GRC (Governance, Risk and Compliance) is a framework that helps companies ensure that they operate responsibly and competently while effectively managing risks. UK financial organisations such as banks and fintech collectively spend £34.2 billion annually on financial regulatory compliance.

However, despite the well-intentioned investments of organisations in improving their overall GRC practices, there is still a significant amount of violations and penalties incurred. This is due to the silo effect in day-to-day processes within organisations, which only feeds into inefficiencies and misunderstandings.

Let us discuss GRC and how companies can develop and implement good GRC strategies that foster collaboration.

Governance

Governance refers to the rules, processes and structures that guide and control how a company is managed and operates. It involves defining clear roles, responsibilities and decision-making processes within the organisation.

Steps for Implementing Good Governance

- Establishing a clear organisational structure and defining roles and responsibilities.

- Developing and enforcing policies and procedures that outline expected behaviour and ethical standards.

- Regularly reviewing and assessing the effectiveness of governance practices.

Risks

Risks can arise from various sources such as operational, financial, legal, regulatory or reputational factors. Risk management involves identifying, assessing and addressing potential risks to minimise negative outcomes and maximise opportunities.

Steps for Effective Risk Management

- Conducting risk assessments to identify potential risks and their potential impact on the organisation.

- Developing risk mitigation strategies and implementing controls to minimise the likelihood and impact of risks.

- Regularly monitoring and reviewing risks to ensure that control measures are effective and updated as needed.

Compliance

Compliance is adhering to laws, regulations, standards and internal policies that apply to the company or organisation. Compliance ensures that the company operates within legal and regulatory boundaries, avoids legal liabilities and upholds ethical standards.

Steps for Achieving Compliance

- Identifying and understanding the laws and regulations that the organisation operates under.

- Developing policies and procedures that align with legal and regulatory requirements.

- Monitoring compliance and addressing any violations.

What is a good GRC strategy?

To implement GRC effectively, organisations should consider the following aspects:

- Creating a GRC framework tailored to the company’s unique needs and processes.

- Assigning dedicated resources or an internal or external GRC team responsible for overseeing the implementation and ongoing management of GRC practices.

- Fostering a culture of accountability, transparency and growth within the organisation.

- Regularly assessing the effectiveness of existing GRC practice and making adjustments as needed.

Reasons to Hire a Compliance Team

Noncompliance with laws, regulations and industry standards can lead to severe consequences such as financial penalties, legal liabilities, reputational damage and criminal charges. Companies can significantly reduce the risk of noncompliance by implementing a robust GRC framework and outsourcing a dedicated compliance team.

