UK businesses are subject to various legal and regulatory financial management and reporting requirements. Failure to comply can result in penalties, fines and legal consequences, as evidenced by the record £46.5 million in fines levied against UK accountancy firms in 2023.

In this context, implementing effective financial governance practices is imperative for businesses to maintain financial integrity, ensure transparency in business practices and avoid legal and financial repercussions.

Read more to discover the purpose of compliance and governance in finance and discuss how businesses can achieve compliance and maintain good financial governance amidst complex financial regulations.

But first, what is financial compliance?

Financial compliance refers to businesses’ adherence to laws, regulations, standards and internal financial management and reporting policies. It involves ensuring that financial activities are conducted legally, ethically and transparently and that financial reports are complete and accurate.

But financial compliance is not solely about adhering to legal and regulatory requirements. It also involves implementing robust policies and practices that promote good financial governance. Businesses that practise sound financial governance will find it easier to maintain compliance.

Understanding Financial Governance

Financial governance encompasses the framework, processes and practises businesses use to manage their financial operations effectively. It involves establishing clear lines of responsibility, implementing internal controls and ensuring that financial decisions align with the organisation’s objectives and stakeholders’ interests.

Furthermore, having the right financial governance system allows for easy identification of issues and risks, enabling prompt action to mitigate them. It also ensures that processes are transparent, errors are quickly identified and rectified, and internal controls are effective.

So, how does it relate to financial compliance?

Effective financial governance practices can facilitate compliance by establishing robust internal controls, promoting transparency and mitigating the risk of fraud and financial misconduct. Conversely, non-compliance with financial regulations can jeopardise a company’s financial governance, leading to reputational damage, legal liabilities and financial penalties.

In other words, financial governance provides the overarching structure and principles for businesses to manage their financial activities effectively, while financial compliance ensures that businesses adhere to the legal and regulatory requirements within that framework.

By implementing sound financial governance practices, businesses can create a solid foundation for achieving compliance and maintaining financial integrity, transparency and accountability.

How Businesses Can Achieve Financial Compliance and Governance

Achieving financial compliance and governance requires a proactive and comprehensive approach. Here are some key steps businesses can take:

-

Establish Clear Policies and Procedures

Businesses should develop and implement clear policies and procedures that outline the financial management and reporting requirements in line with applicable laws, regulations and industry standards. These policies should be communicated effectively to employees, and regular training should be provided to ensure understanding and compliance.

-

Implement Robust Internal Controls

Internal controls are the foundation of effective financial governance and compliance. Businesses should establish effective internal control mechanisms to safeguard assets, prevent and detect fraud, ensure financial records’ accuracy and completeness and maintain appropriate segregation of duties. Regular monitoring and review of internal controls should be conducted to identify and address any weaknesses or gaps.

-

Foster a Culture of Compliance

A strong culture of compliance is critical to ensuring financial integrity and governance. Businesses should promote a culture that emphasises ethical conduct, accountability and transparency in all financial activities, including a zero-tolerance policy towards fraud, corruption and unethical behaviours.

Set the tone from the top by providing training and resources and rewarding and recognising employees who demonstrate good compliance practices.

