In this blog series we explore how automating regulatory compliance can reap significant efficiencies in reducing workload and operating costs.

With a new regulatory development published every 7 minutes across global regulators, it is imperative for institutions to ensure this is captured, processed and understood to stay on top of your regulatory obligations.

The Finreg-E Solution:

Finreg-E offers a regulatory compliance and change management solution built on extensive domain expertise and delivered via artificial intelligence.

We use machine learning and NLP to automate the identification, interpretation, impact analysis and compliance with financial regulatory rules.

We deliver automated regulatory compliance in 60 seconds to make financial regulation EASY!

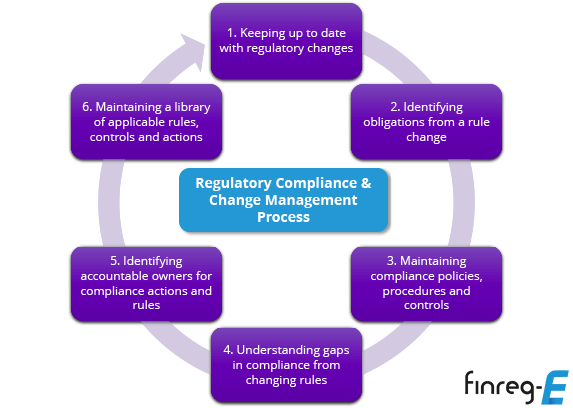

Versus the key compliance processes discussed above, we deliver automated solutions that include:

- Real time rule monitoring with regulatory changes delivered in real time across regulators in one single platform in an organised and consistent format and in translated languages

- Digital, machine readable rules to convert regulatory rules into metadata that can be easily interpreted and coded against internal business processes

- Regulatory obligations and actions extraction to deliver a list of regulatory actions and requirements that need to be complied with

- Automated rule mappings to map regulatory obligations to existing compliance standards such as policies, procedures, controls and other business metadata

- Compliance workflows to perform, assign and track regulatory impact assessments and compliance self-assessments against regulatory tasks and actions

- Regulatory dashboarding to create management information and reports to get a view of your regulatory compliance and change landscape.

Here are the benefits of FinregE’s compliance automation compared to manual processing:

- Increased agility to respond and comply with changes in regulations

- Deploy and implement a data-backed process to recognise gaps in compliance and accountability

- Reduce the clutter and repetitiveness of manual compliance by utilising the power of automation

- Enhance compliance capabilities by working with AI and digital compliance rulebooks

- Reduce errors and duplication by switching to an AI-powered compliance management ecosystem

- Improve visibility of the entire compliance management ecosystem

- Promote simplicity by centralising regulatory rules and compliance actions on an app

- Improve accuracy across compliance reporting to regulatory authorities

What’s our USP versus competitors:

- Our solutions are one of a kind and built around real domain knowledge in understanding and working with regulation, compliance and technology;

- Our AI driven algorithms are unique versus our competitors;

- Finreg-E delivers over 50% reduction in time and operating costs and increases accuracy in meeting compliance by 90% versus managing regulatory change and compliance manually.

We have competed head to head and won mandates against our competitors that demonstrate that our compliance application is superior.