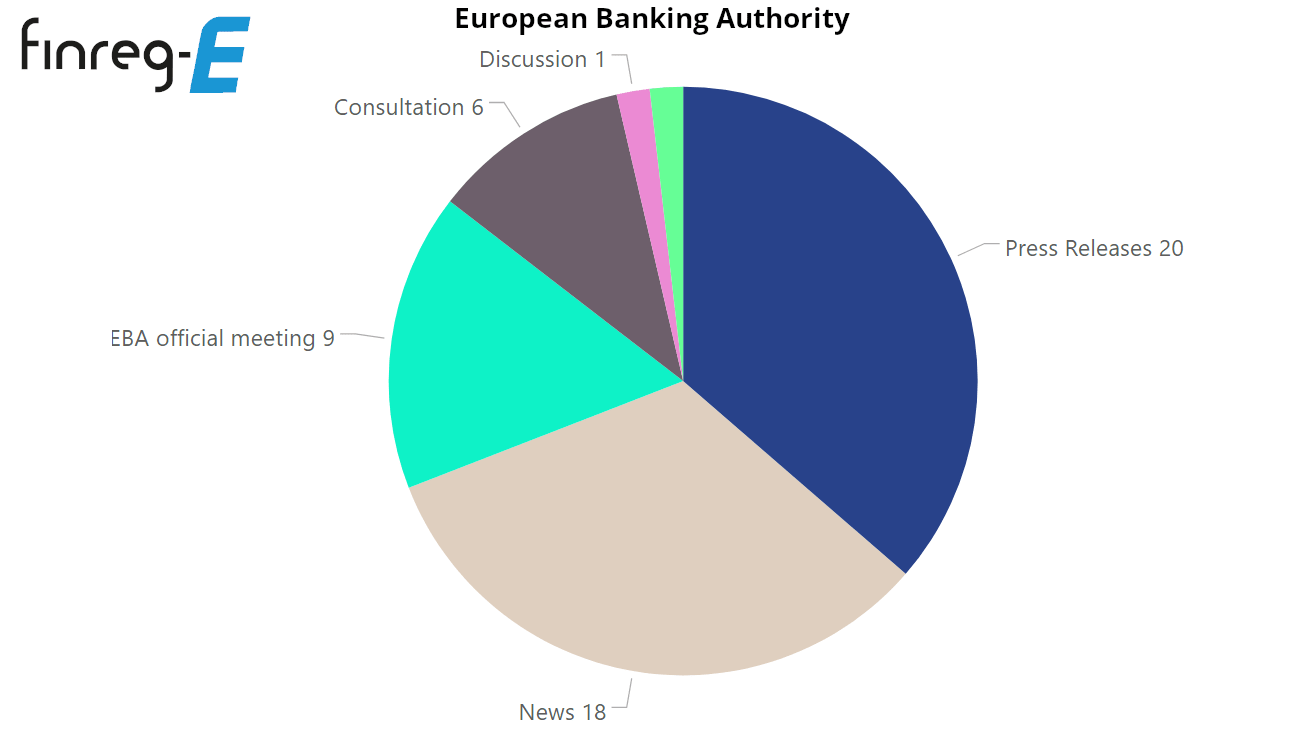

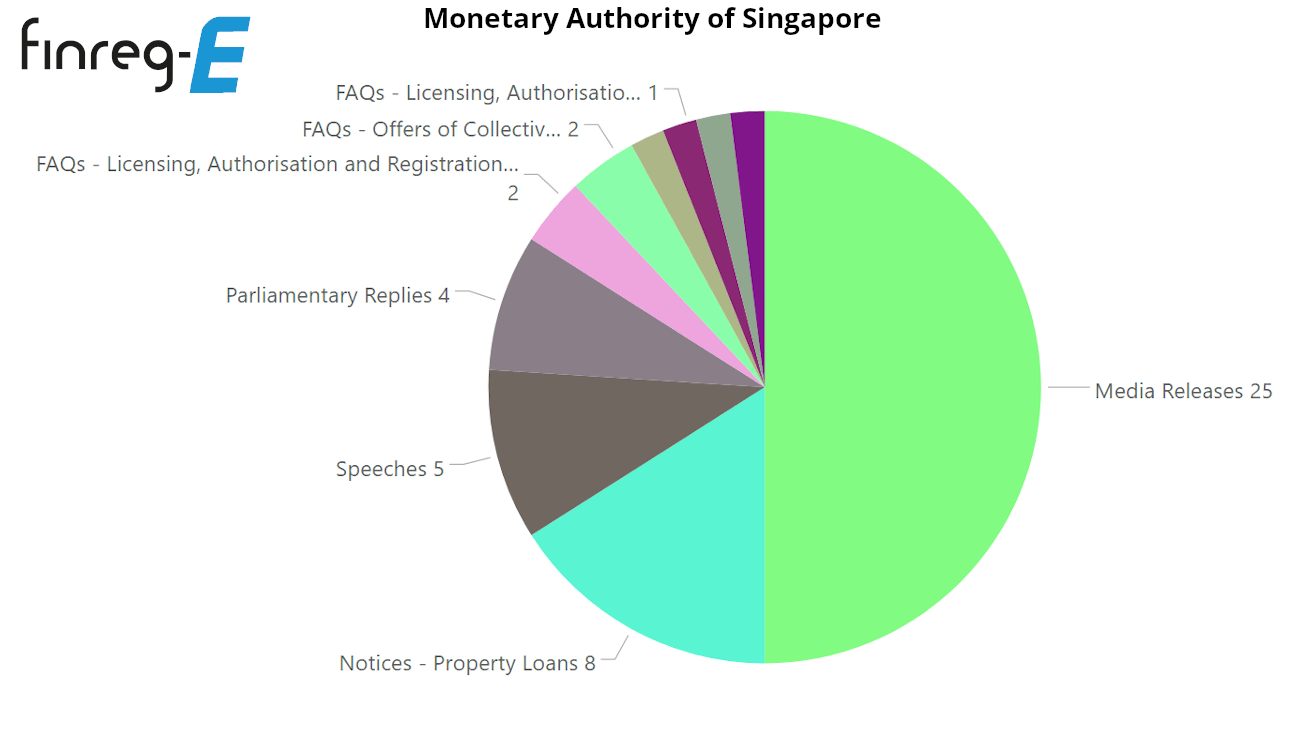

Regulatory publications on Covid-19 by publication “Type” between the period of 01 March 2020 – 26 June 2020

Bank of International Settlements, which includes the Basel Committee on Banking Supervision (BCBS), Committee on the Global Financial System (CGFS), Committee on Payments and Market Infrastructures (CPMI) and Markets Committee

Financial Conduct Authority

Bank Of England

European Securities and Markets Authority

European Insurance and Occupational Pensions Authority

European Banking Authority

Monetary Authority of Singapore

Commodity Futures Trading Commission