-

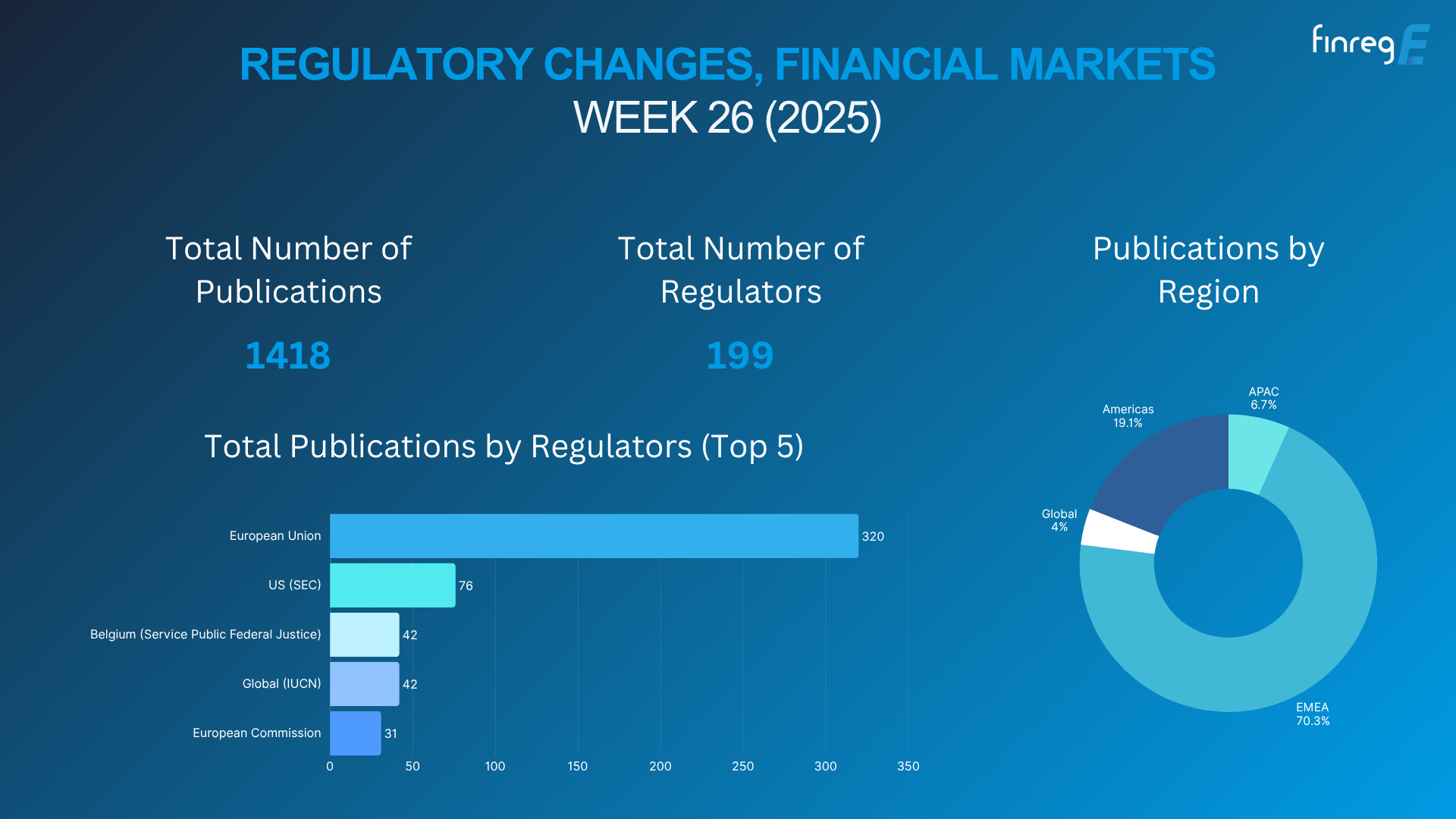

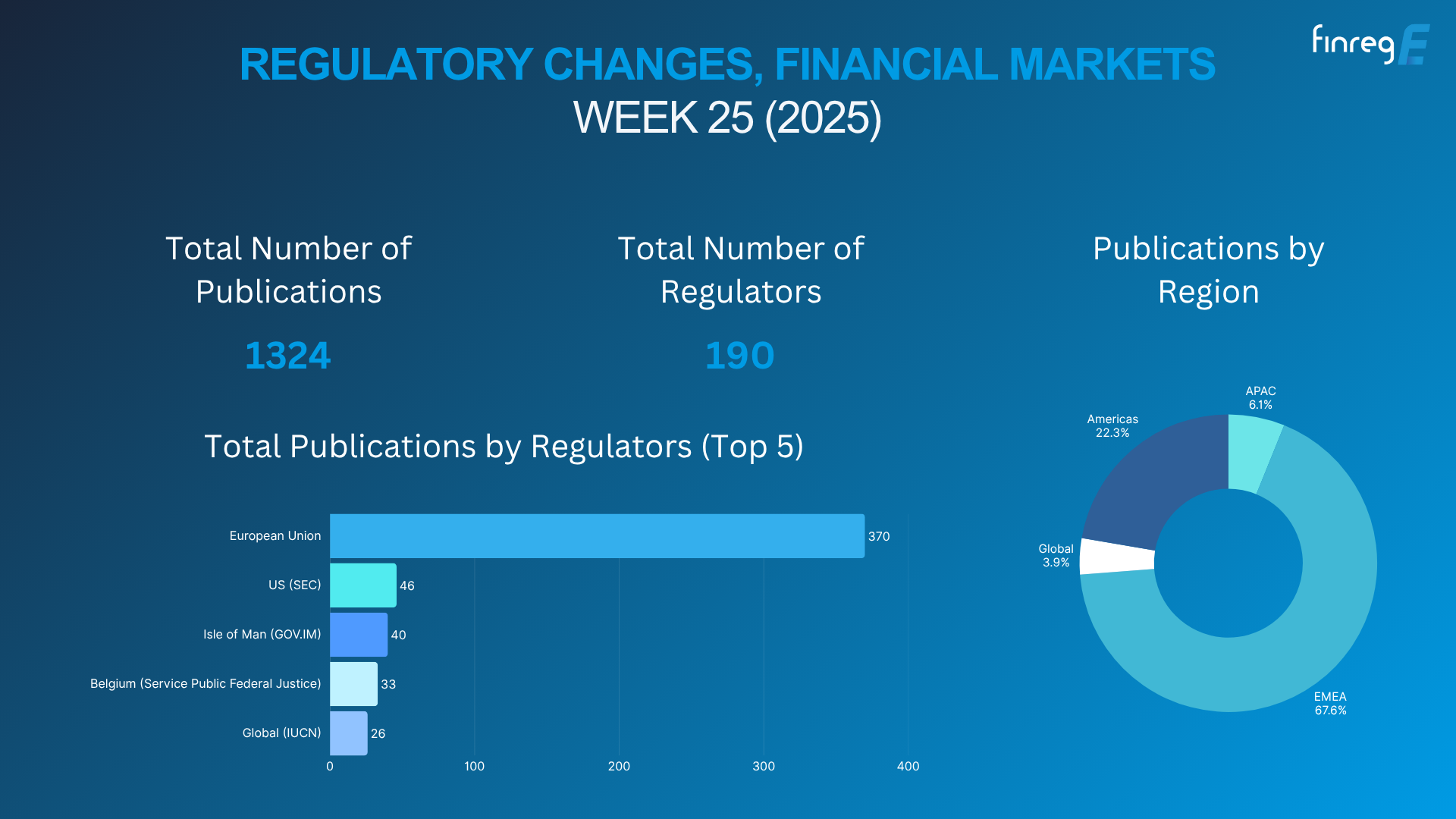

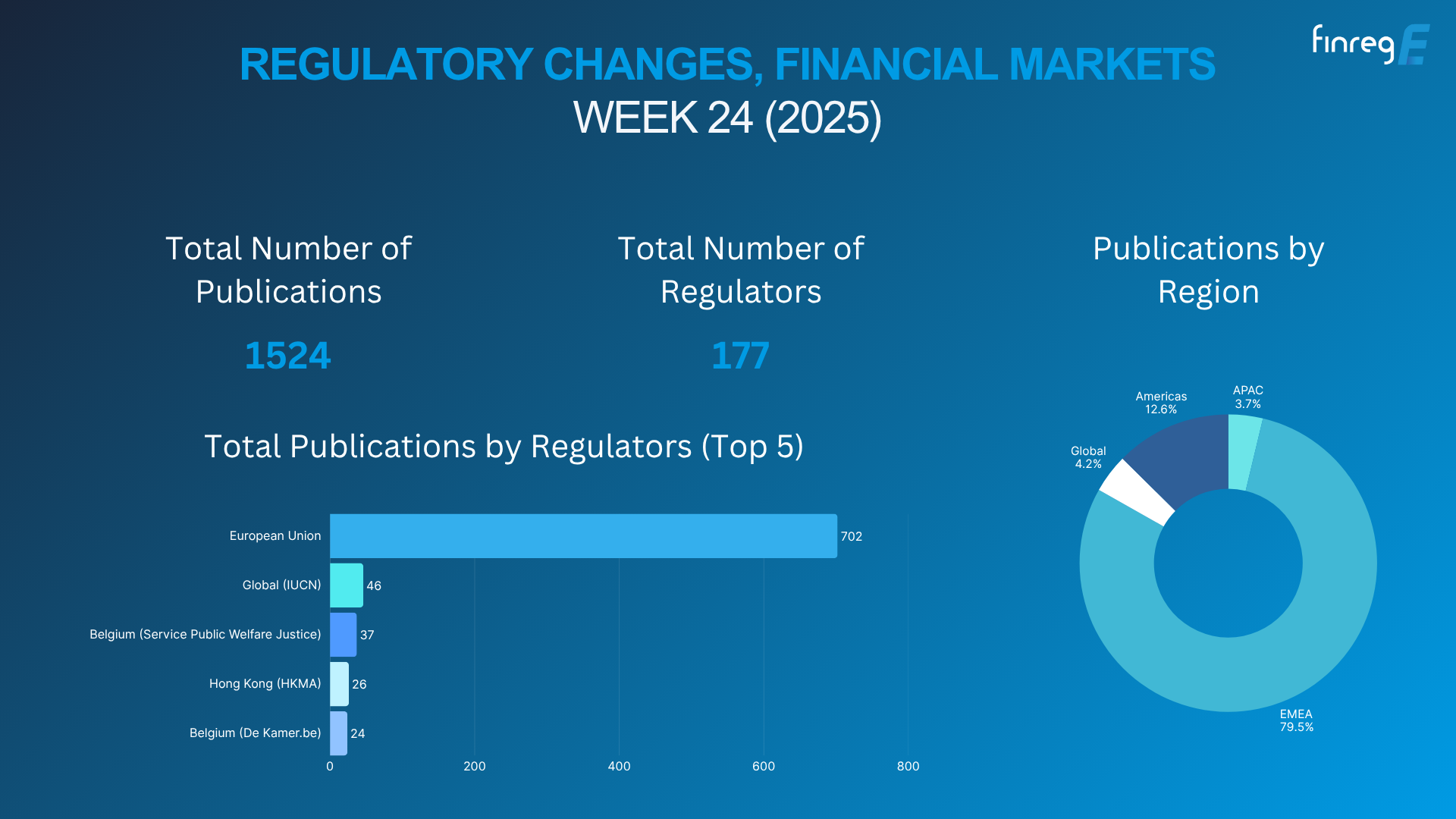

Stay Updated with Regulations and Standards

Financial regulations and standards are subject to change, and businesses must stay updated with the latest developments. This includes monitoring changes in laws, regulations and industry standards and implementing necessary changes to policies and procedures accordingly.

-

Engage Professional Expertise

Given the complexity of financial regulations and governance, businesses may need professional expertise to ensure compliance. This may include hiring qualified financial professionals or engaging external consultants with financial compliance and governance expertise.

Streamline Compliance with Automation, Speed and Efficiency

FinregE specialises in standard and bespoke regulatory compliance modules that automate, accelerate, and streamline compliance processes. Our solutions offer expertise in regulatory requirements, industry best practices and cutting-edge technologies, enabling businesses to implement robust policies and controls for improved risk management, transparency and ethical conduct.

Partner with FinregE to streamline your compliance processes – book a call now.