Imagine a financial world where compliance with complex regulations is streamlined, efficient and automated. Where financial institutions effectively manage risks, detect and prevent financial crimes and report accurate data to regulatory authorities, all while reducing costs and increasing operational effectiveness. This is the reality of Regtech and Suptech, the cutting-edge technologies transforming the compliance landscape in the UK.

As financial regulations become increasingly stringent and constantly evolving, Regtech and Suptech are emerging as game-changers in the financial industry. In this blog, we will explore the concepts of Regtech and Suptech, their significance in the UK financial ecosystem and how they are reshaping the future of financial regulation.

What is Suptech and Regtech?

Regtech, short for regulatory technology, refers to using advanced technologies such as artificial intelligence (AI), machine learning (ML), big data analytics and blockchain to facilitate compliance with financial regulations.

Regtech solutions automate manual and time-consuming compliance processes, enable real-time monitoring and reporting and provide data-driven insights for better decision-making. It is gaining traction in the UK as financial institutions seek innovative solutions to cope with the ever-increasing regulatory landscape.

On the other hand, Suptech, short for supervisory technology, involves using technology by regulatory authorities to monitor, supervise and enforce compliance with financial regulations. Suptech tools enable regulators to collect, analyse and interpret large volumes of data from financial institutions, identify risks and detect potential violations.

Suptech is becoming a critical component of regulatory oversight in the UK, allowing regulators to enhance their effectiveness and efficiency in ensuring compliance.

When to Use Regtech and Suptech

Both Regtech and Suptech are essential in the financial industry. Financial institutions use Regtech to optimise compliance processes, and Suptech is used by regulatory authorities to monitor and supervise compliance with regulations.

Here’s when to use one or the other:

When to Use Regtech

- To automate and optimise compliance processes in financial institutions

- To manage regulatory requirements and improve risk management

- To streamline compliance workflows and enhance operational efficiency

- To stay compliant with regulations and reduce the risk of regulatory fines and penalties

- Across various sectors of the financial industry, including banking, insurance, asset management and payments

When to Use Suptech

- To monitor, analyse and supervise financial institutions’ compliance with regulations

- To collect and analyse data from financial institutions and identify potential risks

- To ensure compliance with regulatory requirements and conduct risk assessments

- To detect and mitigate potential risks and ensure stability and integrity in the financial system

- As a tool for regulatory authorities to enhance their supervisory capabilities and monitor financial institutions’ compliance

Sample Scenario

Here are sample scenarios illustrating the application of Regtech and Suptech in the financial industry:

Scenario 1: Regtech

A large multinational bank operates in the UK and is subject to numerous regulatory requirements, including anti-money laundering (AML) regulations. The bank’s Risk and Compliance team is responsible for ensuring that the bank’s operations comply with these regulations. However, with the increasing complexity and volume of regulatory requirements, the team needs help to manually monitor and manage compliance processes effectively.

The Solution: The bank implements a Regtech solution that automates AML compliance processes. The Regtech tool uses advanced data analytics, machine learning and automation to monitor real-time transactions, customer data and other relevant information.

Moreover, it identifies suspicious activities, flags potential AML risks and generates automated reports for the Risk and Compliance team to review and take appropriate action. The Regtech solution also helps the bank streamline its compliance workflows, reducing the time and effort required to ensure compliance with AML regulations. This enables the bank to efficiently manage its regulatory obligations and reduce the risk of regulatory fines and penalties.

Scenario 2: Suptech

The Financial Conduct Authority (FCA), the regulatory authority responsible for overseeing financial markets in the United Kingdom, is tasked with monitoring and supervising financial institutions to ensure compliance with regulations. The FCA collects vast data from various financial institutions, including banks, insurance companies and investment firms, to assess their risk profile and compliance with regulatory requirements.

In this scenario, the FCA implements a Suptech solution that automates the data collection, analysis and reporting processes. The Suptech tool uses advanced analytics, artificial intelligence and data visualisation techniques to analyse the data received from financial institutions. It identifies potential risks, detects patterns of non-compliance and generates insights for the FCA to take necessary regulatory actions.