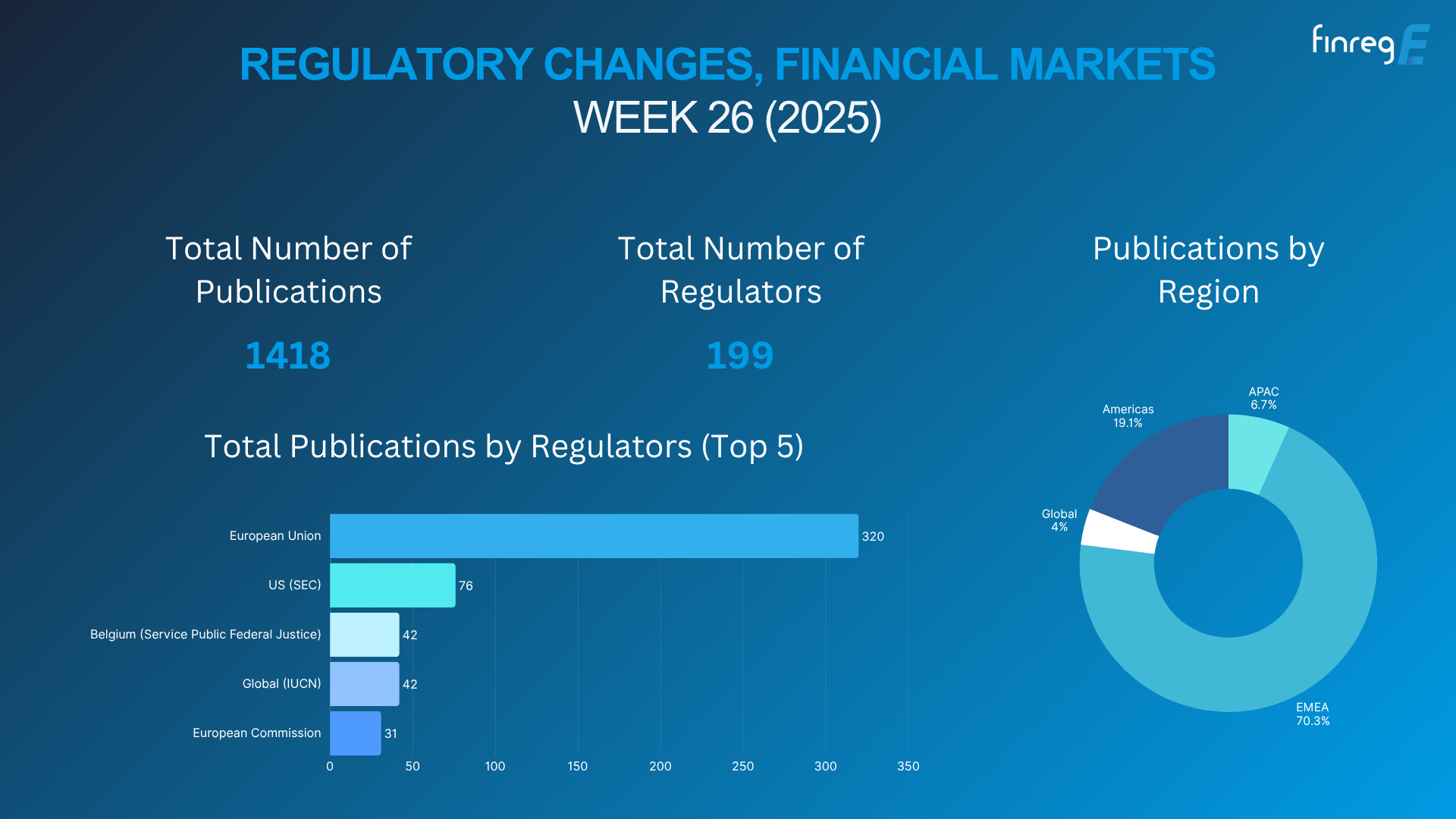

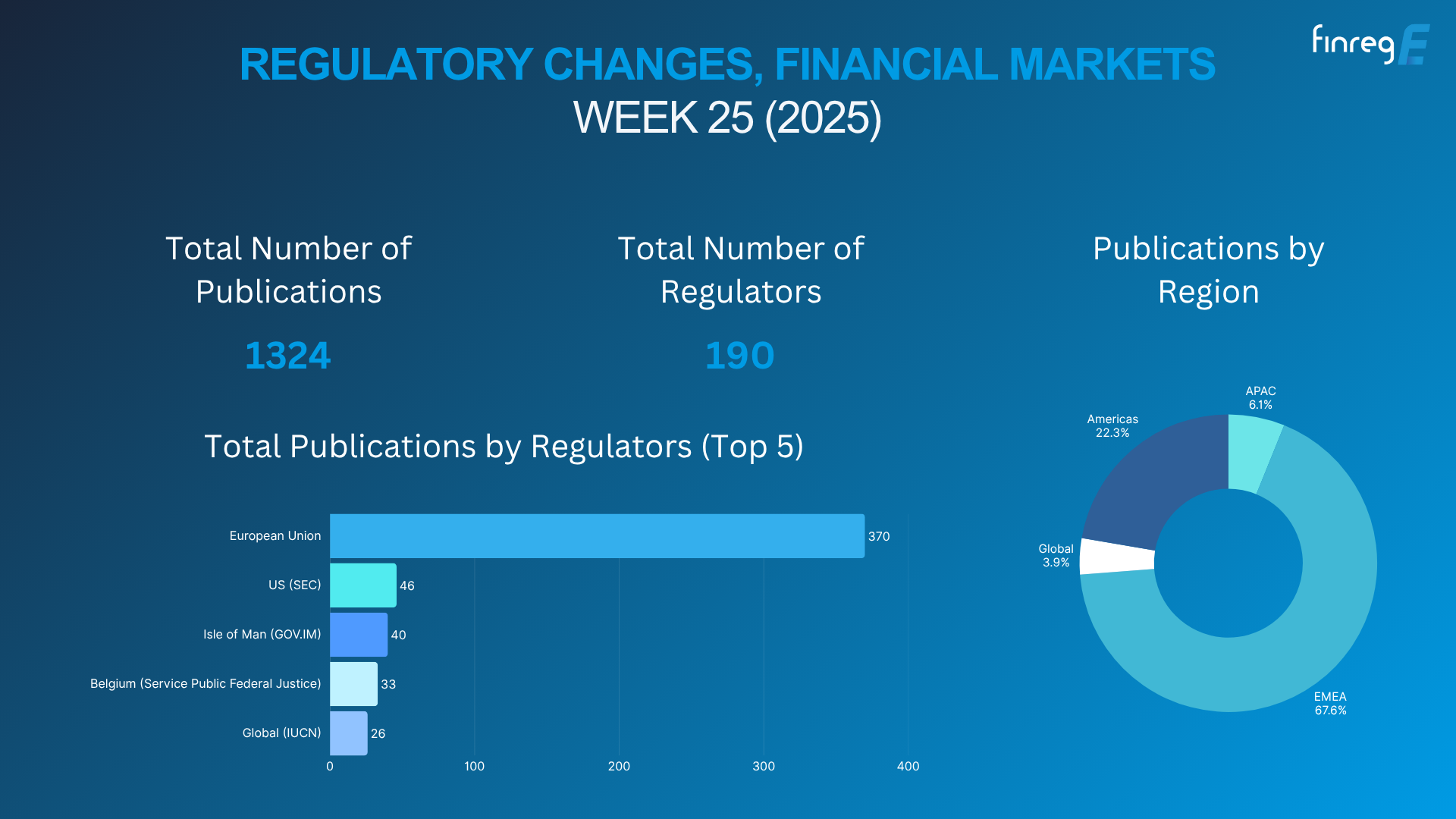

Additionally, financial regulations continually evolve, and keeping up with these changes can be challenging for companies. Outsourcing a compliance team ensures that there are dedicated professionals who stay abreast of regulatory updates, interpret their implications for the business and implement necessary changes in policies and procedures.

A compliance team also has the necessary training and experience to navigate the complexities of financial regulations, reducing the risk of errors or oversights. Finally, having experts allows companies to focus on their core business activities and allocate resources to areas where they can thrive and achieve their goals.

Let’s Make GRC and Financial Regulation Easy

The right tools and people can help you maintain your GRC practices. FinregE offers simple, scalable and sustainable compliance solutions powered by technology. We work closely with clients to create and implement a comprehensive GRC plan.

Book a demo or schedule a consultation with our team of experts today!