The Suptech solution also helps the FCA conduct risk assessments, monitor compliance trends and enhance its supervisory capabilities. This enables the FCA to effectively monitor and regulate financial institutions, ensuring their compliance with regulations and maintaining stability in the financial system.

Conclusion

Regtech and Suptech solutions are essential in ensuring compliance and risk management in the financial industry. Regtech helps financial institutions streamline their compliance processes, while Suptech enables regulatory authorities to monitor and supervise financial institutions’ compliance with regulations effectively.

Need help managing regulatory compliance in the financial industry?

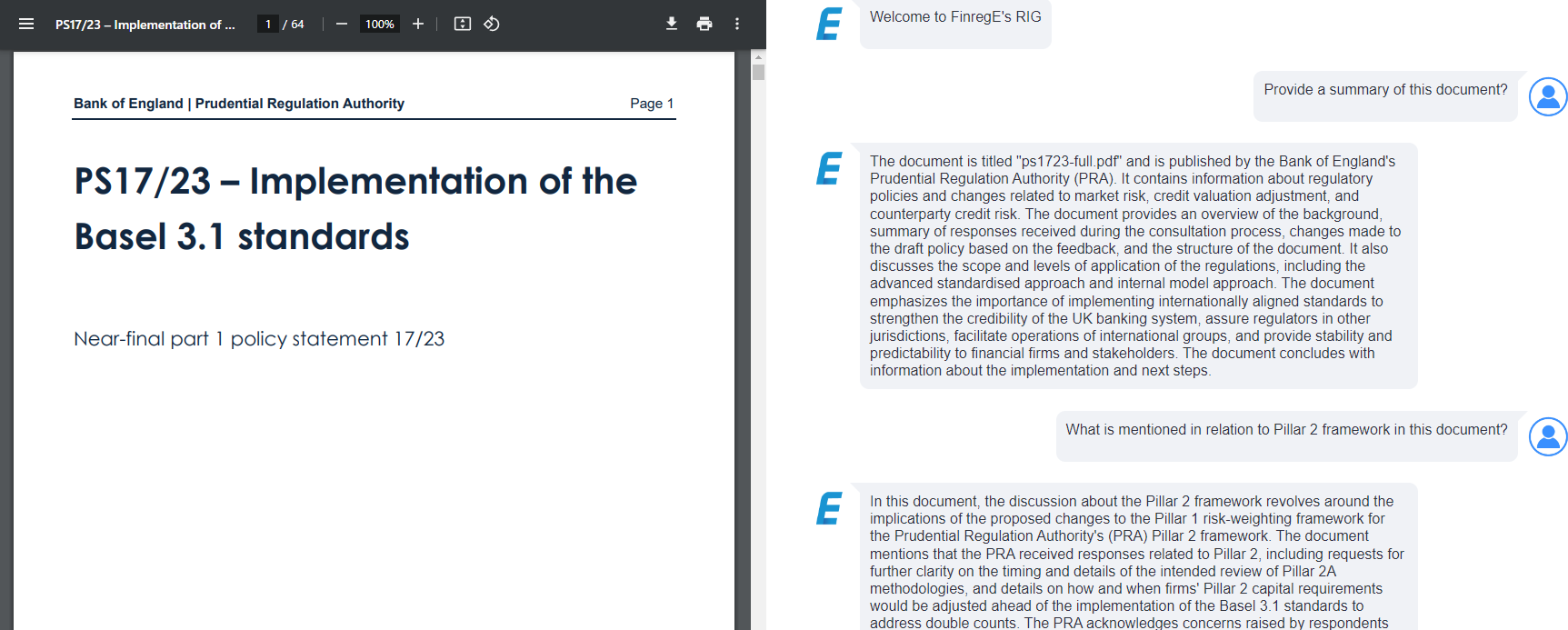

FinregE offers simple, scalable and sustainable automated regulatory compliance solutions. With machine learning, artificial intelligence and the Cloud, FinregE helps you streamline compliance processes and ensure effective compliance management.

Discover how FinregE can be your solution for regulatory compliance – book a demo now!